Just 2-weeks before Christmas, Senate leader McConnell congratulates Biden as the president-elect, and he and Schumer say a stimulus funding deal is on the way. That has the futures pointing to new record highs at the open, assuming the data deluge on the economic calendar doesn’t trip up the bulls. Keep in mind that shortly after the open price, action could become light and choppy as we wait for the FOMC decision and press conference beginning a 2 PM Eastern time. Stay on your toes and prepare for the possibility of some price volatility.

During the night, Asian markets closed the day mixed but mostly higher following the U.S. rebound on Tuesday. European indexes are advancing across the board following a positive global growth trend. Here in the U.S., the bulls are fueled up on stimulus hopes ahead of a big day of economic reports. Buckle up it could prove to be a wild ride.

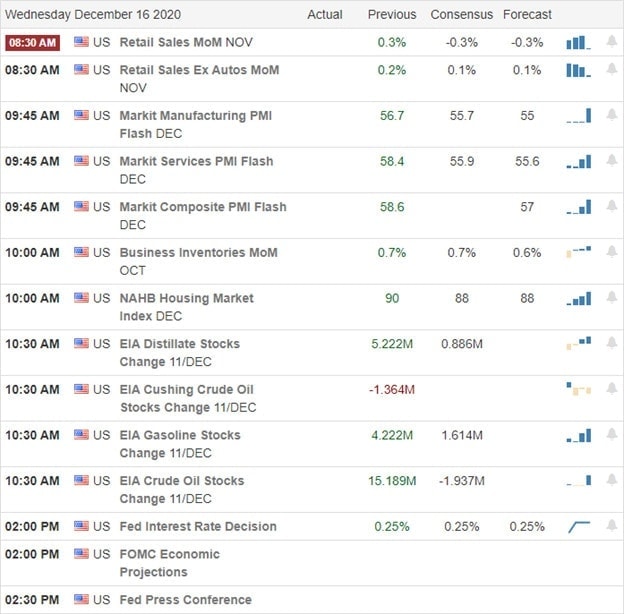

Economic Calendar

Earnings Calendar

The hump day earnings calendar is a light one, but we have a couple of reports worth a look. Notable reports include LEN & TTC.

News & Technicals’

After meeting yesterday on the stimulus bill, Senators McConnell and Schumer hope to soon progress on the funding deal. Hopefulness that the spending bill will soon be on the way is inspiring the bulls once again this morning, likely setting new record highs at the open today. However, attention will quickly turn to the busy economic calendar with Retail Sales, PMI Composite, Business Inventories, Housing Market Index, and EIA Petroleum Status. If that’s not enough to keep traders guessing, we have the FOMC Announcement and the Chairman’s press conference to keep the price volatility alive. In a move that seems to put the presidential election to rest, Senate Leader McConnell congratulates Biden on his win and urges Republicans not to reject the president-elect’s victory.

The bullish trends remain, and with hopes of more stimulus futures point to more record highs this morning. That said, clues are warning that a little caution is warranted. The Absolute Market Breadth indicator continues to downtrend even as the market rallies, suggesting fewer and fewer stocks keep the rally alive. Also, the T2122 indicator is once again suggesting a short-term over-extension. Stay with the trend but have a plan to protect your profits and capital if sentiment begins to shift quickly. Monday’s big rehearsal should serve as a reminder that bears still exist and how quickly the bullish tide can recede from this elevation.

Trade Wisley,

Doug

Comments are closed.