Improved Technical’s, But…

Yesterday’s significant reversal move improved technical’s for the SPY and QQQ indexes as they recovered 50-day morning averages, but overhead resistance remains a concern. So, on the one hand, the recovery was nice to see; on the other hand, it significantly increased the risk of additional whipsaws or reversals as we slide toward the uncertainty of the Christmas shutdown. We turn our attention to potential market-moving economic reports with market emotion high. Anyone’s guess how we react, but remember, the volume may quickly decline as traders take off for holiday plans. Plan your risk carefully!

During the night, Asian market trade mixed but mostly higher, with travel stocks suffering the uncertainty of rising infection rates. Across the pond, European markets trade flat to slightly positive, keeping a close eye on possible pandemic impacts. U.S. futures currently suggest moderate gains and losses at the open, facing a morning of market-moving economic data. Expect price volatility as we react and then choppy conditions due to holiday travel.

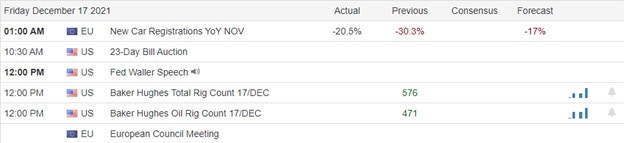

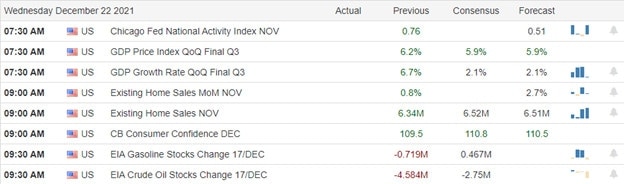

Economic Calendar

Earnings Calendar

We have just 12 companies listed on the Tuesday earnings calendar, with several unconfirmed. Notable reports include KMX, CTAS, PAYX.

News & Technicals’

CES, which serves as an annual showcase of new trends and gadgets in the technology industry, has attracted more than 180,000 people from around the world to a sprawling array of casinos and convention spaces in the past. However, Amazon and its smart-home unit Ring said they would not be onsite at next month’s event due to the “quickly shifting situation and uncertainty around the Omicron variant” of coronavirus. U.S. wireless carrier and conference sponsor T-Mobile also said the vast majority of its contingent would no longer be going. In addition, its chief executive would not deliver a keynote speech. The CDC currently recommends isolation for 10-days after a positive Covid test. Delta wants to cut that in half to five days. The call comes as Covid cases spike and the heavily mutated omicron variant spreads rapidly, straining testing supplies. The head of Germany’s navy said China’s rapid naval buildup underlines a desire by leaders in Beijing to project strength. Vice Adm. Kay-Achim Schonbachsaid China is increasing the size of its navy by the equivalent of the entire French navy every four years. Schonbach commented that the German frigate Bayern is docked in Singapore as part of an effort to safeguard security and stability in the region. Treasury yields ticked lower on Wednesday morning, with the 10-year trading down to 1.463% and the 30-year dipping to 1.876%.

Yesterday’s significant reversal improved technicals, with the SPY and QQQ reclaiming their 50-day averages. However, there remain questions about overhead resistance levels, and the sharp rally just increased the risk considerably for those jumping back into long positions heading into the long weekend. Today we turn our attention to the economic reports of GDP before the bell and Consumer Confidence, Existing Home Sales, & Petroleum Status during the morning session. Hopefully, price action can calm down with these potentially market-moving reports and the high emotion shown in the price action; anything is possible! When considering positions, it would be wise to remember that volume is likely to decline as traders shut down for holiday plans putting them at risk during Christmas closure.

Trade Wisley,

Doug