Thanks To The Members

Thanks To The Members

I want to take a moment and say THANKS to all the members from Hit and Run Candlesticks and Right Way Options for sharing your trades, strategies. You are what makes us the best! Thank you to Ed Carter for the long hard work you have done on Trader Vision. The Trader Vision program could be the most important in a traders tools box.

I want to take a moment and say THANKS to all the members from Hit and Run Candlesticks and Right Way Options for sharing your trades, strategies. You are what makes us the best! Thank you to Ed Carter for the long hard work you have done on Trader Vision. The Trader Vision program could be the most important in a traders tools box.

Ya, it’s Friday, and you know what that means! I’ll see you all today at 9:10 AM ET in the trading room.

► Learn the Power Of Simple Trading Techniques

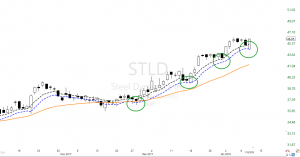

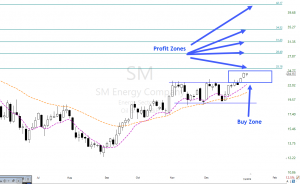

On January 10, we shared SRNE and how to use the trading tools listed below to profit from SRNE. Yesterday the swing profits would have been about 23% or $350.00 with 300 shares. Using our Simple, Proven Swing Trade Tools and techniques to achieve swing trade profits.

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

► Eyes On The Market

The SPY closed with a Doji inside day yesterday still fighting Tuesdays Bearish Dark Cloud Cover. Not yet able to breakout out but holding the bullish trend. Yester marked the twelfth day of a Bullish T-Line Run and unless the Bears can find a way in today will be the 13th day. The last three days have proven to be a battle between the buys and sellers, note the higher lows, but the price action can’t break out. (The battle is on)

The VXX short-term futures closed for the 3rd day above the T-Line and the 3-ema is holding above the T-Line. As long as the price stays above the T-Line, the suggestion is that there is a bit of pressure applied to the buyers. The question is who crakes first.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************