Digesting and Spinning The Fed Change

Stocks began Thursday with a modest gap higher that was met with an immediate selloff back below the prior close. That started a rollercoaster day that ended up not far from where it began as all 3 major indices printed gap-up, indecisive candles. On the day, SPY was up 0.22%, QQQ down 0.31%, and DIA up 0.59%. The gain left the SPY at another all-time high close. The VXX gained a bit back up to 25.70 and T2122 climbed a bit to 67.72 (still in the mid-range). 10-year bond yields rose strongly to 0.746% as buyers sought safety in bonds. Oil (WTI) fell almost a percent to $43.00/barrel.

As expected, prior to the open Fed Chair Powell announced that the FOMC will now use an “Average Inflation Target.” This means the Fed will let inflation run well past the 2% target without action until full employment is achieved. He also implied that the FOMC will let unemployment run below its target before taking action on inflation. This set of announcements did have an immediate impact on bond yields and helped bank stocks as investors started to expect inflation.

At the close, House Speaker Pelosi announced she had held a 25-minute call with White House Chief of Staff Meadows. However, she also said no progress was made and there remains a “tragic impasse” between the two sides. Political blame games followed from both parties. This comes as leaks are suggesting the Senate Republicans are trying to agree amongst themselves on a “mini stimulus” bill that is only half the size of their August proposed $1 billion negotiating position. Just as the Senate Republicans had said the Democrat plan from May was a non-starter and would not even be considered, the Democrats in the House are likely to do the same with a Republican mini bill…assuming the Republicans can agree to it among themselves. Again, just political posturing on both sides here.

On the virus front, in the US, the numbers show we now have 6,048,404 confirmed cases and 184,834 deaths. New cases edged up again Thursday to 46,286 (above the 7-day average again) and new deaths fell back to 1,143 for the day (also still above the 7-day average). Meanwhile, airlines continue to threaten layoffs with AAL saying they will cut 40,000 jobs (mostly from buyouts and early retirements) and now UAL saying they will cut 3,000 pilots, both to take place at the end of Federal-aid…unless they get another $25 billion in aid as an industry.

Globally, the numbers rose to 24,661,422 confirmed cases and 836,338 deaths. In Europe, Germany is introducing tougher virus control measures as cases continue to rise. This includes fines for not wearing a mask in any public space, bans on large gatherings, required isolation after returning from high-risk areas. On the vaccine front, both Japan and Germany announced they are working on contracts to secure enough multi-dose vaccines for all their citizens by mid-2021. Speaking of Japan, PM Abe resigned last night due to unspecified health concerns of his own.

Overnight, Asian markets were mixed again. China led the gainers adding between 1.5% and 2%. Meanwhile, Japan and Australian paced the losers down about 1%. Europe is also mixed so far today, but leans to the red side. The biggest gainer is Belgium (+0.37%) while the biggest loser is Sweden (-1.00%). The 3 major European bourses are all just on either side of flat. In the US, at 7:30 am, the futures are pointing to a modestly higher open in the large-caps and a dead-flat open in the QQQ.

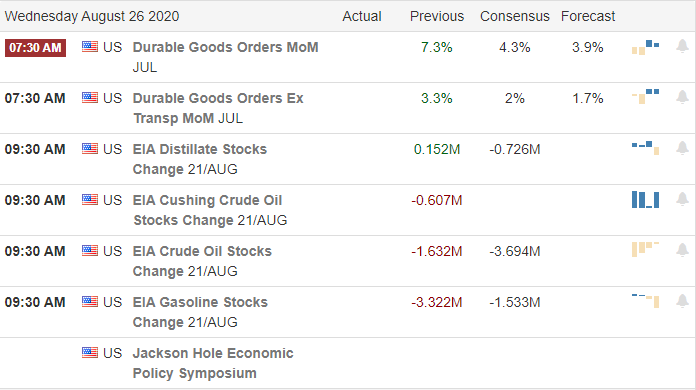

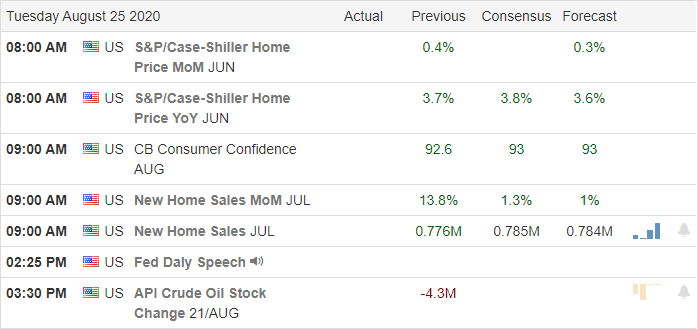

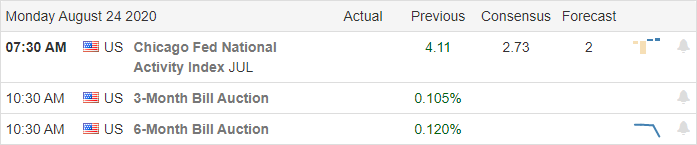

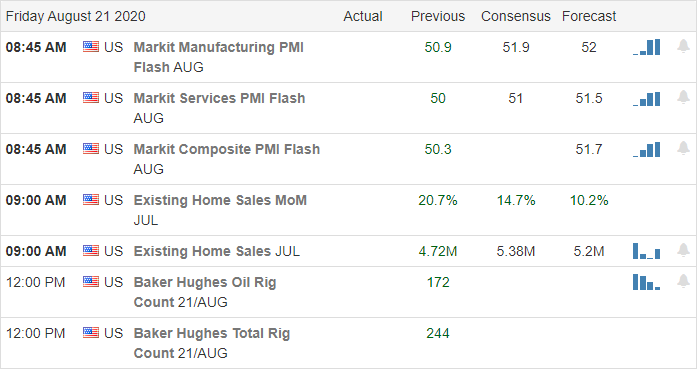

The major economic news for Friday includes July Personal Consumption, July Trade Balance, July Personal Spending, July Retail Inventories (all at 8:30 am), Chicago PMI (9:45 am), Michigan Consumer Sentiment (10 am), and the virtual Jackson Hole Central Banker Symposium continues. Major earnings reports are limited to BIG before the open. There are no major reports after the close.

The rally continues to be strong and extended (from averages), but the bears have shown no sign of having the energy to step in for quite some time. The wait for the political conventions to be over is done and the question is whether the market will now wait until after Labor Day to return or maybe come back next week. Just remember we have had a couple of gap-up indecisive candles in a row now. So, use a little extra caution about getting “too long” into the weekend.

With that said, despite some extension, the trend remains bullish any which way you look at the chart. So, don’t go predicting a reversal to the downside either. Follow the trend and don’t chase moves you have missed. Stick to your rules, process, and work to consistently lock-in your profits and reduce risk. Also, don’t forget to take some off the table today…Friday is payday after all.

Ed

The Daily Swing Trade Ideas for today: CCL, CPRI, FSM, FCX, PVH, BSX, ALLY, NOC. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service