T-Line Low Supports Pullback

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

At 9:10 AM ET. We will demonstrate how IMMU was chosen using our Simple Proven Swing Trade Strategies

Simple Proven Swing Trade Tools

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

► Learn From The Chart (WTW)

On December 26, we shared, in detail, the technical chart properties of WTW in our members Trading Room and why we thought this chart was ready for a run. Yesterday the profits would have been about 13.50% or $685.00 with 100 shares. Using our simple, proven Swing Trade tools and techniques to achieve swing trade profits.

► Eyes On The Market (Caution Caution Caution)

Six days up is more than this horse can take. The SPY has moved higher the past six days a little faster than it can handle and is now in need of a rest. As I mentioned in last nights e-Learning webinar, the market is primed for a profit taking and the morning futures are pointing this out. The main trend is still up, and as of yet, support has not been broken. I suspect we see the sellers challenge the $271.70 area and then we can get a better idea of what price action is up to.

The VXX short-term futures printed a Bullish Egulf yesterday, and today it will likely test the T-Line Band High. A close over the T-Line Band High would indicate that fear is heating up and that would be a first step in creating a bullish bottom in the VXX chart.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Rounded Bottom Breakout POOTB Strategy

FTK has been in a downtrend that seems to have hit bottom on November 8, 2017. A Bullish piercing candle started the bullish price action that has lead to constructing a Bullish Bottom. Price broke out above the 50-SMA creating an RBB strategy, and the recent price action is now creating a Pop Out of The Box strategy as well. To learn more about the “RBB” and the “POOTB” visit us in the trading room.

FTK has been in a downtrend that seems to have hit bottom on November 8, 2017. A Bullish piercing candle started the bullish price action that has lead to constructing a Bullish Bottom. Price broke out above the 50-SMA creating an RBB strategy, and the recent price action is now creating a Pop Out of The Box strategy as well. To learn more about the “RBB” and the “POOTB” visit us in the trading room.

At 9:10 AM ET. We will demonstrate how FTK was chosen using our Simple Proven Swing Trade Strategies

►Simple Proven Swing Trade Tools

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

► Learn From The Chart (ALDR)

On December 26, we shared, in detail, the technical chart properties of ALDR in our members Trading Room and why we thought this chart was ready for a run. Yesterday the profits would have been about 30.47% or $350.00 with 100 shares. Using our simple, proven Swing Trade tools and techniques to achieve swing trade profits.

► Eyes On The Market

The S&-500 closed at another new high yesterday candlesticks stacking higher and higher. I was asked yesterday if the market is getting oversold? I replied “yes,” and I think all investors think the same thing. One person said oversold to what? True oversold compared to what? Then I said maybe the best way to look at this market is to follow the trend, the trend is not predictive it is what it is, and when the price falls out of the trend, you will know. Oversold/overbought indicators promo is guessing and predictions. Price action in or out of the trend is crystal clear.

The VXX short-term futures follow the trend, not much to talk about until price action can close above the “Lower T-Line Band”

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

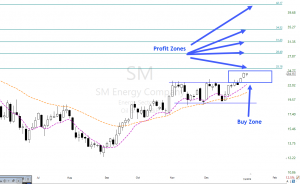

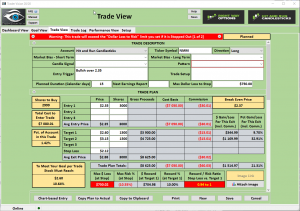

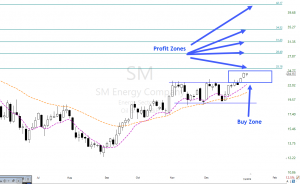

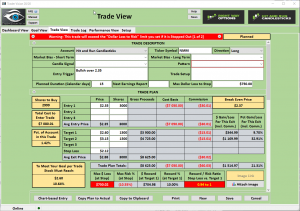

Weekly Doji Continuation Pattern

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

The weekly Doji continuation pattern on SM has recently broken out of a bullish rectangle pattern – On the daily chart, The T-Line is rising after a breakout of resistance with price resting with two dojis and support. The breakout pattern suggests the buyers think has not reached its potential. A major profit zone that you might consider is the $42.00 area with several mini profit zones on the way.

At 9:10 AM ET. We will talk about the technical properties of SM with target zones, a couple of logical entries and a protective stop.

► Must Read Trade Update (OSTK)

On January, we shared, in detail, the technical chart properties of OSTK in the Trading Room and why we thought this chart was ready for a run. Friday the profits would have been about 17.90% or $1280.00. Using our simple tools and techniques to achieve swing trade profits.

