Morning Video Only Today

Sorry everyone but there will not be a morning blog post today.

[button_2 color=”green” align=”center” href=”https://youtu.be/lgd4HQicPk0″]Morning Market Prep Video [/button_2]

Sorry everyone but there will not be a morning blog post today.

[button_2 color=”green” align=”center” href=”https://youtu.be/lgd4HQicPk0″]Morning Market Prep Video [/button_2]

The speeches out of the Jackson Hole gathering are always important, but it seems that this year all eyes are focused on the event. Expect a lot of volatility around the Yellen and Draugi speeches. The big question is which team will be inspired, the Bulls or the Bears? As they talk, expect quick price fluctuations in both directions as the market reacts to every syllable they deliver. A direction may be determined today, but the problem is we have no idea which way that will be. Currently, the index charts and the transports are not showing much confidence, but that could change quickly or become much worse as they speak. Be very cautious.

The speeches out of the Jackson Hole gathering are always important, but it seems that this year all eyes are focused on the event. Expect a lot of volatility around the Yellen and Draugi speeches. The big question is which team will be inspired, the Bulls or the Bears? As they talk, expect quick price fluctuations in both directions as the market reacts to every syllable they deliver. A direction may be determined today, but the problem is we have no idea which way that will be. Currently, the index charts and the transports are not showing much confidence, but that could change quickly or become much worse as they speak. Be very cautious.

The Economic Calendar on this last day of the week has a couple of heavy hitters this morning. First up to the plate is the Durable Good Orders at 8:30 AM Eastern. This number has had some volatility with a big 6.5% rise in June followed by a 5.8% decline in July. Underneath all the bumpiness Durable Goods orders have been strong and are expected to stay so for today’s reading. At 10:00 AM we get a speech from the Fed Chair from the Jackson Hole Symposium. Some are suggesting she will deliver a historic speech clearing the way for more rate increases. Others speculate the big speech will come from Mario Draugi around 3:00 PM. Suffice it to say the world is watching and waiting to react to every utterance they deliver.

The Economic Calendar only has about 20 reports expected today. I quickly looked through them and didn’t see any that I would deem as market moving reports. However, it is still very important for everyone to stay on your toes checking for reporting dates of those you own or are thinking of adding to your portfolio.

Yesterday I warned of the possible pop and in the morning and unfortunately, this is exactly how it played out. Please understand that was not a prediction but merely an observation of the price action that gave me the clues. After the initial volatility, the market became very choppily and flat. If I were to venture a guess why; it would be because everyone is waiting for the Yellen Speech at 10:00 AM eastern today.

With so my eyes on these speeches and so much speculation as to what they may or may not say we should expect some considerable volatility as they begin to speak. Don’t be surprised to big reactions whipsaw price action as the market reacts to every utterance. The good news is the stalemate between the Bulls and Bears could end today. The bad news is we have no idea which team will come out the winner. Be very cautious!

As normal I will be much more focused on taking profits ahead of the weekend than looking for new trades. However, if by chance a direction is made clear, I will be prepared to act. Over all the index charts currently do not look very healthy so once again I will say be very cautious.

[button_2 color=”green” align=”center” href=”https://youtu.be/6NupT3KNM3M”]Morning Market Prep Video[/button_2]Trade Wisely,

Doug

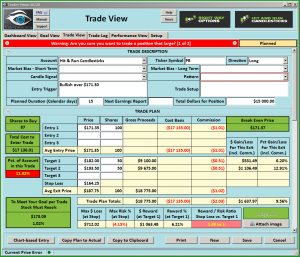

(It’s Friday) Janet Yellen speaks today – will the market be up or down? I don’t know about you, but I have no darn clue, so let’s wait and see. It might be a good time to take a look at your trading plan, at least until Miss Janet starts to talk. A personal trade plan is essential to trading wealth and Fridays are a good day to evaluate your trade plan. Do you have a 12-month goal? Do you know how much per trade, per week so you need to meet the 12-month goal? Do you know what trade set ups are best for you? We have found from our coaching that those that live by a trade plan profit more money and have a much higher success rate of increasing their wealth.

(It’s Friday) Janet Yellen speaks today – will the market be up or down? I don’t know about you, but I have no darn clue, so let’s wait and see. It might be a good time to take a look at your trading plan, at least until Miss Janet starts to talk. A personal trade plan is essential to trading wealth and Fridays are a good day to evaluate your trade plan. Do you have a 12-month goal? Do you know how much per trade, per week so you need to meet the 12-month goal? Do you know what trade set ups are best for you? We have found from our coaching that those that live by a trade plan profit more money and have a much higher success rate of increasing their wealth.

Friday is the day we count our money and reflect on our weeks trading. How did we do? How can we improve? Take time today to pause on trading and consider education. Reevaluate your trading goals, are your goals on track?

