Bear Gap As Bond Yields Rise For Monday

FDX removing guidance and predicting a global recession had markets spooked on Friday. As a result, the 3 major indices gapped down (between 1.1% and 1.5%) at the open and has then oscillated sideways in a fairly tight range until 2:30 pm. At that point the bulls stepped to rally for the rest of the day, closing near the highs of the day. (However, still the lowest close in two months.) This action gave us gap-down, indecisive Spinning Top candles across all the major indices. This will put all 3 major indices in a large Bearish Engulfing signal on the Weekly chart.

On the day, all 10 sectors are firmly in the red. The Energy and Industrials sectors led the way lower while Comm. Services and Consumer Defensive held up the best. SPY fell 1.18%, DIA lost 0.76%, and QQQ fell 0.66%. The VXX gained 3.45% to 19.81 and T2122 dropped deep into the oversold territory at 5.87. 10-year bond yields are back down to 3.453% and Oil (WTI) is mostly flat at $85.28/barrel. So, overall, it has been a fearful and yet undecided day in the market as most eyes focus on the Fed decision coming this week.

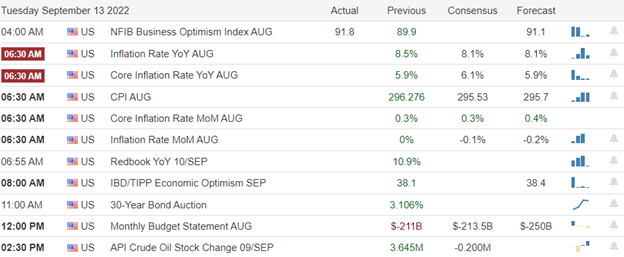

In Economic news, on Friday, Michigan Consumer Expectations came in slightly above expectations (59.9 vs 59.7 forecast) while current Michigan Consumer Sentiment came in below estimates (59.5 versus 60.0 forecast). Bloomberg also reported interesting news about the housing markets that points toward the bifurcation of the economy. If seems that in July nearly one-third of home purchases came in all-cash deals (buyers who paid cash and did not need a mortgage). Records for such things are not kept, but this seems like a huge percentage. On Saturday, GS cut its US Economic Growth forecast for 2023 from 1.5% to 1.1% after it raised its terminal Fed Rate to 4.25% (Fed Funds have priced in 4.5% terminal). Finally, in what points toward a downturn, WBD has fired 100 television ad salesmen as NFLX also announced another round of 300 terminations in a cost containment move.

SNAP Case Study | Actual Trade

In stock news, Reuters reported that the details of SEC accounting guidance for any companies that hold cryptocurrency assets (announced on the last day of March) are now fleshed out. These additional costs and capital reserve holding requirements have caused major lenders (GS, JPM, BK, WFC, STT, etc.) to put cryptocurrency projects on hold (or outright canceled). After the close Friday, US Dept. of Justice officials have asked the court to take part in oral arguments in the Court of Appeals in the Epic Games vs. AAPL antitrust lawsuit. The DOJ is expected to be on the Epic side, but neither party objected to the DOJ request. Also, after the close, BMY and ABBV both announced minor job cuts (360 for both companies combined). On Saturday, the ECB asked AMZN and 4 European companies to submit proposals for the creation of a new Digital-Euro (cryptocurrency). This is part of a two-year prototyping and investigation phase of the project.

In Energy news, Germany took control of a major Russian-owned oil refinery Friday. (This was the Schwedt refinery owned by Rosneft. This refinery supplies 90% of the fuel used in Berlin.) Meanwhile, on Sunday, China’s August gasoline exports were reported as almost double (+97.4%), while its LNG imports for the month fell 28.1% from a year earlier. Overnight, Bloomberg reported that after a Russian Gazprom unit (seized by Germany earlier this year after the invasion) canceled shipments to India, GAIL India has been forced to buy 3 LNG tankers (for October to November delivery) on the open market, paying twice the price it had previously paid Russia.