► Simple Proven Swing Trade Tools

T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

► Eyes On The Market

Friday marked another four days positive run for the S&P-500, and it’s ETF the SPY. This 4-day run may need a little rest and pullback. Price has moved pretty far from the T-Line, and it has been my experience that when this happens price stalls out to allow the T-Line to catch up. Resting pullback can be very shallow or even test the previous day’s support. Below $272.95, we could see $272.60 and below $272.60 and below $272.60 we could see $271.80, so on, so on, so on.

The VXX short-term futures may be trying to get off the ground, above $26.90 and we may have to take the VXX a little serious.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Eleven Trade Ideas

At 9:10 AM ET. We will talk about the technical properties of 11 trade ideas with target zones, logical entries, and a protective stop. The HRC Live Trading Room is the best place to learn the trading technics of the membership and the HRC coaches.

► Must Read Trade Update (OSTK)

On January 4, we shared, in detail, the technical chart properties of OSTK in the Trading Room and why we thought this chart was set up for a trade. OSTK now plus 8.8% or $625.00 with 100 shares. Using simple rules and techniques to achieve swing trade profits. Learning to master the market does take a little work and dedication to success and when the dots connect you will look at life in a whole new way.

On January 4, we shared, in detail, the technical chart properties of OSTK in the Trading Room and why we thought this chart was set up for a trade. OSTK now plus 8.8% or $625.00 with 100 shares. Using simple rules and techniques to achieve swing trade profits. Learning to master the market does take a little work and dedication to success and when the dots connect you will look at life in a whole new way.

Learn our top 16 trading tools: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern • Scanning for Success

► Eyes On The Market (Happy Friday)

And the bulls keep on going and going and going. Another positive day in the market and the trend continues to rise. The SPY is now a bit too far above the upper T-Line Band and likely to contract a little very soon.

The three T-Lines are moving averages that we use for a moving trend of Candlesticks (price action).

The VXX short-term futures bounced a little yesterday, but until price moves above the T-Line Bands, it’s just noise.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Bullish Engulf | POOTB

Hit and Run Candlesticks Members ► Log into the Members Blog for complete blog post with trade ideas | Log In

NTNX – The buyers of NTNX created a Bullish Engulf on December 26 after a bullish run and a pullback. The Bullish Engulf followed by a (POOTB) Pop Out of The Box Pattern. The T-Line family has continued to trend higher proving the strength of the price action and commitment by the buyers. Several profit zones are available with a continued bullish trend.

NTNX – The buyers of NTNX created a Bullish Engulf on December 26 after a bullish run and a pullback. The Bullish Engulf followed by a (POOTB) Pop Out of The Box Pattern. The T-Line family has continued to trend higher proving the strength of the price action and commitment by the buyers. Several profit zones are available with a continued bullish trend.

At 9:10 AM ET. We will talk about the technical properties of NTNX with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

► Must Read Trade Update (INSY)

On December 14, we shared, in detail, the technical chart properties of INSY in the Trading Room why we thought this chart was ready for a run. Yesterday the profits were about 113% or $710.00. Using simple rules and techniques to achieve swing trade profits. A traders lifestyle is worth the work.

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

► Eyes On The Market

Thr Bulls have worked that charts very well the first two trading days of 2018, and I suspect today will be the same. We may all get to ware our 25K tee-shirt for the DOW reaching a milestone after today. So let’s all think positive. The SPY (ETF for the S&P-500) has been lightly bouncing off the T-Line Low reaching and holding on to higher highs. The Lower T-Line is a moving average that we use for a moving trend line of the Candlesticks (price action lows).

The VXX short-term futures hit a new low yesterday after trying to climb over the Lower T-Line only to fail.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

FRTA – Ascending Triangle Breakout

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way

FRTA has been trending and now has broken out of a Bullish Ascending Triangle. After the November 8 Bullish breakout FRTA has produced a rising trend. The past 15 days or so the price action has drawn an Ascending Triangle pattern. FRTA has a great deal of profit potential if you look at the $20.00 profit zone and the profit zones along the way

At 9:10 AM ET. We will talk about the technical properties of FRTA with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

► Must Read Trade Update (SGRY)

On December 12, we shared in detail, the chart setup of SGRY in the Trading Room, Yesterday the profits were about 36.92% or $360.00 with 100 shares. Using simple rules and techniques to achieve swing trade profits. A traders lifestyle is worth the work.

