At the close yesterday, it seemed that everything was coming up roses. Strong earnings reports, resumption of face to face US/China trade talks, debit ceiling, lifted without incident and the market moving up into yesterday close. So what gives with the downbeat futures this morning? My guess is some of today earings reports my be the first to shine a light on trade war impacts as CAT fesses up to results. There is also a concern about the coming reports from FB, AAPL, and GOOG as the Federal government begins a wide tech anti-trust investigation.

The chart technicals of the DIA, SPY, and QQQ remain bullish with only the all-time high resistance levels above to challenge a breakout. Asian markets closed with solid gains overnight with the resumption of the trade talks lifting spirits. European markets are missed but mostly lower this morning as they wait for a possible ECB rate cut. Ahead of a big round of earnings reports and New Home Sales numbers US Futures currently point to a slightly bearish open but could improve or worsen as the numbers roll out. Prepare for volatility and be careful not to get caught up in the morning drama. Stick to your rules!

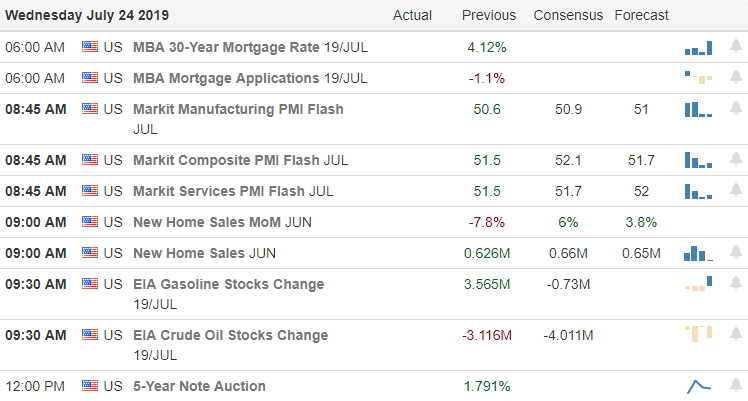

On the Calendar

The Wednesday Earning Calendar could ramp up the market volatility with 224 companies expected to report. Among the notable are, FB, AEM, ALGN, ANTM, T, BA, BSX, CAT, EFX, F, FCX, HLT, LVS, NSC, PYPY, NOW, SIX, SAVE, TSLA, TROW, UPS, VFC, GWW and WIX.

Action Plan

After a day where Congress lifted the debt ceiling, a strong round of earnings reports, learning that face to face US/China negations will resume next week and a solid afternoon rally closing the market near its highs seeing futures in the red this morning is a bit of a surprise. Such is the nature of earnings season, which I have mentioned that large gaps and overnight reversal possible as the market sorts out all the data. So what’s the problem? Today is a very big day of earnings where we some of the effects of the trade war could come to light with the earnings report form CAT. Also, with the Federal Government casting a wide anti-trust investigation net on Tech, FB, AAPL, and GOOG have yet to report raising some concerns.

Technically speaking the trends remain bullish however continue to be challenged by all-time resistance levels in the DIA, SPY, and QQQ. Who knows, maybe today will provide the results necessary for the market to breath a sigh of relief and inspire the bulls to break through the ceiling. On the other hand, one has to wonder what this means for possible rate cuts later this month if the economic slowdown never arrives. It could be a wild and woolly day so buckle up and prepare for a bumpy road ahead.

Trade Wisely,

Doug

Comments are closed.