The markets once again took their cues from vaccine news and hopefulness for federal stimulus as the SP-500 topped 3700 for the first time in history and the Nasdaq set its 50th record high for the year. Valuations continue to soar as the overall market P/E Ratio stretches 72% above the 10-year average. The U.S. added 1 million new infections in just 4-days, but that is not slowing down the bull run with a parade of big investment banks predicting a bullish 2021 market. Trade with the trend but have a plan should the sentiment suddenly shift because current market prices are long from technical supports.

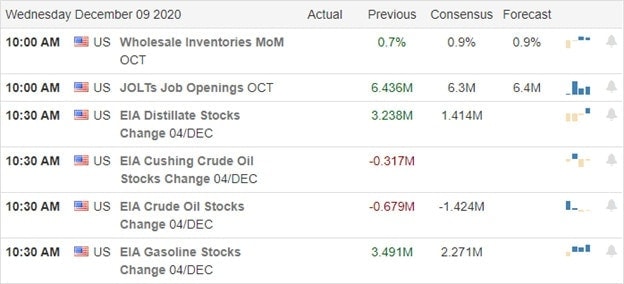

Asian markets traded mixed but mostly higher overnight, with the Shanghai down more than 1%. European markets are currently bullish across the board this morning, with Brexit talks in focus. U.S. Futures point to another morning of bullishness ahead of the JOLTS report and several earnings reports.

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have another light day but still have several quarterly reports of potential market moving. Notable reports include ADBE, CPB, DBI, HOV, VRA & VRNT.

News and Technicals’

It’s becoming all too common, with the market setting new record highs based on vaccine news and federal stimulus hopes. The SP-500 tops 3700 for the first time in history as the Nasdaq prints its 50th record high for the year. As the markets surge higher, so goes the pandemic infections adding 1 million new cases in just 4-days. Phizer is now warning that people with significant allergic reactions shouldn’t take the vaccine after two of Britain’s National Health Service experienced severe reactions. However, both are not recovering, according to the national medical director. Citi Private Bank added its voice to the chorus of big investment banks predicting market gains in 2021 and went on to say it loves these ‘unstoppable’ trend. Mortgage rates continue to fall, setting the 14th record low of the year today, driving more refinance demand.

Without question, the bulls have shown remarkable resiliency and a willingness to buy almost anything, no matter the price. Trends remain strong as we continue to extend steeply away from technicals supports. Stay with the trend, but once again, I caution you to be very careful not to overtrade or chase already extended stocks. Remember, what goes up in a euphoric market rally tends to have severe correction consequences at some point in time. Be prepared in case the sentiment suddenly shifts.

Trade Wisely,

Doug

Comments are closed.