DB Rocking the Market Boat This Morning

On Thursday, markets gapped higher to differing degrees (up 0.74% in the SPY, up only 0.37% in the DIA, and up 1.24% in the QQQ). All three major indices then went on a bullish run, reaching the highs of the day at about 11:10 am. However, then the bears took over selling off the SPY, DIA and QQQ at an increasing tempo that reached the lows of the day at 3 pm. The last hour saw a volatile bounce up off the lows that took all three back up to the opening level by the close. This action gave us gap-up indecisive candles (Doji in the QQQ and DIA as well as a black-bodied Spinning Top in the SPY). This happened on greater-than-average volume in all three of the indices.

On the day, six of the 10 sectors were in the red with Energy (-1.51%) leading the way lower while Technology (+1.50%) fairing much better than the other sectors. At the same time, the SPY gained 0.26%, the DIA gained 0.21%, and QQQ gained 1.19%. VXX climbed 2.67% to 51.89 and T2122 remained well into the oversold territory at 7.94. 10-year bond yields dropped again to 3.412% while Oil (WTI) fell 2.3% to $69.26 per barrel. So, Thursday saw a major divergence with much money chasing the safety of bonds while at the other end of the spectrum high tech names like NFLX, MU, MRVL, and others leading the QQQ higher.

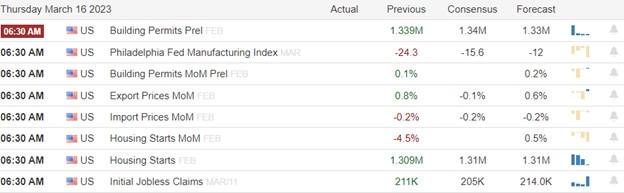

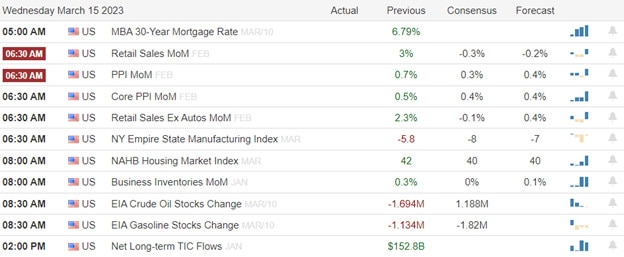

In economic news, Building Permits came in a bit above expectation at 1.550 million (compared to a forecast of 1.524 million and the prior month’s value of 1.339 million). This amounted to a 15.1% month-on-month increase (compared to a forecasted 13.8% increase). Elsewhere, the Q4 Current Account (Imports minus Exports) came in a bit better than expected at -$206.8 billion (versus a forecast of -$213.2 billion and the Q3 reading of -$219.0 billion). Later, February New Home Sales were reported slightly lower than expected at 640k (compared to a forecast of 650k but slightly better than the January value of 633k). During the afternoon, Treasury Sec. Yellen told the House Appropriations Committee that she expects inflation to eventually come down as both supply chain pressures (shortages) and shipping costs continue to fall. She also said a default on US debt would undermine the US dollar’s reserve currency status as well as lead to a recession or worse. Finally, Yellen said that the FDIC is prepared for more actions to protect depositors if needed according to Bloomberg.

SNAP Case Study | Actual Trade

In stock news, BLK doubled down on the ESG topic Thursday when it said it would continue to push companies on how they treat “material” climate-related risks as well as maintaining its stance on the energy transition despite any criticism from some US politicians. Elsewhere, the CEO of C, Jane Fraser, told the Washington DC Economic Club that “this is not a credit crisis” and “the banking system is pretty sound.” She went on to say this is a “situation where “it’s a few banks (causing the problem).” At the same time, F said that it is expecting a $3 billion loss from its electric vehicle unit this year, but remains on track to achieve an 8% pretax margin by late 2026. Later, Reuters reported exclusively that WMT will be asking hundreds of workers at five of the company’s e-commerce fulfillment centers to find jobs elsewhere in the company within 90 days. Midday, aptly named Hindenburg Research (Short Seller) published a report claiming that SQ (Block Inc) overstated its user numbers, understated customer acquisition costs, and facilitated criminal activity. SQ CEO Jack Dorsey denied the claims and vowed to take legal action against Hindenburg and file a complaint with the SEC. After hours, Reuters reported they had internal memos from JPM, C, and BAC telling their employees not to poach clients from stressed banks. The gist of the report was that the big bank’s management did not want to make the problem worse, give anyone the impression their banks are exploiting the situation, or give the banking industry a bad name.

