Mostly Good Earnings Ahead of Fed Meet

Markets opened on the red side of flat, mostly gapping very mildly lower (down 0.13% in the SPY, up 0.02% in the DIA, and down 0.18% in the QQQ). From that point, it was a whipsaw day that saw the bulls marginally in control in the morning and the bears marginally in control in the afternoon. This action left us with indecisive candles in all the major indices. The QQQ printed a DOJI Harami, the SPY printed a Gravestone Doji Harami, and the DIA printed a black-bodied Inverted Hammer-type candle. All three remain above their T-lines (8ema) and nothing appreciable has changed in any of those charts. This all happened on less-than-average volume across the market.

On the day, five of the 10 sectors were in the red with Energy (-0.84%) leading the way lower while Healthcare (+0.71%) held up better than the other sectors. At the same time, the SPY lost 0.10%, DIA lost 0.18%, and QQQ lost 0.11%. VXX fell 1.64% to 37.24 and T2122 dropped back a little further into the mid-range at 65.55. 10-year bond yields spiked up to 3.57% while Oil (WTI) fell 1.41% to $75.70 per barrel. So, to summarize, Monday was a nothing-burger of indecision as markets showed no ill effect from the failure of FRC (acquired by JPM) and seem to be waiting on the Fed or more earnings to move the needle.

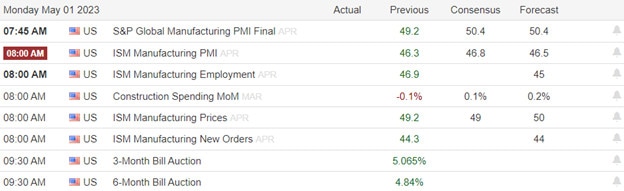

In economic news, April Manufacturing PMI came in below expectation at 50.2 (versus a forecast of 50.4 but still above the March reading of 49.2). (Anything above 50 indicates economic expansion.) Later, April ISM Manufacturing PMI came in above expectation at 47.1 (compared to a forecast of 46.8 and a March value of 46.3). April ISM Manufacturing Employment was well above the anticipated level at 50.2 (versus a forecast of 47.9 and a March level of 46.9). Finally, April ISM Manufacturing Prices came in well above what was expected at 53.2 (compared to a forecast of 49.0 and a March reading of 49.2).

SNAP Case Study | Actual Trade

In stock news, RIDE warned of potential bankruptcy after Foxconn (one of the electric automaker’s largest investors) alleged RIDE has breached the agreement between the two companies. This puts $170 million in funding for RIDE at jeopardy. Elsewhere, AAL pilots have authorized the union to call a strike (96% of pilots voted and 99% of those voted in favor of a strike authorization). No strike date is set as this is negotiation leverage, not imminent action. Later, after the close, Bloomberg reported that IBM has paused hiring with plans to replace up to 7,800 jobs (30% of its non-customer-facing jobs) with AI in coming years. At the same time, Reuters reports that MS will cut 3,000 jobs in Q2. Meanwhile, Reuters reported that META is looking to raise $8.5 billion in a 5-part bond offering. (META raised $10 billion using the same mechanism in 2022.) Finally, overnight, TSLA hiked prices on Model 3 and Model Y cars (in the US, China, Canada, and Japan only) in what seems to be a plea for help by either the CEO or senior management. This minuscule $250 hike in price (on a $40k to $47k original price) and coming after price cuts earlier in the year make it seem like they are flailing around looking for a pricing strategy.

In stock legal and regulatory news, Reuters reported Monday that the EPA may delay a decision on giving eRIN credits to Electric Vehicle makers under a renewable fuel program. The reason for the delay is that the House GOP wants to file a legal challenge on behalf of the fossil-based Energy industry, as they claim those credits were intended only for biofuel (ethanol and biodiesel) manufacturers. This delay will impact TSLA most heavily, but all other electric vehicle makers as well, who will not get the credits they were expecting since the fall. In other EV news, FSR received certification from EU regulators and will begin delivering its “Ocean” electric SUVs on Friday. Meanwhile, a US federal judge gave F a win. He ruled that while Versata Software had proven that F stole their trade secrets in breach of their agreement, the defendant had not provided enough evidence of the damages suffered to justify a lower court jury award of $105 million. Instead, the judge ordered F to pay a massively-reduced $3 million.

LEG, TEX, ANET, FLS, SBAC, AL, SGRY, WWD, INVH, KMT, and VICI all reported beats on both the revenue and earnings lines. Meanwhile, SON, FMC, and SCI all missed on revenue while beating on earnings. On the other side, CYH, RE, OGS, CNO, and RIG all beat on revenue while missing on earnings. Unfortunately, FANG missed on both the top and bottom lines. It is worth noting that SYK, NXPI, SFM, TEX, SBAC, SGRY, and WWD all raised their forward guidance. However, AMKR lowered its forward guidance.

