US & China resume negotiations

As US/China resume negotiations, China’s manufacturing numbers come in less than expected once again raising concerns about economic growth. Asian markets closed mostly lower overnight and European markets are mostly red this morning as well. Here in the US, both the SPT and the QQQ closed at new record highs ignoring global concerns as earnings continue to inspire the bulls higher.

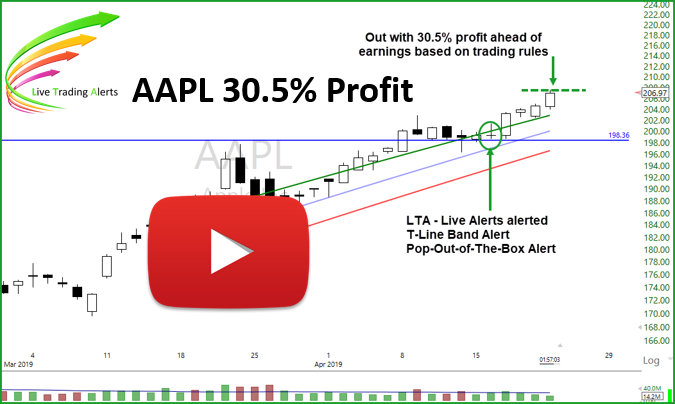

We have nearly 350 companies reporting today topped with the AAPL report coming in after the bell. We also have five potential market-moving economic reports on the calendar as well as the beginning of the 2-day FOMC meeting filling the markets plate for the day. Prepare for volatility but don’t be too surprised if price action becomes light and choppy as we wait for the FOMC announcement Wednesday afternoon. I think we should expect challenging price action the rest of the week where it will be very difficult to swing trade and maintain an edge. Quick and experienced day-traders will likely have the upper hand.

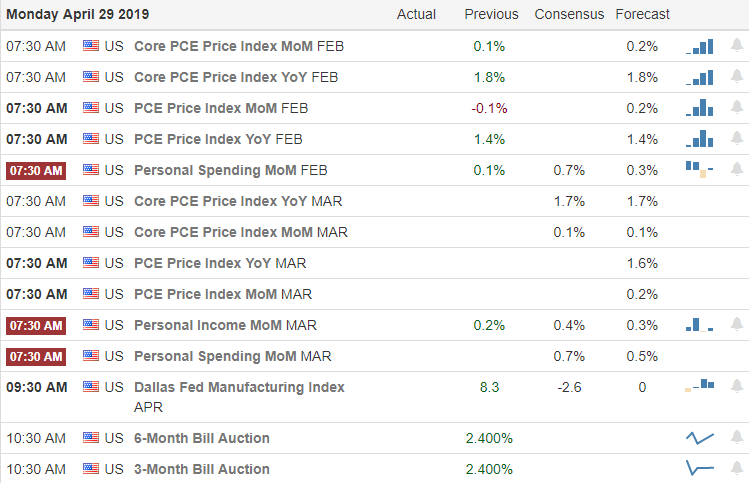

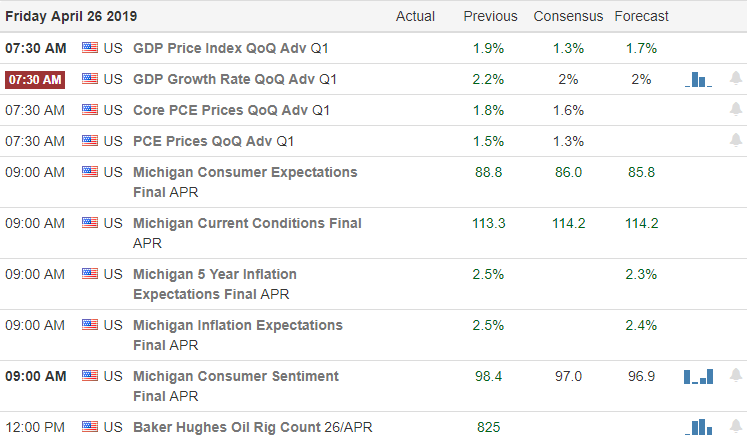

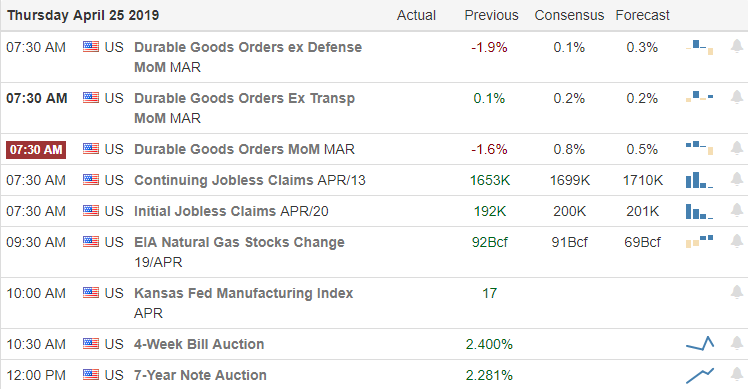

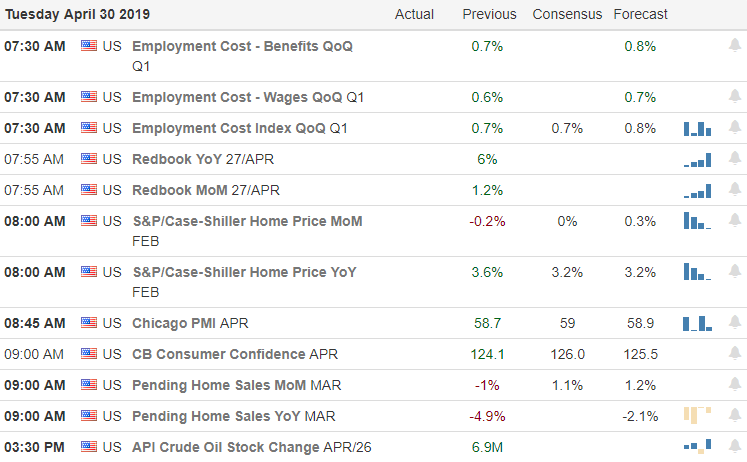

On the Calendar

We have a big day on the Earnings Calendar today with nearly 350 companies reporting. Some of the notable reports are, AAPL, FLWS, AOS, AMD, AKAM, ARNC, ARCC, APRN, EAT, CHTR, CB, COP, GLW, CMI, DENN, ECL, LLY, FEYE, GE, GM, GEO, GRPN, HCA, LL, MA, MCD, MRK, MDLZ, OKE, PFE, PSX, STX, SHOP, SPG, STAG, TWLO, WELL & WH.

Action Plan

Today begins the FOMC 2-day meeting and we have a very big day of earnings reports with AAPL in focus after the bell. GE has already reported better than expected this morning and gapping the stock 7% higher in the pre-market. Commonly the price action is light and choppy ahead of an FOMC announcement but with such big morning of earnings we should prepare for the likelihood volatility.

Overnight Asian markets struggled due to manufacturing numbers coming in less than expected to close their major indexes mostly lower. Europe indexes are flat and mostly lower this morning as well in reaction to the Chian data and selloff in the miners. Consequently, US futures are mixed and pensive as earnings roll-out. Anything is possible by the time the market opens so stay on your toes, focus on price and remain flexible. Finding and holding on to an edge in the kind of environment will be very challenging so plan your risk accordingly.

Trade Wisely,

Doug