In miscellaneous news, the Fed is not the only central bank looking at rate hikes this week. Japan, the UK, Norway, Sweden, Switzerland, Taiwan, and several other countries all have rate meetings set for this week. While the Fed is widely expected to continue the inflation-fighting theme with another 0.75% hike, much of the rest of the world (especially places like the Philippines, Indonesia, and even Turkey) is likely to take a softer approach. (Counting on the US and EU to do the heavy lifting on taming global inflation.) Speaking of Taiwan, overnight President Biden answered an interview question, stating that the US forces would defend Taiwan from “any unprecedented attack.” (That was the fifth time he has made a similar statement on Taiwan since the Russian invasion of Ukraine.) Finally, note that the UK markets are closed for the Queen’s funeral and Japan is also closed for a national holiday.

Overnight, Asian markets were nearly red across the board. Only India (+0.52%) and Thailand (+0.07%) were able to manage to hang onto the green. Meanwhile, South Korea (-1.14%), Malaysia (-1.08%), and Hong Kong (-1.04%) led the region lower. In Europe, we see a similar story taking shape at mid-day. Only Russia (+0.30%) is holding green. At the same time, the DAX (-0.69%), and CAC (-1.23%) are leading the region lower in early afternoon trade. As of 7:30 am, US Futures are pointing toward a gap lower to start the day. The DIA implies a -0.85% open, the SPY is implying a -0.87% open, and the QQQ implies a -0.92% open at this hour. 10-year bond yields are up to 3.506% (the highest level since 2011) and Oil (WT) is down almost 2% to $83.55/barrel in early trading.

There are no major economic news events scheduled for Monday. The major earnings reports scheduled for Monday are limited to AZO before the open. (AZO reported a beat on both the top and bottom lines early today.)

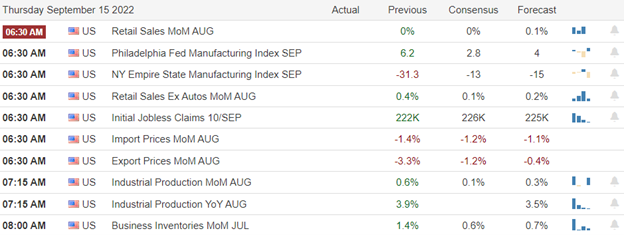

In economic news later this week, Tuesday we get August Building Permits, August Housing Starts, and API Weekly Crude Oil Inventories. Then Wednesday, August Existing Home Sales, EIA Weekly Crude Oil Inventories, Fed Interest Rate Projections, Fed Rate Decision, Fed Statement, Fed Economic Projections, and the Fed Chair Press Conference all are reported. On Thursday, we get Q2 Current Account and Weekly Initial Jobless Claims. Finally, on Friday, we see Mfg. PMI, Service PMI, and Fed Chair Powell speaks again.

In earnings reports later this week, AJG and SFIX report Tuesday. Then Wednesday, GIS, FUL, KGH, LEN, SCS, and TCOM report. On Thursday, we hear from ACN, DRI, FDS, AIR, COST, and FDX report. Finally, on Friday there are no major earnings reports scheduled.

The downtrend continues with the gap lower looking to take at least the SPY and QQQ indices down near to a potential support level. With that said, and while there may be some movement today, many traders are going to be waiting to see whether the Fed gives us any surprises. (Talking heads are all over the place, calling for every scenario from +0.25% to +1.00% on Wednesday. However, traders have priced in +0.75% judging by the Fed Funds Futures.)

The major indices are extended to the downside at this point, far below their T-line and with T2122 deep into the oversold territory. However, we have seen indecision (more wick than candle body) the last 3 days (as well as in the premarket session today). So, expect some volatility after the gap lower…but also be prepared if the market goes dead while traders begin waiting on the FOMC. All we can do is trade the chart (the actual price action) and not what you predict will happen.

Remember that trading is our job, not a pastime or hobby. So, treat it that way. Do the work and follow the process. Stick with your trading rules, trade with the trend, and take those profits when you have them. Demonstrate patience and wait for confirmation. Don’t be stubborn. If you have a loss, just admit you were wrong, respect your stop, and take the loss before it grows. When price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: No Tade Ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service