The bulls produced a Monday reversal on surprisingly low volume as they rushed to buy up risk ahead of the pending CPI report that could produce a substantial price move. Will the bulls get rewarded, or will the report produce a Valentine’s day massacre? We will soon find out and then turn our attention to Wednesday’s market-moving Retail Sales and Industrial production numbers. A slew of earnings will only add to the challenge, so buckle up and prepare for a wild ride over the next few days,

Asian markets mostly gained relatively modest results as Japan nominated their next central bank chief. European look to extend yesterday’s reversal rally, projecting confidence in the pending inflation number. Despite reports that the CPI report could deliver some disappointing sticky inflation reading, the U.S. trade higher in the premarket, hoping to extend yesterday’s big upward push.

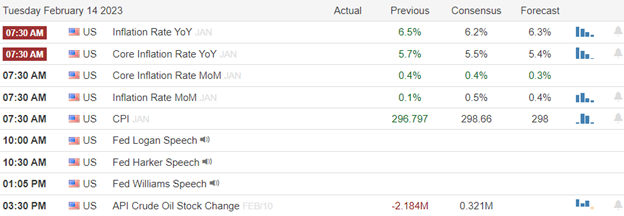

Economic Calendar

Earnings Calendar

Notable reports include ABNB, AKAM, ANDE, BTU, CLF, CRK, CNDT, DVN, GDDY, GFS, GXO, HLF, HWM, KO, MAR, QSR, SCI, SU, TRU, TRIP, UPST, WEBR, & ZTS.

News & Technicals’

All market eyes Tuesday will be on the release of the Labor Department’s consumer price index, a widely followed inflation gauge. Economists are expecting that the CPI will show a 0.4% increase in January, which would translate into 6.2% annual growth. However, there’s some indication the number could be even higher. The Federal Reserve is determined to keep fighting inflation so that the report could harden their position.

Inflation in the U.S. is likely to be “far stickier” and could last a decade, according to Bill Smead, chief investment officer at Smead Capital Management. Wall Street is gearing up for news on key inflation data later Tuesday as the Labor Department will release its January consumer price index.

President Joe Biden is expected to name Federal Reserve Vice Chair Lael Brainard to the White House’s top economic policy position as early as Tuesday. Brainard would replace White House National Economic Council (NEC) Director Brian Deese, who has announced his resignation.

We began the week with another reversal as the bulls rushed to buy, pressing resistance levels, seemingly unconcerned about the potential big-point reaction from the pending CPI report. While the VIX registered a reversal of fear, volume was surprising considering the big move in the indexes. Expect a substantial price reaction as the number comes out, and don’t rule out the possibility of a wild whipsaw before the open. Anything is possible, and the market will turn its eyes toward the Retail Sales and Industrial Production numbers on Wednesday morning.

Trade Wisely,

Doug

Comments are closed.