Q3 Earnings Strong As Big Banks Crush It

On Wednesday, markets gapped and ran higher the first 10 minutes, then sold off hard the rest of the first hour. However, whipsaw rules remain in effect and that led to a long, slow rally that ran higher the rest of the day. This took us out near the highs in indecisive Doji-like candles in all 3 major indices. It’s worth noting that the T-line (8ema) held as resistance again today. On the day, SPY gained 0.37%, DIA gained 0.06%, and QQQ gained 0.80%. The VXX fell 2% to 24.14 and T2122 rose to 76.34, just outside the overbought territory. 10-year bond yields fell a bit to 1.542% and Oil (WTI) was flat at $80.57/barrel.

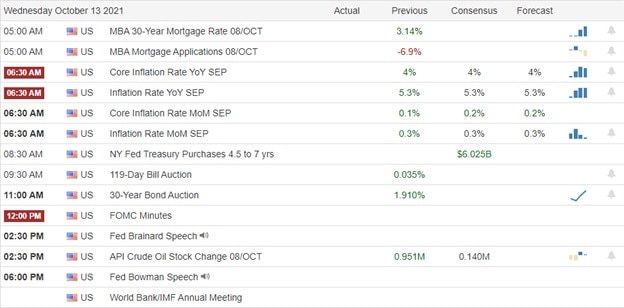

September CPI came in hotter than expected. The Social Security cost of living increase was also announced at +5.9%, the largest in 40 years. A couple of Fed members also admitted in speeches that inflation is going to hang around longer than they had foreseen. Then at 2 pm, the FOMC minutes also indicated that (as was widely expected) the Fed has discussed and broadly agree that they should begin a gradual taper of buying bonds in mid-November (still buying, but buying less).

In the morning earnings releases, among the major banks, BAC, MS USB, WFC all easily topped estimates on both lines. (C is not scheduled to release until 8 am.) It is worth noting that like JPM yesterday, BAC’s report benefitted from better-than-expected loan losses that allowed them to reduce loan loss reserves significantly. In healthcare, UNH also reported a beat on both lines. In the retail/pharmacy area, WBA reported a very strong quarter, also handily topping estimates for both lines, saying they had administered twice as many Covid vaccine shots as had been expected. Interestingly, in the semiconductor space, TSM beat on revenue but came in a bit light on revenue (likely due to substrate shortages).

FB faces more bad headlines (and by extension so does TWTR). It was announced today that a whistleblower (not the same one from the US last week) is set to testify before the UK Parliament. This time, the testimony will be about FB knowing and not acting to combat election interference by “bot accounts” (controlled by government agencies in countries like Russia) in various country’s national elections. This hearing will be part of the debate for a UK law that would impose hefty fines if social media giants knowingly fail to take action against illegal or harmful content.

Overnight, Asian markets were mixed but leaned higher. South Korea (+1.50%), Japan (+1.46%), and Indonesia (+1.36%) led the gainers. Malaysia (-0.49%) was the only appreciable loser as the rest of the region was flat on the day. In Europe, we see even more green as only Denmark (-0.35%) shows any real red at mid-day. The FTSE (+0.73%), DAX (+0.88%), and CAC (+0.90%) are all trading strong in early afternoon action. As of 7:30 am, US Futures are pointing toward a gap higher. The DIA is implying a +0.67% open, the SPY implying a +0.77% open, and the QQQ implying a +0.86% open at this hour. In early morning trading, the Dollar is higher, while 10-year bond yields are down a bit and Oil (WTI) is up 1.35% again.

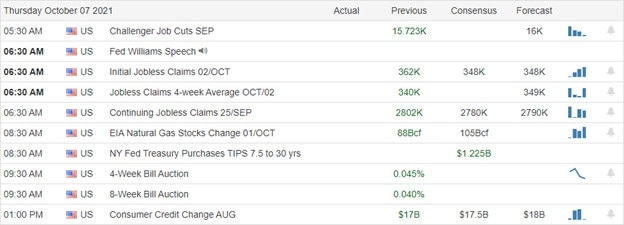

The major economic news scheduled for release on Thursday includes Sept. PPI and Weekly Initial Jobless Claims (both at 8:30 am), Crude Oil Inventories (11 am), and a couple of Fed speakers (Bostic at 10 am and Williams at 1 pm). Major earnings reports scheduled for the day include BAC, C, CMC, DPZ, MS, PGR, TSM, USB, UNH, WBA, and WFC before the open. Then after the close, AA reports.

The bulls are looking to run on a second straight day of great earnings reports to start the season. Premarket prices are pointing to a gap higher. In addition, it looks like the “opening trade” stocks, such as travel and leisure are surging in the premarket. However, remember that the downtrend remains intact and the 8ema has held as resistance the last couple of days. So, trade carefully, because the whipsaw has been in effect especially early recently.

Don’t jump to any reversal conclusions or get caught up in the need for action or FOMO. Focus on your trading process and on managing those things you can control (while not worrying about things you can’t influence). Watch your current positions before looking to add new trades. Remember, it’s discipline and good trading rules that protect us from ourselves. Consistently take profits when you have them. Don’t let greed get the better of you. Finally, remember that we have monthly options expiring at the end of the week. So, it’s time to think about closing, rolling, or riding into expiration with very little time value left.

Ed

Swing Trade Ideas for your consideration and watchlist: BTBT, FCX, AG, AMD, SNOW, MSFT, GOTU, BIDU, LI. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service