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Not much changed from yesterday – we still have a couple longs and a couple shorts. We really aren’t interested into much until the market is more in our favor.

Are you having trouble putting together a winning trade? Not sure what scans to use? So near to having multiple winning trades, but something always goes wrong. Maybe a couple hours with a trading coach could make all the difference in the world. Hit and Run Candlesticks has 4 trading coaches – Learn More about the Coaches

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

I follow the T-Line and the 34-ema regularly, and the combination is flashing warning signs. The SPY, IWM, and the transports all show the T-Line to be below the 34-EMA and any weakness in the QQQ’s today might push the T-Line over. Of course, Janet Yellen is to speak today, and that could change everything. My plan today will be to sit tight and wait.

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

FB – Bullish over $171.30 with the Bull Flag. FB has seen a nice bullish run with a pullback that is currently holding the $164.30 support line. A breakout of the upper flag line would set FB up to test the recent high and then possibly $180-$190 area. A little bullish help from the market would help – Remember not to force a trade. You don’t work for the trade – the trades work for you.

FB – Bullish over $171.30 with the Bull Flag. FB has seen a nice bullish run with a pullback that is currently holding the $164.30 support line. A breakout of the upper flag line would set FB up to test the recent high and then possibly $180-$190 area. A little bullish help from the market would help – Remember not to force a trade. You don’t work for the trade – the trades work for you.

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Added another long to the trade portfolio so now we are long 4 positions and short 2

Are you having trouble putting together a winning trade? Not sure what scans to use? So near to having multiple winning trades, but something always goes wrong. Maybe a couple hours with a trading coach could make all the difference in the world. Hit and Run Candlesticks has 4 trading coaches – Learn More about the Coaches

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

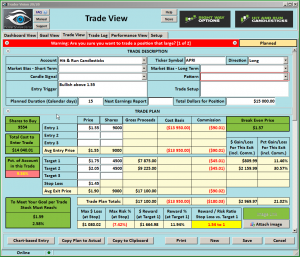

If you bought 100 shares when we posted to our members on May 19. Hit and Run Candlesticks members practice trade management and trade planning with Price and Candlesticks, The T-line, Trend, Trend Lines, Chart Patterns, Support, and Resistance.

With yesterday’s inside day Doji close it would seem the buyers and sellers are still at undecided on a Bullish Breakout or to continue the trend down. With the T-Line below the 34-ema, I must give the game to the sellers, and the buyers are fighting like crazy. Price the most important player on the field is still below the major trend line and below the T-Line and the Bulls have not broken the Lower High Lower Low cycle. We are keeping our inverse ETF list handy.

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.

We kick off the Thursday Economic Calendar with the Weekly Jobless Claims number at 8:30 AM Eastern. Normally we would have seen an increase in Jobless numbers this time of year due to the annual auto retooling. However, this year claims have held steady at historic low levels. Forecasters are expecting to see an increase this week to 237K vs. 232K on the last reading. At 10:00 AM we get a reading from Existing Home Sales which are expected to rise to 5.565 million annualized rate vs. the 5.520 in the last report. After that, we have a few reports that are very unlikely to influence the market and a bunch of bill/note announcements.

On the Earnings Calendar, we have nearly 80 companies expected to report today. Retailers play a prominent role today with reports from ANF, BURL, DLTR, FLWS, and SHLD all reporting before the bell. It’s been a rough quarter for retail so let’s hope we can begin to see that trend change today.

After the morning gap down the Bull attempted a rally but near resistance levels, they seemed equally matched by the Bears. Sideways choppy price action most of the day was the result. Resistance levels continue to hold as does the newly developed technical downtrend. Currently, futures are pointing to a slightly higher open, but as of now, it appears to be less than yesterdays highs. Perhaps today’s economic and earnings data will provide some directional inspiration after the open.

Currently, I am holding some nice gains in several positions and yesterday during the daily live session I picked up a few DIA and SPY puts. Please understand I am not trying to predict the market is about to fall with the put purchase. I am merely adding a little hedge to lower my long exposure to the market. As we approach the weekend, I will have a focus on taking some profits. With the overall market testing resistance, I will also be very focused on price action. I want to be prepared to act if the Bulls break through resistance or if the Bears gain the edge on this battle ground.

[button_2 color=”green” align=”center” href=”https://youtu.be/I_BBPBWDQ-8″]Morning Market Prep Video[/button_2]Trade Wisely,

Doug

Yesterday it was nice to have such a strong bullish move and relieve some of the bearish pressure. Unfortunately, the relief rally was not a game changer. The indexes closed the day below resistance levels and continued to remain under the current downtrends. The Bulls still have a lot of work to do if they are to regain control and I suspect the Bears still have some fight in them.

