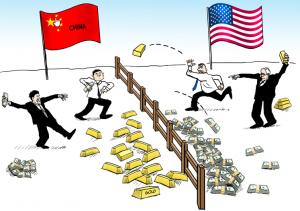

Trade War Fears

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

However, yesterday’s selling seemed measured and controlled with 3 of the four indexes holding onto a fragile but current up-trend. Keep in mind that big moves inspired by fear can also quickly reverse if that fear suddenly passes. Have a plan, stay focused on price and be prepared for anything but don’t let fear control your trading.

On the Calendar

Thursday is a big day on the Economic Calendar with several potential market-moving reports with four of them dropping at 8:30 AM. The weekly Jobless Claims is expected to come in at 229,000, continuing to show strong labor demand. A robust consensus of 23.0 with rising backlogs and the risk of hitting capacity constraints, from the Philly Fed Business Survey. The Empire Ste Mfg. Survey should come in cooler at 15.0 according to consensus. Then the Import/Export Prices are seen rising a moderate 0.3% on imports as well as 0.3% increases in export prices. At 10:00 AM we hear from the Housing Market Index which forecasters see steady strength with an unchanged reading or 72. To finish off the major reports today, we have the Treasury International Capital at 4:00 PM.

Today marks our last really big earnings day this season with nearly 190 companies expected to report. While there are earnings spread out for the remainder of the month, they should be overall less impactful as the number of reports diminishes.

Action Plan

Things were looking pretty good yesterday until fear of a trade war with China sent a share of BA sharply lower. After losing the 25,000 level, the Dow experienced some pretty heavy selling testing the lower boundary of the price wedge pattern. Although the SPY, QQQ, and IWM experienced some selling pressure, they all managed to close within their current uptrend and stayed above their respective 50-day averages.

I said yesterday that my gut tells me that the market wants to go higher. Yesterday’s price action while bearish didn’t dissuade that feeling. With 3 out of 4 indexes holding onto an uptrend, the technicals slightly favor the bulls as long as support levels hold. However, it wouldn’t take much more selling pressure to shift the battle to the bears so stay focused on price action. The current pullback has the potential to set-up some great entries if the bulls can tow the line. Mark up your watchlist and be prepared.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/k3wS2vOCzL8″]Morning Market Prep Video[/button_2]

Comments are closed.