The U.K. reported a new, more contagious strain of the virus on Sunday, overshadowing the 900 billion stimulus bill agreement sending the futures sharply lower. If this morning’s gap-down reversal gains momentum, it could be a painful day with price and technical supports substantially lower. Though cooler heads may prevail, make sure you have a plan to protect your capital. Expect extreme sensitivity to the news as countries extend and strengthen restrictions in reaction to the new strain.

Asian markets closed mixed but mostly lower overnight. European markets trade decidedly bearish this morning as new travel restrictions go into place. U.S. futures have bounced off overnight lows but still point to a substantial gap down ahead of a light earnings and economic calendar day. Buckle up volatility and with an extreme sensitivity to news surrounding the new strain.

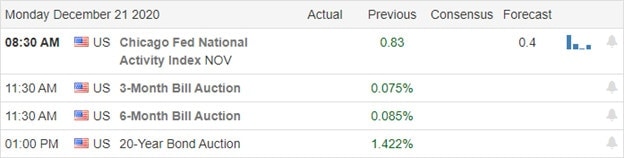

Economic Calendar

Earnings Calendar

As we kick off the Holiday week, we have a light earnings calendar. Notable reports include FDS & HEI.

News and Technicals’

The second vaccine from Moderna reaches hospitals today after emergency approval last week, with infection and death rates remaining very elevated. Late Sunday afternoon, Congress agreed on a 900 billion dollar stimulus bill, the 2nd largest in history. The House will vote on the bill later today, sending to on to the Senate for approval. Airlines are on track to receive another 15 billion in government support but must call back furloughed workers to receive the payments. Yesterday the U.K. scientists identified a new, more aggressively infectious strain of COVID. In reaction, several countries have already banned travel, and instead of the planned easing of restrictions ahead of Christmas, Parlement may add to lockdown restrictions in an emergency Parliament meeting. After hearing about the stimulus agreement, U.S. futures surged 200 points but have turned sharply bearish as new restrictions in reaction to the new strain worry investors.

After a very volatile overnight futures market fueled on the mixed emotions of stimulus and a more infectious strain of the virus, the market points a substantial gap down at the open. Dow futures more than 600 points but has thus far rallied off the overnight lows. That said, those that were buying up positions before the weekend will likely experience a painful reversal this morning. Perhaps cooler heads will prevail, but this is the kind of event that could easily trigger a swift and significant selloff. Try not to panic and stay focused on the price action but plan to protect your capital if the run for the door gains momentum.

Trade Wisely,

Doug

Comments are closed.