Market Opens Lower on AAPL News

Market Opens Lower on AAPL news, The news from AAPL suggesting a world slow down which is causing the futures to find lower ground. At the moment 6:25 am Central the SPY is holding above yesterdays low, by the end of the day $242.20 could get tested. And a Bullish close over $252.55 could lead us to the 34-EMA. With the gov shut down and the trade war, the market will remain a complete mess. We have found short-term swing trading from the hour chart brings better-looking charts and cleaner profits.

Pre-market the VXX chart is not showing as much bullishness as I would have thought with price hanging below the 15-min 200-SMA. While the VXX has shown profit-taking over the past few days, it does remain a bullish chart pattern. The profit taking has not caught the 20-SMA, and it may take a day or two for this to happen.

Right Way Options Trading Room

Right Way Options Room Update – The RWO trading room is now open all day to share ideas and watchlist suggestions. Watch Doug as he prepares and explains his trades. Learn More about Right Way Options – Click Here

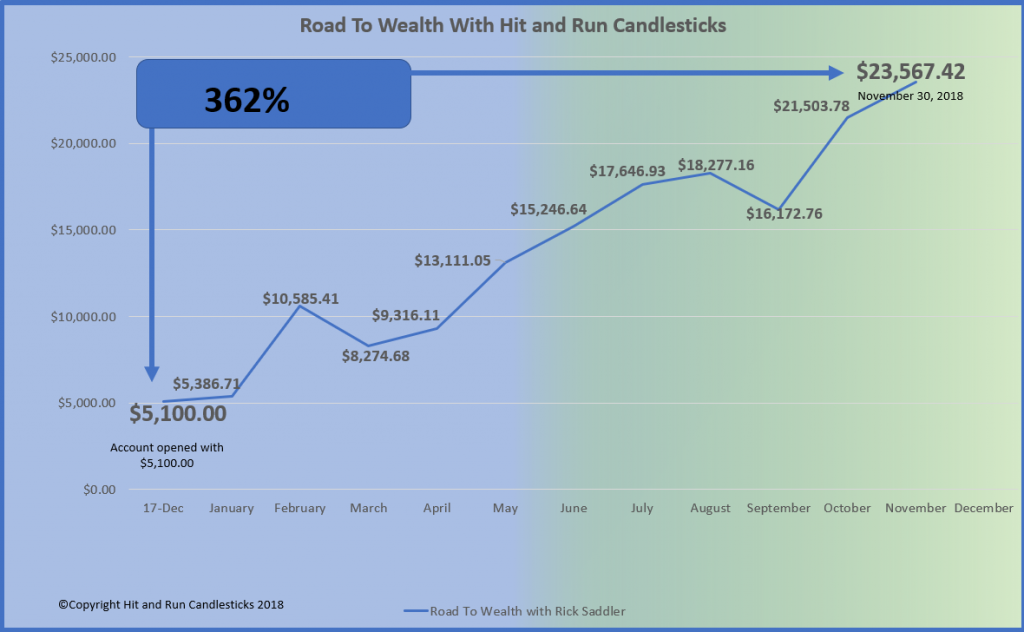

Testimonial From Rick Saddler Fonder of Hit and Run Candlesticks – After 30-years of stock swing trading I now swing trade Simple Directional Options, and my 2018 trading account is up over 360%. Thank

Top Gun Day Trading Room

Day Trading Room Update – The Top Gun Trading room began the new year with some decent trades up over $300 while risking only $100 per trade. Our latest trades include:

- 1 x TSLA Put trade for +$125

- 2 x QLD trades for +65

- 2 x SPXS trades for $114

- Learn More about Top Gun Day Trading – Click Here

Hit and Run Candlesticks Trading Room

The Road to Wealth • Inner Circle – For 2019 Rick plans on taking the now $23,567.00 account to $50,000.00 before December 31, 2019. Remember he already has increased the account from $5,000.00 to $23,567.00 or 362% in 2018. If you would like to learn from someone that truly makes money not just one hit wonders and backs it up with his account statement. – Learn More Here

SWN, CLVS, LVS, EBAY, MRO, DLTR, VLO, SBUX, PG, LLY, MRK are on our watchlist for a possible trade today or within the next few days. Past performance does not guarantee future results. Learn how to trade before you trade.

For 2019 Rick plans on taking the now $23,567.00account to $50,000.00 before December 31, 2019. Remember he already has increased the account $5,000.00 to $23,567.00 or 362% in 2018. Would you like to learn from someone that truly makes money, not just one hit wonders and backs it up with his account statement!

Trading Services We Offer

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing/ Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by it and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service