Overnight, Asian markets leaned heavily toward the green side. Shanghai (+1.14%), Shenzhen (+1.09%), and South Korea (+0.91%) led the region higher with Australia (-0.92%) showing any appreciable loss. In Europe, the bourses are mostly in the red on moderate moves at midday. The CAC (-0.41%), DAX (-0.19%), and FTSE (-0.01%) lead the region lower with three minor bourses modestly in the green in early afternoon trade. As of 7 am, US Futures are pointing toward a slightly red start to the day. The DIA implies a -0.22% open, the SPY is implying a -0.19% open, and the QQQ implies a flat -0.03% open at this hour. Meanwhile, 10-year bond yields are back down to 3.536% and Oil (WTI) is off another seven-tenths of a percent to $75.16/barrel in early trading.

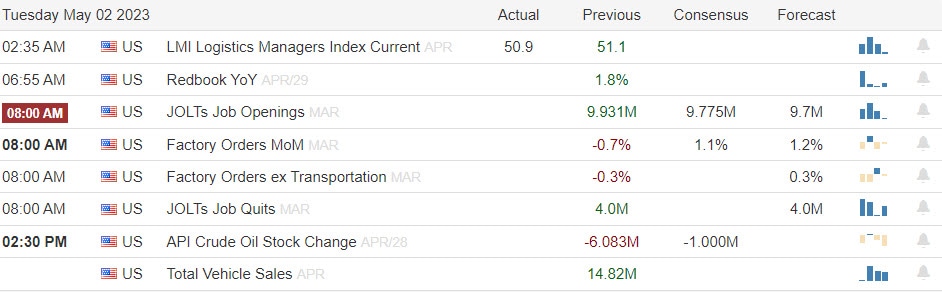

The major economic news events scheduled for Tuesday are limited to March Factory Orders and March JOLTs Job Openings (both at 10 am), and API Weekly Crude Oil Stocks (4:30 pm). The major earnings reports scheduled for the day include ADT, AER, AGCO, ARLP, ABC, AME, BP, BR, CX, CQP, LNG, CIGI, CEIX, CEQP, CMI, DORM, DD, ETN, ECL, EPD, ESAB, EXPD, FELE, IT, GVA, GPK, HWM, HSBC, IDXX, IHRT, ITW, INCY, NSIT, LDOS, MDC, MPC, MAR, TAP, MLPX, MD, PFE, PEG, QSR, SEE, SUN, SYY, TROW, TRI, TRN, UBER, ZBRA, and ZBH before the open. Then, after the close, AMD, AMCR, AFG, ANDE, ASH, AIZ, AXTA, BXC, BFAM, CZR, CRC, CWH, CHK, CLW, CLX, EIX, ET, ENLC, EQX, EXPI, F, THG, HLF, JKHYLFUS, LUMN, MTW, MTCH, MCY, MUSA, OKE, PGR, PRU, RNR, SPG, SBUX, SMCI, UNM, VOYA, WELL, WU, and YUM report.

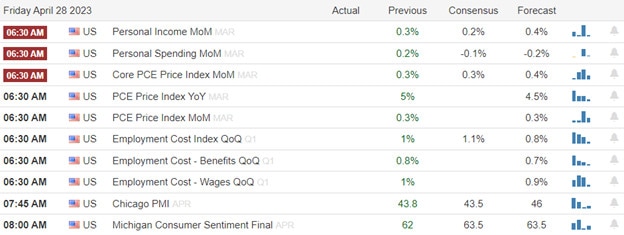

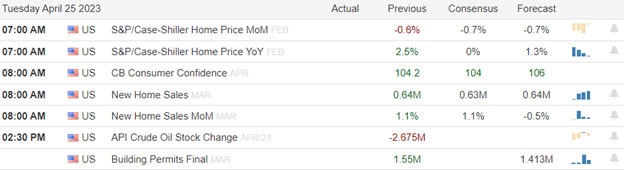

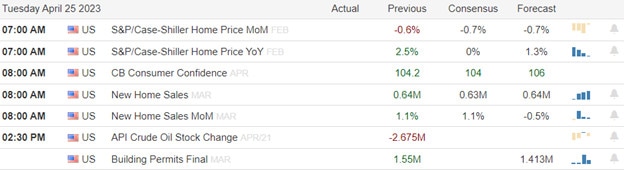

In economic news later this week, on Wednesday, the ADP Nonfarm Employment Change, Services PMI, April ISM Non-Mfg. PMI, EIA Crude Oil Inventories, FOMC Rate Decision, FOMC Statement, and Fed Chair Press Conference all happen. Thursday, we get March Imports, March Exports, March Trade Balance, Weekly Initial Jobless Claims, Preliminary Q1 Nonfarm Productivity, Preliminary Q1 Unit Labor Cost, the Fed Balance Sheet, and Bank Reserves with the Federal Reserve. Finally, on Friday, April Average Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, and the April Unemployment Rate.