Yesterday it was nice to have such a strong bullish move and relieve some of the bearish pressure. Unfortunately, the relief rally was not a game changer. The indexes closed the day below resistance levels and continued to remain under the current downtrends. The Bulls still have a lot of work to do if they are to regain control and I suspect the Bears still have some fight in them.

A mistake I used to make was to focus too closely on the hard right edge of the chart. Yesterdays, bullish move would have me tossing caution to the wind, and I would buy stocks with both hands severely over trading the market condition. If the market turned, I would suffer big losses damage not only my account but also crush my confidence as a trader. My suggestion, if you do trade, consider smaller than normal positions to control the risk. Also be mentally prepared to exit trades quickly should the market begin to turn against you. Be willing to take small gains and cut off losses quickly if you suddenly find yourself on the wrong side of the battlefield.

The hump day Economic Calendar kicks off at 9:45 AM with the PMI Composite Flash report. The consensus is expecting a moderate but constructive growth with services continuing to outpace manufacturing. At 10:00 AM we get the latest reading on New Home Sales which forecasters are expecting to remain flat at the July 610K print. 10:30 AM the very important EIA Petroleum Status Report. The last reading showed a decline in inventories, but crude continues to struggle under selling pressure. There is no forecast for this number, so all we can do is wait and hope it will continue to decline and supporting prices.

The Earnings Calendar has just over 50 companies reporting 3rd quarter results. There are several details in the list today with LOW being the most notable and heavily watched. LOW will report before the bell.

Yesterday all the major indexes caught a relief rally that was quite strong and leaving behind an open gap. The DIA, SPY and QQQ’s, all left behind a candle pattern loosely interpreted as a Morning Star. As good as that would seem the indexes are still not out of danger. First, this pattern requires follow-through. Price action to be valid. Secondly, all the indexes closed below. Short-term down trends as well price resistance. The questions now, will the Bulls have the moxie to push through the resistance? I suspect the Bears will have something to say about that mounting a defense. It should be an interesting battle.

Currently, the futures are pointing to a lower open which is not a surprise after such a big move. There are a lot of good charts flashing buy signals after yesterdays move. While I am long the market, I want to remain very cautious. For me, that means I want to be careful to not over trade during this market condition. I will normally begin with smaller than normal positions to reduce my risk. I will also be prepared to take any profits much faster should the overall market show clues of failure. If the Bears happen to regain control, a very quick sell off is possible, so plan accordingly and remain focused on the price action after the open.

Trade Wisely,

Doug

APRI – A T-Line Run Flag Pullback is trending and recently broke out of the $1.48 resistance line and has now pulled back on Bullish profit taking. Price has also pulled back while staying above the V-Stop. Price has also cleared the Dotted Duece and may be ready to take on the 200-SMA. We will be using the Rounded Bottom Breakout Strategy. Until the price is over the 200-SMA.

APRI – A T-Line Run Flag Pullback is trending and recently broke out of the $1.48 resistance line and has now pulled back on Bullish profit taking. Price has also pulled back while staying above the V-Stop. Price has also cleared the Dotted Duece and may be ready to take on the 200-SMA. We will be using the Rounded Bottom Breakout Strategy. Until the price is over the 200-SMA.

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Added another long to the trade portfolio so now we are long 4 positions and short 2

Are you having trouble putting together a winning trade? Not sure what scans to use? So near to having multiple winning trades, but something always goes wrong. Maybe a couple hours with a trading coach could make all the difference in the world. Hit and Run Candlesticks has 4 trading coaches – Learn More about the Coaches

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

If you bought 100 shares when we posted to our members on March 23. Hit and Run Candlesticks members practice trade management and trade planning with Price and Candlesticks, The T-line, Trend, Trend Lines, Chart Patterns, Sup

port, and Resistance.

[button_1 text=”Learn%20The%20Life%20Of%20A%20Swing%20Trader” text_size=”32″ text_color=”#000000″ text_font=”Open Sans;google” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”Y” subtext=”Limited%20Time%20Offer%20-%20Annual%20Membership%2015%25%20Discount” subtext_size=”20″ subtext_color=”#e60acd” subtext_font=”Open Sans;google” subtext_letter_spacing=”0″ text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#ffa035″ styling_gradient_end_color=”#ffa035″ drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://ob124.infusionsoft.com/app/orderForms/Hit-and-Run-Candlesticks-Annual-Membership-65025″ new_window=”Y”/]

We did get relief bounce as we thought we would and a darn good one at that. Unfortunately, it did not close over major resistance, so the Bulls have a great deal more work to do. The upper down trend line is still in play for the sellers and price is still above the cl

oud on a Morning Star signal (2-Day) chart. The sellers have the upper hand as far as the market goes as we start the day. There are many individual long trades that look great. But we are going to keep our inverse ETF list handy.

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.