Market Doldrums Ahead of Weekend

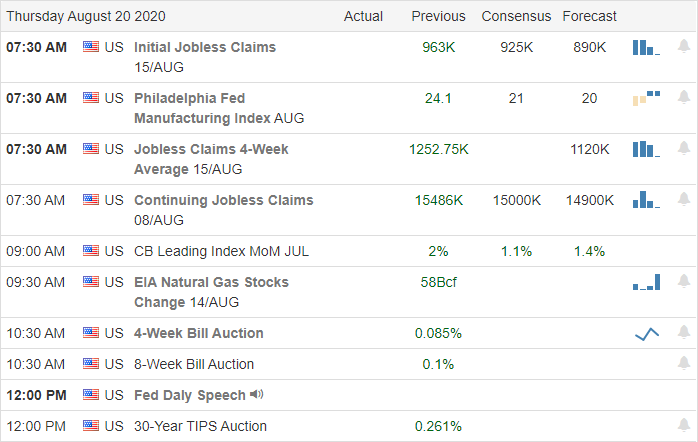

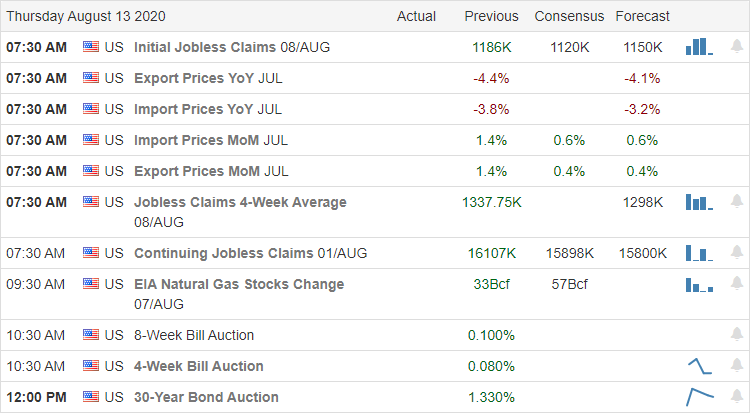

Higher than expected Initial and Continuing Jobless Claims caused a gap down at the open. However, the bulls stepped in immediately and rallied markets all day (give or take s sideways mid-day grind). The result was a Bullish Piercing Candle in the SPY and a Bull Engulfing signal in the QQQ. QQQ also printed another all-time high and all-time high-close. On the day, QQQ gained 1.39%, SPY gained 0.31%, and DIA was up just 0.16%. The VXX fell again to 24.50 and T2122 also fell to 37.40 (getting closer to the oversold territory). 10-year bond yields fell again to 0.651% and Oil (WTI) also fell a bit to $42.62/barrel.

During the day, a CA Appeals Court granted UBER and LYFT an extension on the date when they have to comply with a state order to treat drivers as employees. However, this reprieve lasts only until 5pm on August 25 unless the two companies submit written appeals to lower court ruling and the state regulation. CEO Mark Zuckerberg also finished his 2-days of testimony before the FTC as part of the agency’s antitrust investigation of FB. The FB testimony was the last of the major techs that are targets of the investigation as the CEOs of AMZN, AAPL, and GOOG all preceded Zuckerberg. (No word on when the investigation will be completed or any findings announced.)

On the virus front, in the US, the numbers show we now have 5,746,534 confirmed cases and 177,438 deaths. While the new cases are down (still over 45,000) from the highs, the 7-day averages remain stubbornly at 47,000 new cases and 1,000 deaths per day. Other than the numbers, there was little news on this front domestically as US public attention has been diverted to other things like the end of summer, CA troubles, and politics. However, more colleges did announce outbreaks, the move to virtual classes, and/or at least pauses in sports. Among those Thursday were a number of small colleges along with East Carolina and Notre Dame (Football team outbreak).

Globally, the numbers rose to 22,891,444 confirmed cases and 797,665 deaths. In Brazil, despite a veto from their President, the Brazilian Congress wisely overrode the veto to order mandatory mask wearing. In Asia, South Korea they saw an 8th straight day of triple-digit new cases while Japan is also battling a new wave of cases. Japan has had more than a third of their total cases this month alone. However, in China, new cases are so under control that they have rolled back mask requirements in Beijing.

Overnight, Asian markets were mostly green. Shenzhen, Taiwan, South Korea, and New Zealand were the leaders with over 1% up moves. However, markets in Europe are much more mixed and flatter so far Friday. The biggest movers so far are Russia (+0.64%) and Belgium (+0.49%). The 3 major bourses are all just on the red side of flat at mid-day. In the US, as of 7:30 am, the futures are pointing to a very modest lower open this morning. None of the 3 major indices are pointing to even a gap down of two-tenths of a percent.

The major economic news for Friday is limited to August Mfg. PMI and August Service PMI (both at 9:45 am) and July existing Home sales (10 am). Major earnings are limited to DE, FL, and PDD before the open. There are no major earnings after the close.

On Thursday the bulls rallied back nicely from Wednesday’s black candles. There were no bears to be seen. However, it still feels like a drifting market which is waiting for political conventions and Congressional vacations to end or some other shoe to drop. The trend remains bullish but the summer doldrums are clearly in effect.

If we are trading today, all we can do is follow the trend and stick to our trading rules. Don’t forget to book some profits, because Friday is payday after all. Don’t try to predict any reversals or breakouts. Don’t chase moves you have missed. Above all, remember, our job is to be consistently profitable, not get rich quick.

Ed

The Daily Swing Trade Ideas for today: PZZA, AMD, YUM, RCL, CAR, CVLT, LYV, FCX. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service