Bulls continue to march higher.

Inspired by better than expected earnings results, the bulls continue to march higher with record-breaking results in the SPY and QQQ. Even the beleaguered IWM got into the game yesterday breaking through a downtrend that began in October of last year. The huge loss from BA and disappointing results out of CAT has moved the overall Dow earnings results into the negative column this quarter, but surprisingly, the index trend remains bullish.

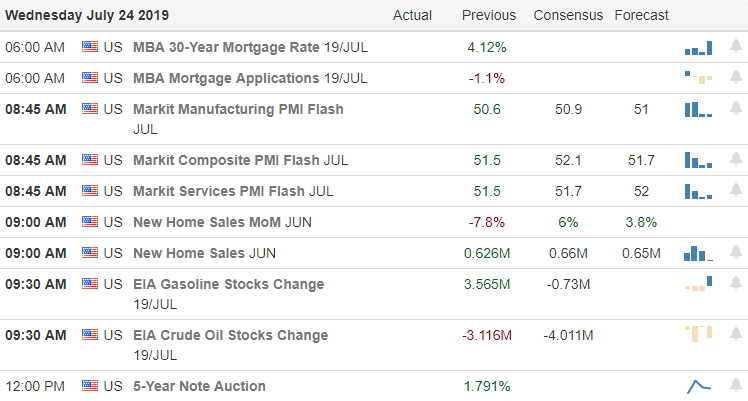

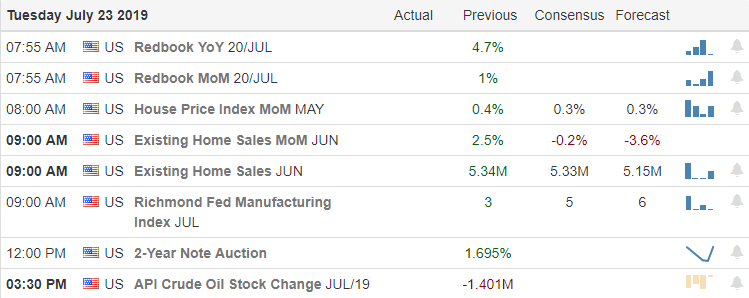

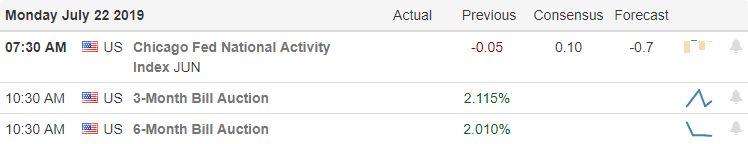

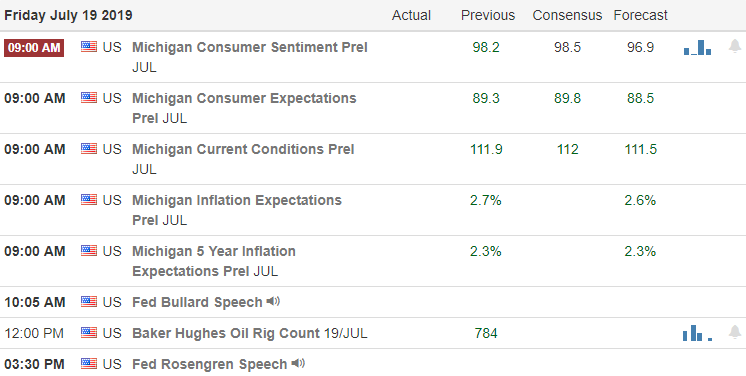

We have a very big day of earnings and economic reports so expect price action volatility to continue. With the VIX close to dipping to an 11 handle, the market appears to have no fear, but that always raises the question of complacency. Remain bullish but keep an eye on the VIX watching for clues if the trend begins to shift. Asian markets closed with modest gains overnight, and European markets trade mixed ahead of the ECB rate decision. US Futures once again point to a bullish as earnings roll out and ahead of economic reports.

On the Calendar

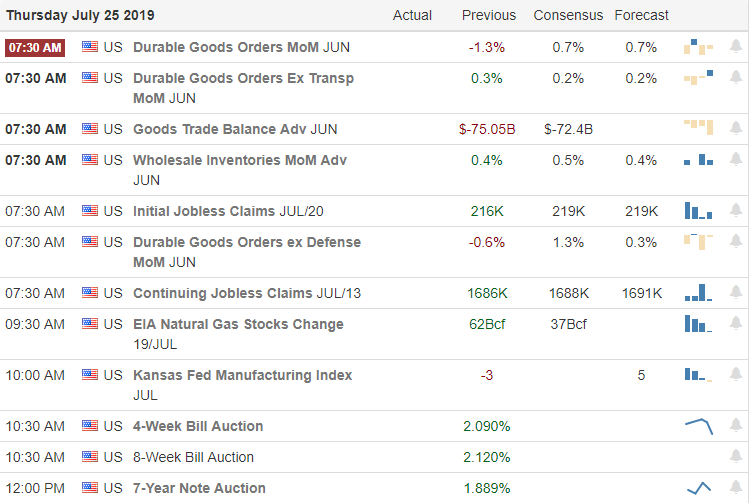

On the Thursday Earnings Calendar, we will have the biggest day of reports this week with more than 325 companies reporting. Among the notable reports are, AMZN, BUD, MMM, ABB, AFL, ALK, GOOGL, AAL, AZN, BMY, CELG, CX, CMCSA, FSLR, HSY, HBAN, INTC, IP, IVZ, TREE, MAT, MGM, NOK, PBR, RCL, LUV, SBUX, TMUS, UN, VLO, WM, WWE, WH, XRX & AUY.

Action Plan

Today we face the biggest day of news events this week to follow yesterdays record-breaking SPY and QQQ bull run. Even IWM which has stubbornly languished in a downtrend suddenly found inspiration to rally yesterday among the better than expected earnings. After accepting a 5 Billion dollar fine for privacy violations, FB beat analysts earnings estimates lifting the stock in aftermarket trading. The Dow, on the other hand, suffered damage after the huge loss reported by BA that moved the entire index into the negative overall earnings growth column for this quarter.

We should expect some volatility in price action with over 325 companies reporting today as well as Durable Goods Order, International Trade in Goods and the weekly Jobless Claims numbers at 8:30 AM Eastern. Trends remain bullish in the DIA, SPY, and QQQ and the VIX is showing so little fear it may reach an 11 handle today raising the question of complacency. However, with the bulls firmly in control and strong upward trends, I will happily continue to follow the price up and banking gains along the way. Go bulls.

Trade Wisely,

Doug