Yesterday was a mixed bag of results in the indexes as vaccine news seems to have lost some of its power to inspire the bulls facing a long winter with more lockdown restrictions likely. However, with the healthcare system bursting at the seams with pandemic patients, Congress feels the pressure to pass a stimulus bill by the end of the week. Could this perhaps inspire a Santa Claus rally, or has is it already baked into the current index prices. Something ponders as you plan your risk facing a hectic week of economic data ahead.

Overnight Asian markets closed in the red across the board, responding to a resurgence of virus concerns. European markets trade cautiously mixed this morning with Brexit talks in focus. Here in the U.S., futures point to an overnight reversal as the bulls gain new energy with high hopes of stimulus money soon on the way.

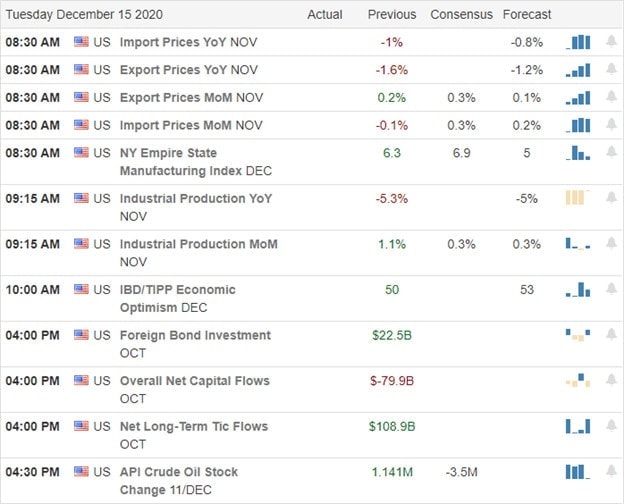

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have a light day. Notable reports include AOUT and NDSN.

News & Technicals’

Yesterday the vaccine news that pushed the markets higher at the open ran out of energy, creating a mixed bag of results in the indexes. The QQQ and IWM managed to rally while the DIA and SPY sold-off as the VIX rallied, showing a little fear. It would seem the vaccine news has now baked in, and the market is beginning to focus on the genuine possibility of more restrictions and lockdowns impacting business. The Electoral College has confirmed Joe Biden as the next President of the United States and ended the Trump administration’s long legal battle. Futures are once again rising with Congress working to pass a stimulus bill by the end of the week. With the U.S. death toll topping 300K and the health care system strained nearing capacity in many parts of the country, Congress feels the growing pressure to respond. The big tech social media giants face hefty fines under new UK rules as the U.S. steps up with substantial antitrust pressure of their own.

Although the DIA and SPY selling was significant, the daily charts remain in bullish trends but signal a bit more caution is warranted. It is still possible that the indexes experience a Santa Claus rally is a stimulus bill does get passed. Still, we should also consider the possibility that stimulus hopes have already been priced into the market. With pandemic lockdown restrictions on the rise and a long winter ahead, the stimulus bill’s passage may well become a sell the news event. Yesterday’s price action points to growing volatility and points to the danger of chasing stocks that are already quite extended. We have a lot of data coming our way in the next few days, so plan your risk carefully and remember to take some profits along the way.

Trade Wisely,

Doug

Comments are closed.