Bearish Engulfing Candles

After hearing some sobering health officials testimony in congress, profit-takers rushed in at the end of the day, leaving bearish engulfing candle patterns on all the index charts. Those that got short early will now have to deal with a morning gap up inspired by a proposed 3-trillion dollar stimulus bill the includes more direct payments to citizens. Although the House plans to pass the bill, the Senate is currently suggesting it will be dead on arrival. Expect more price volatility in the coming day as a result.

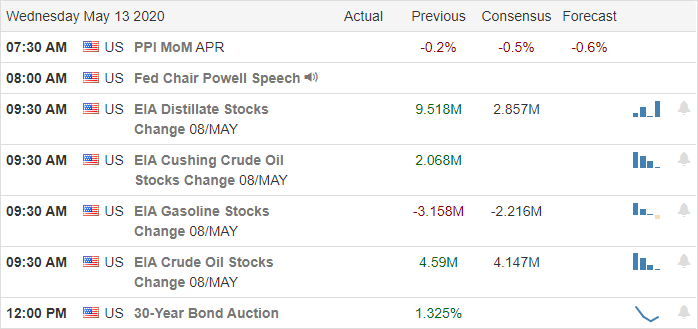

Asian markets closed the day mixed but mostly lower in a modest trading session. European markets are lower across the board as virus reemergence fears weigh on investors. Fueled by the prospect of more government debt spending, the US Futures point to a gap up open ahead of earnings, Powell comments, and the latest reading on PPI. It could be a wild and woolly day, hold on tight!

