Q4 GDP and Earnings On Tap

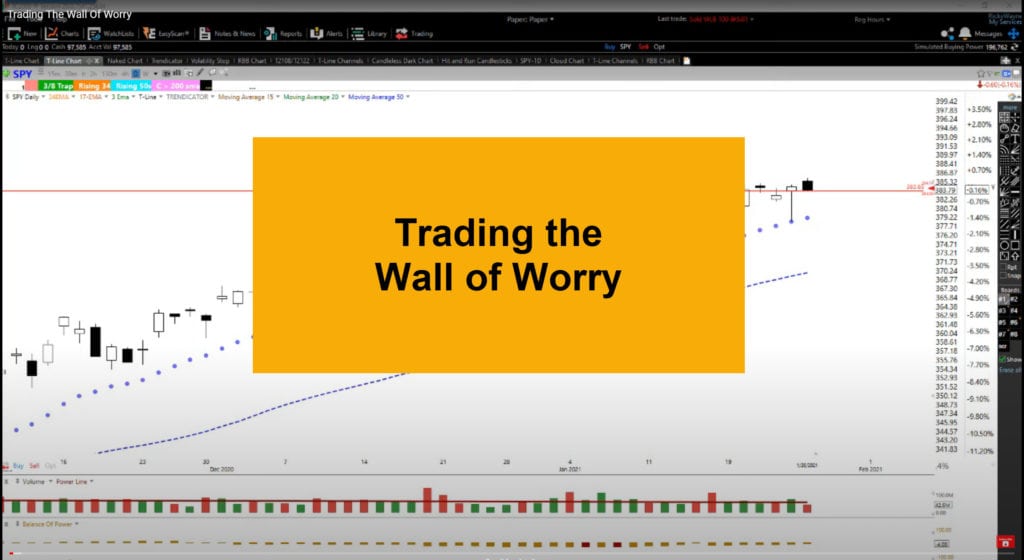

Markets gapped down Wednesday, on the heels of an ugly BA miss and the social media mob driving stocks in massive swings (like AMC which was up 300% in pre-market). After the open stocks then did some roller-coaster swings the rest of the morning. However, the afternoon saw another strong selloff that the Fed decision, statement, and press conference did nothing to slow down. All 3 major indices put in large, ugly black candles, but at least a rally the last half hour kept us from closing on the lows. On the say SPY lost 2.44%, DIA lost 1.98%, and QQQ lost 2.79%. The VXX gained almost 18% to close at 20.25 and T2122 (4-week New High/Low Ratio) fell down near the oversold territory at 23.76. 10-year bond yields fell sharply as traders chased safety, closing at 1.014% and Oil (WTI) was down slightly to $52.66/barrel.

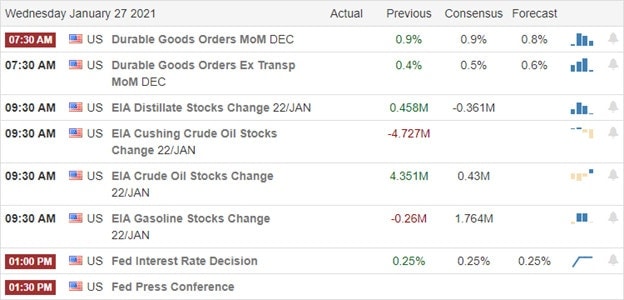

During the afternoon, the Fed decided to hold rates near zero and Fed Chair Powell said FOMC would not taper bond purchases in the foreseeable future while reiterating that any talk of tapering is premature. He did say there was a potential for “transient inflation” and that what is really driving market (asset) prices isn’t monetary policy…it’s about expectations around vaccines and fiscal policy (stimulus). In that vein, House and Senate Majority Leaders (Democrats) seem to be giving up on President Biden’s desire for a bipartisan stimulus package, instead saying they are preparing to pass the Covid Relief bill without the support of any Republicans. While they say they want to win Republican support, Senator Schumer and Representative Hoyer said they believe they can get it done either way.

