The market seems solely focused on stimulus, rallying the NASDAQ to new record highs. Little details such as declining retail sales, new record hospitalizations, and the highest daily death toll over 3600 Americans won’t stand in its way. Sorry for the sarcasm, but ignoring the economy’s actual state can make for a hazardous situation if the market sentiment suddenly decides to shift. Stay with the bullish trend but stay focused and have a plan to capture gains and protect your capital because a shift south could be swift and punishing.

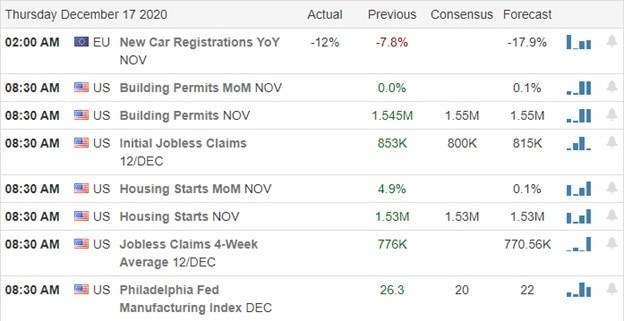

Overnight Asian markets recovered from early losses to close with modest gains across the board. Across the pond, European markets advance with stimulus talks in focus. Ahead of Housing Starts, Jobless Claims, and the Philly Fed MFG Index, futures currently point to a bullish open fueled up on hopes of more federal deficit stimulus spending. Stay focused as we continue to extend.

Economic Calendar

Earnings Calendar

As usual, the Thursday earnings calendar is one of your busiest days of reports. Notable reports include CAN, BB, FDX, GIS, JBL, NAV, RAD, & WOR.

News & Technicals’

Focused only on stimulus hopes and seemingly ignoring any other economic details, the futures are rising this morning. A miss on Retails Sales, a decline in PMI, with new records of more than 3600 deaths and hospitalizations while on the same day printing new a record on the NASDAQ. Jerome Powell left rates near zero and reintegrated the FOMC commitment to keep them low as long as necessary for the economy to recover. The FDA expects to vote on Moderna’s Covid vaccine later today, and Congress is making progress on the stimulus bill. Several states joined Texas in an antitrust lawsuit against Google, claiming collusion with Facebook fixing advertising prices. Antitrust against the tech giants seem to be shaping up as a theme for 2021.

At the risk of sounding like a broken record, stay with the bullish trend but have a plan to capture gains and protect capital if the market suddenly decides to care about the actual economy’s condition. Before the open, today will get readings on Housing Starts, Jobless Claims, and the Philly Fed MFG Index. The most likely to move the market would typically be the Jobless Claims, but with high hopes of newly printed stimulus debit, even a negative number could inspire new record index highs. I will reiterate that both T2122 and T2101 are both flashing clues to be cautious, so be careful not to overtrade or chase already extended stocks.

Trade Wisely,

Doug

Comments are closed.