In terms of earnings reports later this week, on Wednesday, ADNT, ALGT, AVNT, AVA, GOLD, BDC, BGCP, EAT, BIP, BLDR, BG, CDW, CHEF, CLH, SID, CVS, XRAY, DBD, DRVN, EMR, EL, EEFT, EXC, FTS, GRMN, GNRC, GFF, HBI, HZNP, INGR, JHG, KHC, LPX, MUR, NI, PSN, PSX, RXO, SMG, SBGI, SITE, SR, SPR, STLA, TKR, TT, TRMB, UTHR, VRSK, YUM, ALB, ALL, ATUS, AMED, ANSS, HOUS, APA, ATO, AVT, EQH, BHE, BKH, CPE, CENT, CENTA, CDAY, CHRD, CIVI, COKE, CTSH, CODI, CTVA, CCRN, CW, NVST, EQIX, ETSY, FG, FLT, FNF, ULCC, GIL, GL, HST, IR, IOSP, MRO, VAC, MMS, MELI, MET, MKSI, MOS, NFG, OPAD, PARR, PDCE, PSA, QGEN, QRVO, QCOM, QDEL, O, REZI, SIGI, SEDG, RUN, TWI, TTEC, TTMI, UGI, VSTO, WERN, WES, WMB, XPO, YELL, and Z report. On Thursday, we hear from GOLF, ATI, AEP, BUD, APG, APTV, ARNC, ARW, BALL, BHC, BCE, BDX, BERY, BWA, BV, BRKR, CAH, CG, COMM, COP, CEG, DLX, DNB, EQNR, ES, RACE, FOCS, GTES, GPRE, DINO, HII, H, IBP, ICE, IRM, ITT, JLL, K, KTB, MMP, MLM, MDU, MRNA, MODV, NFE, NJR, NVO, DNOW, NRG, OPCH, OGN, PZZA, PARA, PH, PTON, PENN, PCG, PNW, PLTK, PPL, PRMW, PRVA, PWR, RCM, REGN, RCL, SABR, SBH, SRE, SHEL, FOUR, SWK, STWD, TRGP, TFX, TU, BLD, UPBD, VNT, W, WLK, WRK, XYL, ZTS, ATSG, LNT, AIG, COLD, AMN, AAPL, TEAM, BGS, BECN, BIO, SQ, BCC, BKNG, CNQ, CVNA, ED, CTRA, CWK, DASH, DKNG, DBX, ERJ, EOG, EXPE, FND, FTNT, GDDY, GT, LYV, LYFT, MTZ, MATX, MTD, MCHP, MNST, MSI, NCR, ZEUS, OTEX, OPEN, OEC, CNXN, PBA, POST, KWR, RRX, RGA, RKT, SEM, SHOP, TDS, TXRH, TSE, TPC, and USM. Finally, on Friday, AES, AMC, AMCX, AEE, AXL, AMRX, BBU, BEPC, BEP, CLMT, CI, CNK, CNHI, D, ENB, EPAM, EVRG, FLR, FYBR, GLP, GTN, HUN, IEP, JCI, LSXMK, LSXMA, MGA, NMRK, OMI, PBF, PAA, PAGP, QRTEA, WBD, and BAP report.

In miscellaneous news, on Monday the US Treasury Department warned that the government could run out of cash by June 1 without a debt limit increase. In response, the President called the Majority and Minority leaders of both Houses of Congress, inviting them to a May 9 meeting to talk about the debt ceiling and federal spending. In other news, after JPM acquired FRC on Sunday night, CEO Jamie Dimon reversed his recent warnings and said the “banking crisis” may be over for now. He went on to point out that many regional banks have posted good first-quarter results. Dimon’s rival, CEO of C, Jane Fraser agreed saying the US banking system is “the envy of the world” (which, to be fair, is not the same thing as saying it is in great shape).

So far this morning, ABC, PFE, ETN, DD, UBER, GPK, ZBH, AME, QSR, ZBRA, MDC, IDXX, MAR, MPLX, TROW, TRI, MD, and IT have all reported beats on both the revenue and earnings lines. At the same time, BP, MPC, and EPD missed on revenue while beating on earnings. On the other side, LDOS, and TRN both beat on revenue while missing on earnings. Unfortunately, GVA missed on both the top and bottom lines. (There are many others reporting later this morning.) It is worth noting that ABC, ETN, and IT have raised their forward guidance. Meanwhile, DD and ZBRA have both lowered guidance.

With that background and with the possible exception of DIA, it looks like the market is looking to open flat again today as we wait on the Fed decision and the digestion of a flood of earnings. All three major indices are above their 3ema, T-line (8ema), and 17ema…all of which are also trending higher. SPY and DIA continue to face a resistance level right near the Friday close. However, immediate resistance for QQQ is less than obvious. Over-extension is not a problem in any of the major indices. With so much in the air, it is quite possible that a good part of at least today and Wednesday will be spent in “wait and see” mode. The Fedwatch tool tells us that confidence in a 0.25% rate hike by the Fed is even stronger than yesterday, up to 91% probability. The other 9% probability is for “no hike.” Beyond this week, futures still currently see little (32% on the largest probability and that for a quarter-point hike in June) chance of an additional increase this year and most are actually still betting on rate decreases sometime in the Fall. (That would be against what the Fed has repeatedly said, but that is what the Fed Fund Futures tell us.)

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service