After the close, AAPL reported blowout earnings. It booked more than $111 billion in revenue for the 4th Quarter and beat earnings estimates by 19% ($1.68 vs $1.41 est). FB also beat on earnings, but did warn of potential impacts from the AAPL privacy changes impacting FB ad targeting and thus ad sales. TSLA beat on revenue, but missed earnings, but it did still report a profitable quarter for the sixth straight time. However, they did say they expect 50% average annual growth in deliveries going forward.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 26,166,423 confirmed cases and 439,521 deaths. However, the number of new cases continues the recent trend of falling as the average new cases are now 166,164 new cases per day. Still, deaths remain stubbornly high at 3,370 per day. Dr. Fauci told reporters that current vaccines (PFE and MRNA) can be easily adapted and/or augmented with booster shots for new virus variants as needed. However, even as-is, he expects the vaccines to provide significant protection against current known variants.

Globally, the numbers rose to 101,534,385 confirmed cases and the confirmed deaths are now at 2,186,710 deaths. In good news, the world’s average new cases is down again to 573,783 per day, but deaths remain high at 14,272 new deaths per day. In the UK, the government says the latest lockdown is working and the country has seen positive test rates fall by 45%. However, two regions (London and the East-midlands) still are seeing a rising number of new cases. In Germany, the Health Minister told the public they should expect at least another 10 weeks of vaccine shortages.

Overnight, Asian markets were red and down significantly, across the board. Shenzhen (-2.82%), Hong Kong (-2.55%), and Indonesia (-2.12%) paced the losers, but no Asian exchange lost less than 1%. In Europe, markets are mixed, but lean to the downside so far today. Among the big 3 bourses, the FTSE (-0.76%) and DAX (-0.44%) are lower while the CAC (+0.09%) is just on the green side of flat. As of 7:30 am, US Futures are pointing to a mixed and modest open. The DIA is implying +0.21%, the SPY implying +0.05%, and the QQQ implying -0.42% at this point (ahead of GDP).

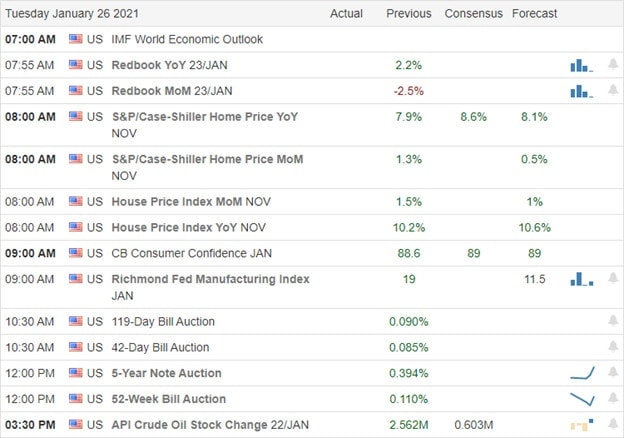

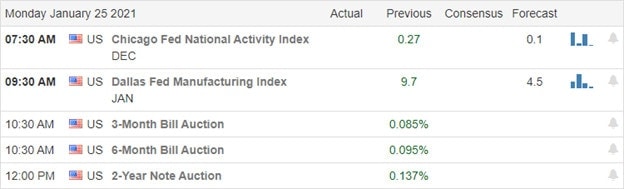

The major economic news for Thursday includes Q4 GDP, Dec. Trade Balance, Weekly Initial Jobless Claims, and Dec. Retail Inventories (all at 8:30 am) and Dec. New Home Sales (10 am). Major earnings reports on the day include FLWS, AOS, ATI, ADS, MO, AAL, AIT, BC, CMCSA, DOV, DOW, FLEX, JBLU, MMC, MA, MKC, MCD, NOC, NUE, NVR, ORI, PNR, BPOP, PHM, RCI, SHW, LUV, SWK, STM, TROW, TSCO, VLO, WRK, and XEL before the open. Then after the close, AJG, CE, EMN, JNPR, MDLZ, OLN, PFG, RMD, RHI, SIGI, SWKS, X, V, and WDC all report.

