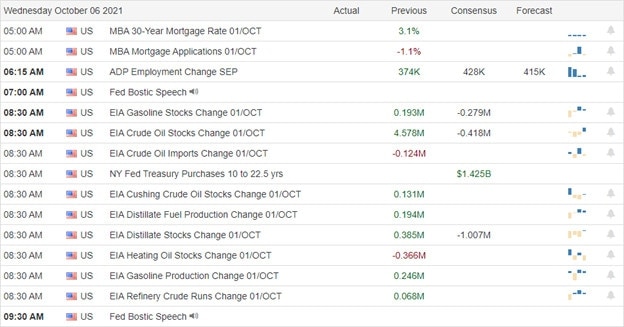

This morning as we wait for the private payrolls number, it looks as if we could suffer a punishing overnight reversal making yesterday’s rally nothing more than a dead cat bounce. However, with worries about the debt ceiling, spiking energy prices, and rising bond yields, the ADP number will have some weighty lifting to do if it’s going to inspire the bulls. With the 200-day moving averages within striking distance, I would not rule out the possibility they get tested as support. So buckle up; it could be a wild price action day as the market try’s to digest the data and quantify its fears.

Asian markets saw nothing but red across the board overnight except for China closed for a holiday. European markets trade decisively bearish this morning, with the DAX and CAC down more than 2%. With an ADP number just around the corner, U.S. futures point to a punishing overnight reversal the may take back all of yesterday’s rally and then some at the open.

Economic Calendar

Earnings Calendar

We have nine companies verified to report on the Wednesday earnings calendar. Notable reports include AYI, STZ, LEVI, & RPM.

News and Technicals’

Facebook whistleblower Frances Haugen testified before a Senate panel Tuesday, telling lawmakers they must intervene to solve the “crisis” her former employer’s products created. Haugen unmasked herself Sunday as the source behind leaked documents at the core of a revealing Wall Street Journal series about Facebook. She was a product manager on Facebook’s civil integrity team. Facebook CEO Mark Zuckerberg on Tuesday addressed claims made by whistleblower Frances Haugen, denying that the company prioritizes profits over user safety. In her annual policy address on Wednesday, Hong Kong’s controversial national security law and electoral changes have brought the city “back on the right track,” Chief Executive Carrie Lam said. OPEC+ is sticking to an earlier pact on oil output despite calls for more crude production. John Driscoll, the chief strategist at JTD Energy Services, said that OPEC+ decision was a “very prudent course of action” until one considers the ongoing energy crises and possible supply disruptions. Oil prices jumping to $100 per barrel is possible, but Driscoll said it’s not sustainable. Treasury yield moved higher this morning, with the 10-year rising 3-basis points to 1.56% and the 30-year jumping 4-basis points to 2.137%.

Yesterday’s bounce was nice but did nothing to resolve the overhead resistance or technical damage, and now it looks as if it was nothing more than a dead cat bounce. Debt ceiling worries, surging energy prices, and rising bond yields are just a few of the issues continuing to motivate the bears in a possible overnight reversal. As a result, traders picking up new long positions yesterday will likely feel a bit betrayed this morning. For years traders have been conditioned to buy the dip, but that activity can heavily damage accounts in a market correction and outright destroy them if this turns into a full-on bear market. With the 200-day moving average within striking distance in the DIA and QQQ, we can not rule out the market’s potential to test those levels in the near future. Of course, if the ADP number comes in surprisingly bullish, that could change sentiment. However, should it come in less than expected, it could also create a bearish pile-on selloff. So hang on tight; it could be a wild day!

Trade Wisely,

Doug

Comments are closed.