Vaccinations Begun and Stimulus Hope

Markets gapped up about 0.65% Monday and after a grind sideways for about an hour the large-caps sold off. However, the QQQ maintained their sideways grind all day long. At the close, the SPY and DIA printed ugly black candles while the QQQ left a high wick. On the day the SPY was down 0.47%, the DIA was down 0.63%, and the QQQ gained 0.73%. The VXX gained 2.3% to 18.42 and T2122 fell sharply back into the mid-range at 51.75. 10-year bond yields rose slightly to 0.895% and Oil (WTI) gained three-quarters of a percent to $46.94 (the highest close since March).

During the day, a bipartisan group from the Representatives proposed a $908 billion stimulus compromise bill in the House. Interestingly, this bill essentially mirrors the bipartisan proposal made in the Senate a few weeks ago, but which Senate Majority Leader McConnell would not endorse and has said should be replaced by the White House’s late proposal. The Senate bipartisan group plans to introduce their proposal as 2 bills later Monday. One includes both the business immunity and $160 billion in aid for state and local governments. The other includes all other provisions that have been essentially agreed in negotiations.

In Brexit news, there remains no deal with both sides saying they are far apart. All the deadlines for reaching a deal that can be debated in the respective Parliaments and implemented in time have now passed. Still, the two leaders claim there is still hope with two weeks left until a crash-out of the UK-Europe trade deal. Related to this, the UK has taken action similar to what President Trump wants in the US. The British bill will hold websites (specifically social media) liable for what is posted by any of their users. Fines range up to 10% of global revenue per incident of what the government then says is harmful content.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 16,942,980 confirmed cases and 308,091 deaths. We are now seeing 7-day averages of 218,226 new cases and 2,527 deaths per day. However, vaccinations did begin Monday in a relative handful of hospitals across the country. The majority of states have received at least some doses of vaccine in a herculean logistics effort. Sec. Azar (HHS) said that if vaccines from MRNA, AZN, and JNJ are all approved quickly, it may be possible for each American who actually wants one to get their first dose by the end of March. This comes as GOOG pushed back the company’s return to offices until at least September.

Globally, the numbers rose to 73,292,455 confirmed cases and the confirmed deaths are now at 1,630,581 deaths. As a reference, the world is averaging about 627,000 new cases and almost 11,000 new deaths per day. In the UK, Health Minister Hancock announced a new mutation of the virus has been found, which is spreading faster than the original variants, especially in specific places like London. In related news, London was placed under the country’s toughest tier of restrictions as cases spike in the city. In addition, two of the largest British Medical Journals have posted editorials pleading with PM Johnson to not relax restrictions over Christmas as he has promised he will. In Germany, the Health Minister urges the EU to follow the UK and US leads and approve a vaccine before Christmas.

Overnight, Asian markets were mixed and flatish, but leaned to the modestly red side. Hong Kong (-0.69%) and Australia (-0.43%) paced the losing exchanges. On the other side, Malaysia (+0.68%) and Shenzhen (+0.39%) led the gainers. However, most Asian exchanges were moderately down on the day. Meanwhile, in Europe, we are seeing a mixed but more active market. The FTSE (-0.35%) is down with the CAC (+0.28%) modestly higher and the DAX (+0.71) bullish so far. However, the biggest moves are seen to the downside by smaller exchanges (Portugal -0.95% and Denmark -0.93%) so far today. As of 7:30 am, US futures are pointing to a bullish open. The SPY is implying a +0.71% open, the DIA implying a +0.63% open, and the QQQ implying a +0.60% open at this point in the premarket.

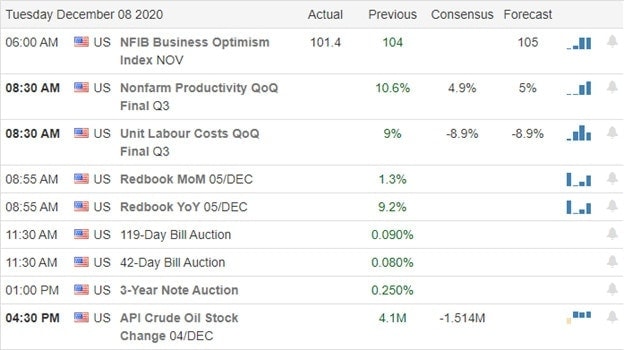

The major economic news for Tuesday is limited to Import/Export Price Indices and NY Empire State Mfg. Index (both at 8:30 am) and Nov. Industrial Production (9:15 am). There are no major earnings reports on the day.

With little economic and no major earnings data, the hope surrounding the beginning of vaccinations and hope for stimulus are likely to give the bulls an edge at the open. However, remember Monday, when a gap higher was met with a selloff by the end of the day. Also, keep in mind that politicians are involved in the stimulus and government funding extension negotiations. This just means that posturing and who knows what kind of news could pop-up at any time until the bills are signed. Also, remember we remain near all-time highs. So, just be careful to not get carried away on either side of the market.

As always, respect the trend, support and resistance, and price action. Stay disciplined to your trading rules and trust your process. Keep taking those singles and doubles that the market offers you. Don’t try to wring every penny out of every last share. It’s better to sell into strength and book the sure profit. Leave “top picking” to the traders who need their ego stroked more than they need to make money.

Ed

Swing Trade Ideas for your consideration and watchlist: EYE, PZZA, DKNG, AMBA, KO, FLEX, PENN, PTON. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service