The NASDAQ sets if 49th record high of the year even as the bears make half-hearted attempts in the SPY and DIA. While there are clues that the economy is slowing due to pandemic shutdowns, the bulls remain resolute, showing a willingness to keep extending. Even with vaccines coming to market, we still have a long winter ahead of us, and in the short-term, markets look very extended. Euphoric markets tend to last longer than most would expect, so stay with the trend, avoid chasing extended stocks, and be careful not to overtrade. Runs like this tend to end in an ugly way.

Asian markets closed modestly lower across the board overnight, and European markets see red with a Brexit deal hanging in the balance. Ahead of earnings, another light economic calendar, and Congress still unable to get their act together, U.S. Futures point to lower open.

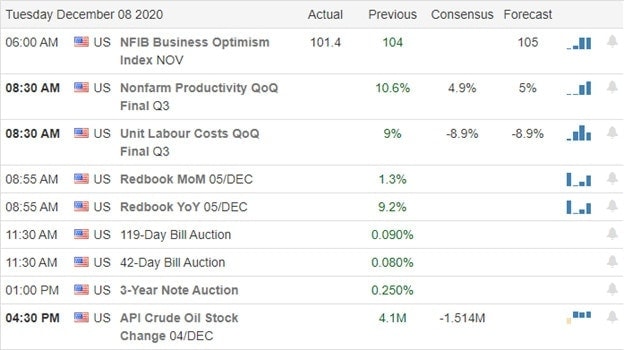

Economic Calendar

Earnings Calendar

Although the earnings have been winding down, we still have several stepping up with quarterly reports. Notable reports include CHWY, GME, AZO, CONN, GWRE, HRB, THO., BF.B.

News & Technicals’

Although we had a little selling yesterday, it was very controlled, and by the end of the day, the bulls maintained control of the trends. The NASDAQ fought the selling, rising to its 49th high record for the year. The Pfizer vaccine has begun rolling out, with a 90-year-old woman in the UK receiving the very first dose. The UK is dubbing the event at V-day after suffering considerable losses across the country due to the pandemic. With the federal government facing a funding shutdown on the 11th, the best it seems that Congress can do is attempt to pass a spending bill that will cover a single week of operation as they continue to haggle over the stimulus bill. With management like that, it’s no wonder that the federal debt is quickly approaching 30 trillion.

Bulls remain in control of the trends, and the T2122 indicator continues to flash a short-term overbought condition. There are so many stocks looking parabolic; it’s very reminiscent of the euphoria present in the 1999, 2000 tech bubble. Although the market conditions are very different, the fear of missing chase of very extended stock prices is much the same. A euphoric market can last much longer than one might think, but it is usually swift and very punishing for those coming to the party late when they end. Although I sound like a broken record, I want caution traders to stay with the trend but guard yourself against overtrading and avoid chasing already extended stocks.

Trade Wisely,

Doug

Comments are closed.