It looks like Mr. Market may be waiting on the Q4 GDP print before reacting this morning. That and a slew of earnings news are likely to be the drivers today. However, “social media-driven massive moves” is not only pushing around individual stocks in unheard of ways, it is also introducing major volatility and fear of systemic reaction from the big boys (who don’t like their short positions being attacked by non- Wall Streeters). So, exercise some caution today until the direction is clear and be wary of volatility.

As always, follow the trend, respect support and resistance, and don’t chase the moves you missed. Lock in your profits when you achieve trade goals and stick to your discipline. Remember, our job as traders is to produce consistent gains…not catch lightning in a bottle. So, stick with your plan, maintain discipline and work your process.

Ed

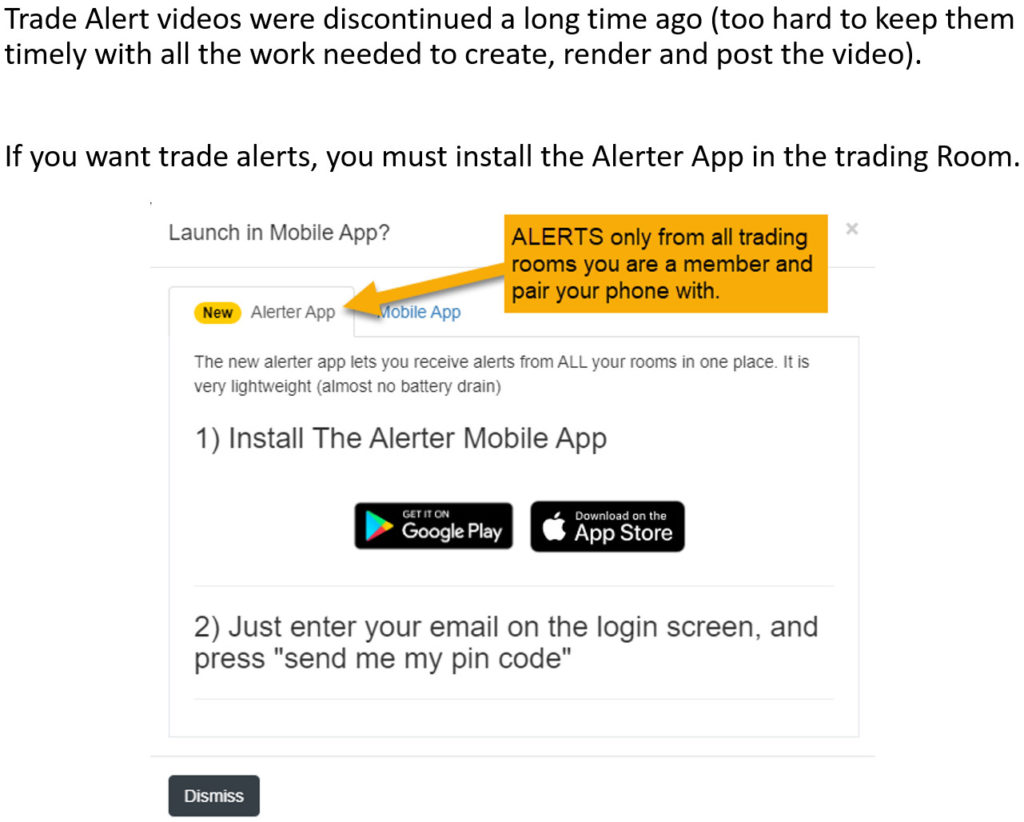

Swing Trade Ideas for your consideration and watchlist: No trade ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service