Debt Deal Close With Holiday Ahead

On Thursday, the major indices diverged greatly at the open. The SPY gapped up 0.92%, QQQ gapped up a massive 2.29%, but the DIA opened flat (down 0.02%). SPY immediately faded half of its gap higher and then went through wild fluctuations until noon. At that point, a volatile rally took over for the rest of the day but ended on a down wave the last 15 minutes. Meanwhile, QQQ followed up its gap higher by fading a third of the gain in the first hour before rallying strongly back above the open by 11 am. From there, it rode waves slightly bullishly to the highs of the day at 2 pm. QQQ then had a significant selloff and recovery before taking profits for the last 15 minutes of the day. However, after its flat open, DIA sold off, ground sideways, and sold off again, reaching the lows of the day at about noon. From that point, the mega-cap index ETF rode a wavy rally back to break even before taking profits on those last 15 minutes. This action left us with three indecisive Doji candles (a gap-up Dojis in the QQQ and SPY as well as a flat Doji in the DIA.

On the day, eight of the 10 sectors were in the red with Technology (+2.45%) way out front leading the market higher and Energy (-2.04%) and Communication Services (-1.92%) lagging far behind the other sectors. At the same time, the SPY gained 0.86%, DIA lost 0.08%, and QQQ gained 2.43%. VXX fell 2.34% on the day to end at 37.07 and T2122 climbed but remains in the oversold territory at 14.52. 10-year bond yields spiked up to 3.819% while Oil (WTI) plummeted 3.31% to end the day at $71.88 per barrel. So, Thursday was the Tech Bulls’ Day, with NVDA (+24.37%) and AMD (+11.16%) pulling the rest of the QQQ and SPY upward on the promise of AI-based chip sales after the NVDA report. However, fear of a US Debt Default pulled downward against that exuberance, weighing most heavily on the stodgy, mega-cap DIA. It is worth noting that QQQ had above-average volume, DIA had average volume, and SPY had just below-average volume for the session.

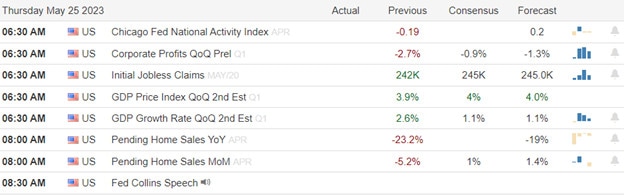

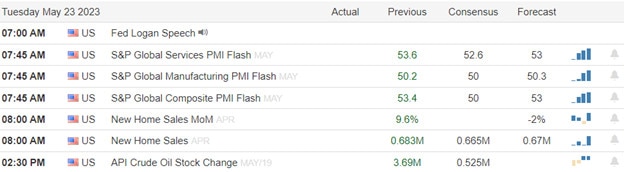

In major economic news Wednesday, Q1 GDP was revised upward to +1.3% (versus a forecast of +1.1% and the Q4 reading of +2.6%). However, the Q1 GDP Price Index also was revised up slightly to +4.1% (compared to an expected +4.0% and the Q4 value of +3.9%). At the same time, Initial Weekly Jobless Claims came in far below the expected number at 229k (versus the forecast of 250k but still more than the prior week’s 225k). Later, April Pending Home Sales were reported at dead flat +/-0.0% (as compared to a forecast of +0.5% but much better than the March reading of -5.2%). After the close, Bank Reverse Balances with the Fed were reported at $3.251 trillion (down $29 billion from last week’s $3.280 trillion value).

SNAP Case Study | Actual Trade

In stock news, Nippon Steel continued its talks with the Management of TECK about taking a stake in the coking coal miner, despite the GLNCY bid (opposed by TECK mgmt.) to buy TECK. At the same time, CMI has decided to brave debt ceiling risks to price an IPO for its filtration unit. This new IPO will begin trading Friday. Meanwhile, ILMN saw the Chair of its board voted out as activist investor Icahn (Chair of IEP) led an investor revolt. However, two of Icahn’s board nominees failed to be elected and the CEO also retained his seat. Elsewhere, the CEO of F (Farley) told an MS investor conference “I think we see the Chinese as the main competitor, not GM or Toyota” … “The Chinese are going to be the powerhouse.” Interestingly, on the same day, F struck a deal with TSLA to allow F electric vehicle owners access to the TSLA supercharger network as of early 2024. On a day when AI reigned in the market, MSFT President Smith told a Washington DC audience that deep fakes are the biggest AI concern. “We’re going have to address the issues around deep fakes. We’re going to have to address in particular what we worry about most foreign cyber influence operations, the kinds of activities that are already taking place by the Russian government, the Chinese, the Iranians,” he said. He went on to call on President Biden to use an Executive Order to force federal agencies that use or deal with AI in any way to adopt and comply with a framework developed by the US NIST in 2020. Smith also called for the creation of a new federal agency dedicated to regulating AI.

In stock legal and regulatory news, in the afternoon, German authorities announced that they received serious indications of possible data protection violations by TSLA. They cited 100gb of confidential TSLA customer and former/current employee data (including names, social security numbers, salaries, bank details, addresses, email, phone numbers, etc.) leaked to German newspaper Handelsblatt. TSLA European HQ has been notified of the investigation and the matter has also been reported to the EU over GDPR violations. Elsewhere, the US State Dept. followed up on MSFT’s report Wednesday by Thursday announcing that Chinese hackers had targeted both US and Western countries’ governments and public infrastructures. The report went on to say that FTNT products had been compromised and were being used by the Chinese “Volt Typhoon” group of attacks. Later, a US district judge refused to dismiss a case, ruling that BAC must face allegations that it failed its responsibility by permitting unauthorized transactions on CA unemployment and disability benefit cards. (BAC paid $225 million to settle cases brought by two US agencies over very similar matters in 2022.) After the close, the New York City Banking Commission voted to freeze NYC deposits in COF and KEY after the two banks failed to file plans to eliminate discrimination from their operations.

