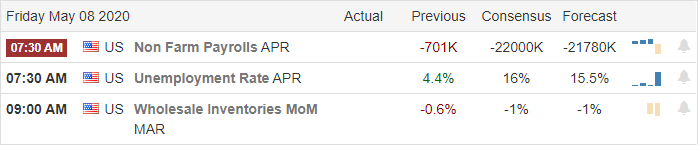

The tenacious bulls push indexes higher even as unemployment soars to 33 million. The NASDAQ recovers all of the 2020 losses with as APPL, AMZN, GOOG & GOOGL do the majority of the heavy lifting even as the Absolute Breadth Index remains in a downtrend. It would seem in light of unprecedented government spending the idea of working and company production is an outdated concept easily replaced by mountains of debt. Will the historic Employment Situation number matter? We will see in a couple of hours.

Asian markets rallied to end the week with Japan up more than 2%. European markets are bullish across the board this morning, and US Futures continue to power higher this morning ahead of job numbers and earnings. As we head into the weekend, don’t be too surprised if some profit-takers take advantage of the gap up, reducing risk.

Economic Calendar

Earnings Calendar

The Friday earnings calendar indicates about 150 companies will step up and report. Notable reports include BLMN, EXC, TWNK, KIM, NBL, PPL, SEAS, SWCH, & VTR.

Technically Speaking

More bullishness yesterday as the indexes rose more than 1% as the NASDAQ recovers all of 2020 losses even as the country deals with 33 million unemployed. Today the Employment Situation number is expected to report the worst jobs report in the countries history, but somehow that does not seem to matter. How can this be? I believe it is all in the weighting of the averages. MSFT, AMZN, GOOG & GOOGL account for nearly 20% of the SP-500. So is the SP-500 reflective of the actual market condition? With the Absolute Breadth Index still showing a downtrend, one might have to answer that question with a no. Combine that with trillions of dollar’s flooding in from government stimulus where debt no longer matters and an extremely accommodative central bank the SP-500 reflecting the actual market condition is all but impossible.

Technically the DIA, SPY, and IWM remain bullish but locked in a tightening consolidation pattern with the tech-heavy QQQ enjoys the majority of the benefits of the big-4 titans continue to rally. I get asked the question nearly every day. How long can this continue? My answer is always the same. Stay focused on the price and trade the chart. The trend is the trend until the trend breaks, and right now, it seems the bulls have an unquenchable desire for risk no matter the state of the economy. That said, please remember that gap up opens near index highs, and price resistance levels have the potential to find profit-takers creating a pop and drop pattern. As of now, US futures indicate a strong gap up open in total defiance of unemployment that may well continue through the end of the day. However, don’t rule out the possibility that profit-takers could take advantage of the gap closing trades and avoiding the weekend risk.

Trade Wisely,

Doug

Comments are closed.