With tech under pressure yesterday, the attempt to pump up the open in the premaket found sellers reversing the hope of relief shortly after the open. This morning the futures once again point to a hopeful relief rally, but with significant jobs data just around the corner, can we trust bulls to hang in and fight? No matter what happens with the VIX elevated, expect the price action to challenge us with whipsaws and reversals. Keep a close eye on overhead resistance levels for entrenched bears that will likely not easily give up their current dominance of the trend.

With China closed, Asian markets traded in a choppy session, with the Nikkei falling more than 3% in early trading but recovered to close down 2.91%. However, European markets are trying to shake off market worries, trading in the green this morning across the board. U.S futures have also recovered from overnight lows, pointing to a bullish open ahead of Trade and ISM Services data.

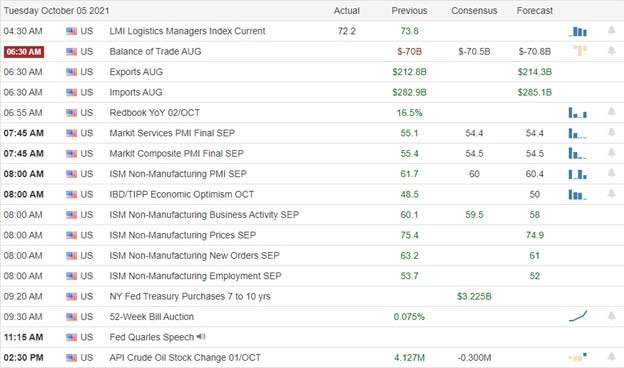

Economic Calendar

Earnings Calendar

We have just two verified reports on the Tuesday earnings calendar, and both PEP & SAR are notable.

News and Technicals’

PepsiCo on Tuesday raised its full-year forecast after its quarterly earnings and revenue topped analysts’ expectations. In addition, the company’s organic revenue climbed 9% in the quarter. New Zealand has become the latest country to abandon a “zero Covid” strategy, a decision that comes as the delta variant of the virus proved too potent to stop. A “zero Covid” policy seeks to eliminate community transmission of the virus. However, experts say the highly infectious delta variant makes that tricky. President Joe Biden on Monday blamed Republicans for blocking efforts to raise or suspend the U.S. borrowing limit and avert a first-ever default on the national debt. Republicans are “threatening to use their power to prevent us from doing our job: Saving the economy from a catastrophic event,” Biden said. China needs to bolster its coal supply to avoid an economic slowdown this quarter, but Beijing’s icy relations with Australia could make that difficult, according to Japanese investment bank Mizuho. The world’s second-largest economy is facing a power shortage owing to a combination of factors such as extreme weather, surging demand for Chinese exports, and a national push to reduce carbon emissions. China generates most of its electricity by burning coal, but major power plants’ inventory reached a 10-year low in August.

Although futures point to a rebound this morning, the technical damage in the chats worsened yesterday, with SPY and QQQ creating news lows with tech under pressure. The T2122 indicator suggests we have not reached an oversold condition, so we can’t rule out additional selling. However, it would also be unwise to rule out the possibility of a relief rally. Markets rarely fall in a straight line and are more commonly a very volatile process with big swings between the lows and highs of the downtrend. Should the bulls step up, it could provide some excellent relief, but don’t ignore the overhead resistance or forget the market-moving jobs data later this week. With the 200-day averages now within striking distance on the DIA and QQQ at a test of that, technical support is not out of the question. With the VIX elevated, we should also expect erratic price action, whipsaws, and reversals to challenge a trader’s discipline and trade plan.

Trade Wisley,

Doug

Comments are closed.