A report suggesting we could have a challenging 2nd quarter earnings season dampened the bullish sentiment this morning. Asian markets closed mixed but mostly lower and European markets are seeing flat and mixed markets this morning. Currently the Dow futures are pointing to a gap down of about 75 points while the SP-500 and the NASDAQ futures are flat to modestly lower.

With a challenging 2nd quarter in mind and a relatively light economic calendar this week we could unfortunately experience some light and choppy price action this week as we wait. On Friday the 12th we get reports from JPM, PNC & WFC followed by C and GS Monday the 15th. We will have a little excitement this week with the CPI report and the FOMC minutes on Wednesday.

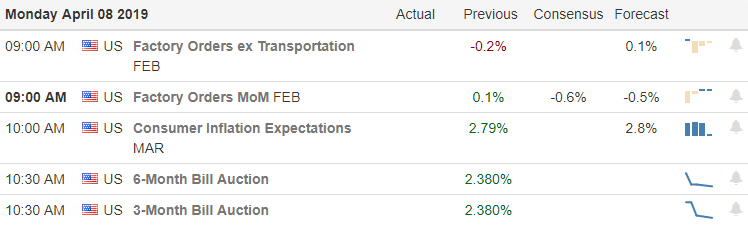

On The Calendar

Interestingly enough we have around 50 companies showing up on the Earnings Calendar today but there is only handful that are confirmed reports so far this morning. Looking through the list there is none that are particularly notable.

Action Plan

During the evening futures were looking bullish on continued hopes of a trade deal but this morning they have taken on bearish attitude. Asian market closed mixed but mostly lower and European markets are mixed and currently flat. It seems as if the market is now suddenly worried that 2nd quarter earnings will not support current prices.

Analysts have lowered earnings targets significantly. According to a report the expectation was for about a 3% growth in earnings but now their thinking it could be down 4%. If the analysts lower the targets enough and the company tops the estimates the market could still go higher in this silly game. However, if a large group of companies misses the lowered targets then this could be a very challenging upcoming earning season. Friday the 12th we will hear from JPM, PNC and WFC followed closely by C and GS Monday the 15th to set the stage.

Trade Wisely,

Doug

Comments are closed.