Jobless claims disappointed markets yesterday but having Congress adjourn for the weekend without reaching a stimulus deal appears to be the more significant disappointment this morning. The Whitehouse’s legal battle could also create considerable volatility in the days ahead, depending on how or if the Supreme Court gets involved. The market hates uncertainty, and as we slide into this weekend, considering this historic rally, traders have some tough decisions to make. Capture gains or wait, holding on to hopes for the week ahead. What’s your choice?

Asian markets finished the week with mixed results, but European markets see red across the board as Brexit, and the U.S. stimulus battle continues. The U.S. futures market point to a bearish open that could test index trend supports as traders grapple with the weekend’s uncertainty. It’s been a while since the bears showed much of a willingness to fight but never forget they can attack anytime, so have a plan to protect your capital should they decide to show some teeth.

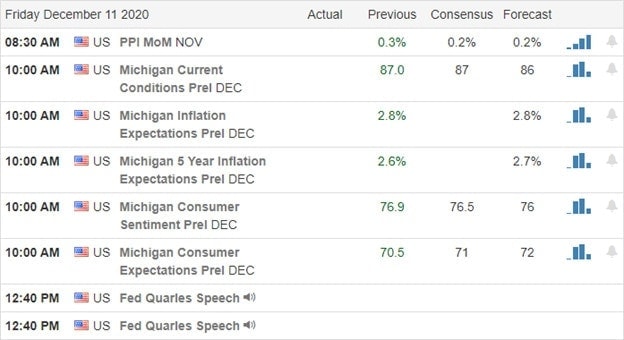

Economic Calendar

Earnings Calendar

Although we have some very small-cap companies, Friday is a light day of quarterly reports. Looking through the list, I could only come up with one somewhat notable, JOUT.

News & Technicals’

An increase in unemployment has the bears stirring about yesterday, but overall the market was still hoping that Congress would reach a stimulus deal. Instead, Congress passed a single week stopgap spending bill avoiding a government shutdown and then adjourned for the weekend. As a result, the market is showing its disappointment, suggesting a bearish open. Prizer’s Covid vaccine took a big step forward with the FDA’s advisory committee recommendation for emergency use. Now it moves up the ladder looking for a full FDA agency approval. In a move that bucks the overall market love affair with Tesla, Jefferies downgraded the company, suggesting they don’t believe the carmaker can dominate the auto industry. Battleground states urge the Supreme Court to reject Texas efforts to overturn the election results. Seventeen states have joined with Texas setting up an interesting legal battle that could create substantial market shockwaves depending on how the battle progresses.

Although the pullback may be disappointing to many, the T2122 indicator has signaled this possibility for some time. Should the early morning bearishness hold through the open, the short-term trends will receive a test of support. If the bulls have the energy to defend, then there is no harm in taking a little break in the current rally. However, if the bears become emboldened, price support suggests that the pullback could be quite painful. Remember, the market has the propensity to throw a bit of a temper tantrum when they don’t get their stimulus fix. Stay focused and have a plan should the bears decide to show their teeth.

Trade Wisely,

Doug

Comments are closed.