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops • RBB Pattern • Pop Out of The Box Pattern

► Eyes On The Market

Welcome to 2018, what a great day yesterday was. Seems like the market it is playing with a full team! The SPY is still under the control of the T-Line trend (above all 3). Yesterday the SPY closed up $1.01 with a small breakout poised to follow through with a J-Hook continuation pattern.

The DJ-30 closed yesterday with a Doji, bullish chart pattern above the T-Line, come 25K you can do it!

The VXX short-term futures lost all interest yesterday in playing the game!

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

NMM Bullish Morning Star Presented

NMM – Last Friday NMM presented us with a Bullish Morning Star with multiple signs of support and the Lower T-Line Band. Note how the Star came off the Lower Band and Fridays price action closed over the Upper T-Line Band. The 4 and five days charts fit the (RBB) strategy profile with two profit zones before the Dotted Deuce and two before the 200-period moving average.

NMM – Last Friday NMM presented us with a Bullish Morning Star with multiple signs of support and the Lower T-Line Band. Note how the Star came off the Lower Band and Fridays price action closed over the Upper T-Line Band. The 4 and five days charts fit the (RBB) strategy profile with two profit zones before the Dotted Deuce and two before the 200-period moving average.

At 9:10 AM ET. We will talk about the technical properties of NMM with target zones, a couple of logical entries and a protective stop. We will also be showing our trade plan with risk/reward and expected profits.

► Must Read Trade Update (CVRR)

On November 8, we shared, and in detail, the technical properties of CVRR in the Trading Room, Friday the profits were about 27.8% or $360.00. Using simple rules and techniques to achieve swing trade profits. A traders lifestyle is worth the work.

► Eyes On The Market

Last weeks price action wasn’t much to brag about although the buyers were able to keep the sellers away for the most part. The Daily price bar closed as a Bearish Engulf, but we did close on support, so the battle begins. If the sellers can close below $266.30, the mid-December low may be in for a test. A push by the buyers with a close over $268.60 and the Bulls are on there way to challenge the $272.00 area

The VXX short-term futures started a dance last week so they need to be watched a little closer than normal. The past 9-day pattern is a bottoming channel with a Bullish engulf. The pattern needs to follow through so we will keep our eye on it.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

DJ-30 + 160.77 = 25K

Will the DJ-30 it to 25K this year? The chart is a position to make the run. Over the past few days, the price action has been building a J-Hook continuation pattern, at this point the bull team needs to push over the recent high of $24876.07 and the hope for a gust of wind to carry the industrial bird to the altitude of 25K

Will the DJ-30 it to 25K this year? The chart is a position to make the run. Over the past few days, the price action has been building a J-Hook continuation pattern, at this point the bull team needs to push over the recent high of $24876.07 and the hope for a gust of wind to carry the industrial bird to the altitude of 25K

At 9:10 AM ET. We will talk about the technical properties of charts with target zones, logical entries, and protective stops.

► Eyes On The Market

We saw the market a nice lift going into the close yesterday from the SPY, look at the chart, and you can see how price action has been carving out a reversal bottom near the support of the V-Stop and the Lower T-Line Band. Those are two tools that winners use by the way. IWM and the DIA’s saw bullish interest into the close yesterday while the QQQ’s was just plain lazy. I truly wish the best for the DJ-30 finding the perfect landing spot on 25K

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Geeze This Market Is Slow

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”

Geeze this market is slow. For the next two days (Thursday/Friday) we will not be offering any trade ideas or trading picks on our blog, the market is just to darn slow and dead. If something changes, we will change. The trading room will be open, and we will discuss possible trades as we see them. There is simply a time to trade and times to sit back and enjoy. We hope this year has been good to you and that your trading and education goals have been met. If you feel like sharing your trading and educational goals, please email us @ https://hitandruncandlesticks.com/contact/ we will do our very best to help, use subject line “GOALS”

At 9:10 AM ET. We will talk about the technical properties of charts with target zones, logical entries, and protective stops.

► Eyes On The Market

The overall market has been horrible slow this week, and the next 2-days will likely be the same. We have had a few great discussions in the trading room. As of the close yesterday the bulls are holding there support with only a few minor signs of cracks, nothing I am going to worry about right now. We feel the best way to handle this market right now is to “Do Nothing” enjoy the family and the holiday time. Forcing trades never work out in the end.

Rick’s Swing Trade ideas – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Chart Patterns • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.

IMMU has had a beautiful bullish run from early December breaking out of the October high. The sellers printed a Shooting Star, and price action followed for six straight days. Yesterday after meeting up with the T-Line Low price fought back by closing up 8.23% and creating a bullish J-Hook continuation pattern. Over $16.45 could trigger more buyers. We have added IMMU to our watchlist for consideration.