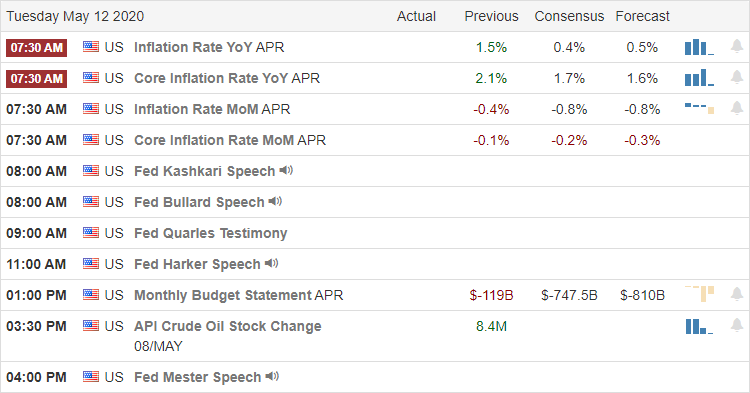

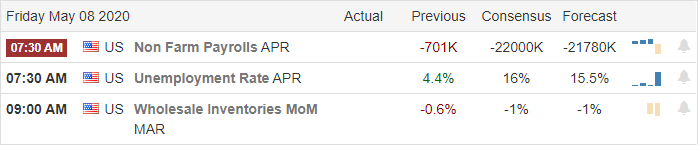

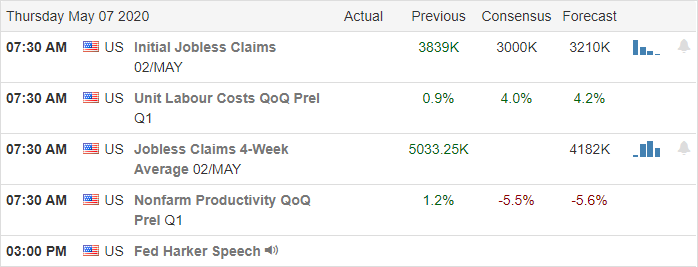

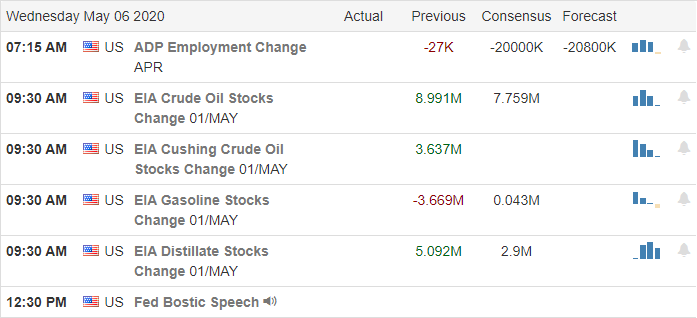

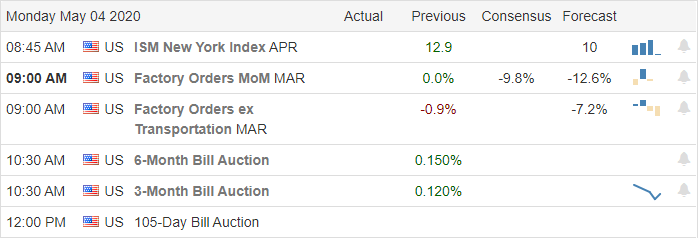

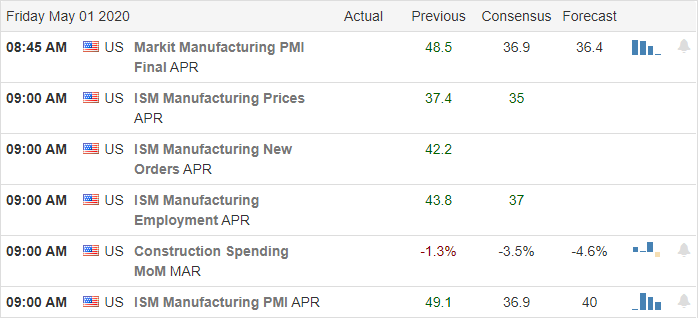

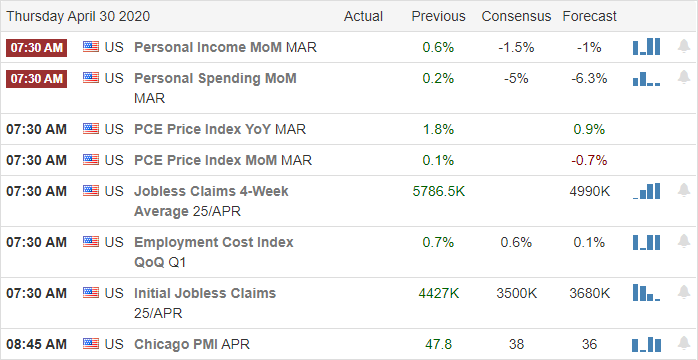

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar we have just short of 150 companies reporting today. Notable reports include CSCO, JACK, SDS, & TCEHY.

Technically Speaking

After attempting to break resistance in intra-day price action, the QQQ finally found some profit-takers and the big-4 turned quickly south. Health officials in congressional testimony gave a sobering opinion and warned that reopening the economy to soon could create a wave in new infections that may get out of control. They said the chance of having a vaccine by the next school and college season is unlikely and warned of a resurgence of the virus next fall. The report seemed to shake the overall market that has strongly rallied over the last month with very optimistic views of reopening. Then overnight the House democrats unveiled a new 3-Trillion dollar stimulus bill that once again provides direct payment to citizens. As usual, the prospect of newly printed money and governmental debt spending rallied the overnight futures that currently point to a significant gap up at the open. The Senate has already stated it is unlikely to pass their chamber.

Yesterday’s closing selloff left bearish engulfing candle patterns near resistance levels on all the major index charts. Unless there is an outside influence, a bearish engulfing candle suggests a follow-through down is likely. However, this morning there is the possible 3-trillion outside influencers changing the prospect of follow-through and punishing those that took short positions. To be fair even with yesterday’s quick selloff, there was no major technical breach with all the indexes hold above support levels and their 50-day averages. However, it did offer up a quick reminder of how quickly the tide can shift and how dangerous a wide consolidation range can be when it does. Plan your risk carefully and expect a bit more challenging price volatility for the rest of the week.

Trade Wisely

Doug