In debt ceiling news, mid-morning Thursday, Representative Hern (head of GOP caucus) told Reuters the he believed it likely a debt-ceiling deal would be done by Friday afternoon. He said “I think it’s some of the finer points they are working on right now,” … “You are likely to see a deal by tomorrow afternoon.” (That makes sense as Speaker McCarthy has promised his conservative faction three days to read the deal. So, a Friday afternoon deal gives them the normal 3-day weekend off to “read” the deal with a vote on Tuesday.) By mid-day, Reuters sources inside the negotiations said the two sides were just $70 billion apart and they were edging close to a deal. However, the source also said what is likely to emerge is just a “slimmed-down version” of an agreement rather than the hundreds of pages of detail the full bill will require. A second source in the room told Reuters that top-line numbers will be hammered out allowing both sides to declare victory while the fine details of what actually gets cut and what gets funded at what level) will all be worked out in future appropriations bills. If that is true, it begs the question of why the hell the Congress (GOP) took us through this entire song and dance. If there is no budget now, will be no budget after the deal (because this is not about a budget it’s about permissible debt), and the plan all along has been for Congress to actually budget by releasing appropriations at a line-item, fine-detail level…then this whole debt ceiling fiasco was just a publicity stunt for conservative lawmakers. They could have done the same thing without all of the drama.

After the close, ULTA, MRVL, WDAY, RH, LGF.A, and DECK all reported beats on both the revenue and earnings lines. Meanwhile, COST, GPS, and ADSK all missed on revenue while beating on earnings. It is worth noting that DECK lowered its forward guidance. The surprises included a 200% upside earnings shock from LGF.A, a 106% upside earnings surprise from GPS, and a 33% upside earnings shock from DECK.

Overnight, Asian markets leaned to the green side, but the biggest mover was toward the red. Hong Kong (-1.93%) and New Zealand (-1.09%) showed the only appreciable losses on the day. Meanwhile, Taiwan (+1.31%) and India (+0.97%) led the more numerous green exchanges higher to end the week. In Europe, the bourses are mostly green on modest moves at midday. Greece (+1.45%) is the exception to the rule with the CAC (+0.22%), DAX (+0.10%), and FTSE (+0.20%) leading the region higher in early afternoon trade. In the US, as of 7:30 am, Futures point toward a modest green start to the day. The DIA implies a +0.15% open, the SPY is implying a +0.19% open, and the QQQ implies a +0.36% open at this hour. At the same time, 10-year bond yields are retreating to 3.789% and Oil (WTI) is up nine-tenths of a percent to $72.49/barrel in early trading.

The major economic news events scheduled for Friday include April Durable Goods Orders, April Goods Trade Balance, April PCE Price Index, April Personal Spending, and April Retail Inventories (all at 8:30 am), and Michigan Consumer Sentiment (10 am). The major earnings reports scheduled for the day are limited to BIG, BAH, and HIBB before the opening bell. There are no reports scheduled for after the close.

So far this morning, KT, PDD, and BAH reported beats on both the revenue and earnings lines. However, BIG and HIBB both missed on the top and bottom lines. It is worth noting that HIBB has lowered its forward guidance. Notable surprises include an 82% downside earnings shock from BIG and a 76% upside earnings surprise from PDD (which also delivered 187% earnings growth for the quarter).

In miscellaneous news, after-hours Thursday, CNBC reported that JPM is developing a “ChatGPT-like” AI named “IndexGPT” to give investment advice to its customers. The US Supreme Court dealt a blow to the EPA’s ability to regulate pollution by ruling in favor of a couple who had sued to fight the designation of their lakefront property as Wetlands. The ruling put new rules (written by the conservative majority) on the Clean Water Act which Bloomberg says will make it harder to stop pollution done on private property. Finally, META has offered to “limit use of other businesses’ advertising data” for its own Facebook Marketplace offerings in a proposed concession to the British Competition and Markets Authority (anti-trust watchdog). Using the product/price offerings, advertising, and sales (order click) data from other companies that use META as an advertising platform had always been a primary strategy of the company. While doing it less to UK businesses is a step in the right direction, this is not final and was not a META commitment to any other country.

With that background, it looks like the Bulls are frisky again this morning with price now at the highs of the overnight trading in the SPY, QQQ, and DIA. SPY appears to be crossing back above its T-line (if premarket price holds) while QQQ is pulling away from its own 8ema to highs not seen in more than 13 months. Of course, DIA has the most work to do and must break its downtrend and deal with a resistance level immediately if the bulls are going to take it higher. Extension is not a problem in SPY obviously. DIA is also good in that department if premarket trends hold. However, QQQ is getting extended from its T-line to the upside. The T2122 indicator tells us the market remains oversold. With all of this said, we have to remember that this is the Friday before a 3-day weekend and there is still a lot of potential for politicians to throw a wrench into market works (drama for drama’s sake) related to the Debt Ceiling. (Not only today but over the long weekend as well.) So, be careful and position your account for the day and the long news cycle ahead. Take profits, move stops, lighten up, and consider the appropriate hedges.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service