In stock legal and regulatory news, Bloomberg reported that the European Central Bank is rethinking their treatment of liquidity risk in the wake of the failure of CS (and SIVB in the US). This seems like a pretty obvious need but Bloomberg says sources confirm the discussions are underway (just not formal yet). Meanwhile, COIN fell on Thursday after Wednesday night’s Wells Notice from the SEC. However, the firm tried to push back against the SEC by telling Reuters that the company had asked the SEC what product they are selling the SEC considers a security but the agency declined to respond. Elsewhere, the CFO of HSY said the company is evaluating how it might reduce or eliminate heavy metals (found by Consumer Reports magazine research) from its dark chocolate products. HSY faces multiple lawsuits over the presence and lack of disclosure of those metals in the products. At the same time, the Wall Street Journal reports the Dept. of Defense has launched an investigation into BA over the company allowing 250 people to work on current and future Air Force One jets without proper security clearance. Mid-afternoon, Reuters reported that the US and European Commission have reached an agreement that will allow electric vehicles containing minerals extracted or processed in Europe to qualify for US green subsidies (as set up in the Inflation Reduction Act package). After hours, Bloomberg reported that the US Dept. of Justice is investigating CS and UBS (among other banks) for helping Russian oligarchs evade sanctions.

In energy news, Oil snapped a 3-day winning streak amidst rumors that OPEC+ will not increase its production cuts, despite oil being at 15-month lows. This came after Reuters reported that three OPEC+ delegates told them the group is unlikely to go past the 2 million barrel production cuts agreed on in November. Elsewhere, US Energy Sec. Granholm told lawmakers Thursday that “the US is in no hurry to refill the Strategic Petroleum Reserves. She also noted that the department intends to proceed with the congressionally mandated release of another 26 million barrels this year.

After the close, JOAN beat on revenue but missed on earnings.

Overnight, Asian markets were nearly red across the board. Taiwan (+0.32%) and Shenzhen (+0.25%) were the only green. Meanwhile, Malaysia (-0.80%), India (-0.77%), and Hong Kong (-0.67%) paced the losses. In Europe, we see the same picture taking shape at midday with only Russia (+0.04%) clinging to green territory. The spike in default insurance costs at DB has the whole region in fear. The DAX (-2.21%), CAC (-2.16%), and FTSE (-1.92%) are typical and lead the region lower in early afternoon trade. As of 7:30 am, US Futures are pointing toward US markets following the rest of the world lower, at least at the start of the day. The DIA implies a -0.96% open, the SPY is implying a -0.75% open, and the QQQ implies a -0.42% open at this hour. At the same time, 10-year bond yields are plummeting as traders seek the safety of bonds, now down to 3.311% and Oil (WTI) is being crushed by nearly 4% to $67.20/barrel in early trading.

The major economic news events scheduled for Friday include Feb. Durable Goods (8:30 am), Mfg. PMI, S&P Global Composite PMI, and Services PMI (all at 9:45 am). Fed member Bullard also speaks at 9:30 am. The major earnings reports scheduled for the day are limited to EXPR before the opening bell. There are no major earnings reports scheduled for after the close.

So far this morning, EXPR reported a miss on revenue while beating on the earnings line (smaller loss than expected).

In late-breaking news, the big story of the premarket is that DB stock price plunged as much as 13% overnight following a sudden spike in the company’s credit default swaps (i.e. the cost of insuring that they do not default on their debt) Thursday night. As a result, there is widespread fear in Europe of contagion of runs on the large European banks like DB, HSBC, BNPQY, SAN, UBS, or ISNPY. In the meantime, across the border in Switzerland, Swiss Banking Regulators blamed the collapse of CS on “the US banking crisis.” (This conveniently forgets years of scandal, mismanagement, criminal activity, and the $8 billion in losses CS racked up in 2022.)

With that background, it looks like the bears are looking to take us back toward the bottom of the week’s range. However, premarket action is very volatile today, making large swings in both directions. SPY and DIA look like they will open below their T-line (8ema) while, as has been normal for a while, QQQ looks to be holding up best at this point. Overextension from the T-line is not an issue in any of the big indices. However, T2122 is back in the oversold zone. While there is some economic news this morning (including Durable Goods Orders before the open) today, I suspect that talk and fears related to regional banks (and theoretically some of the big boys) will dominate market sentiment. As an aside, it might be interesting to hear Fed mega-hawk Bullard’s tone at 9:30 am amidst market fears over banks. (I wonder if he is a little more dovish than usual this morning and talks up the Fed’s ability to prop up the banking system if needed.) So, be cautious and also remember that this is a Friday. The last two weekends have seen major market-moving news cycles related to banks. Don’t bet against a third such weekend. Have your account prepared.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service