Yesterday the bulls and bears battled it out in a choppy cage match that seemed to show some concern for the Jobless Claims numbers. However, looking at the morning futures seems to indicate, we don’t care about unemployment. I must admit the ability of the market to ignore history-making unemployment is not only fascinating but also quite troubling. That said, the bulls remain in control, and index trends remain bullish as we head into 2-days of ugly job numbers. Plan your risk carefully.

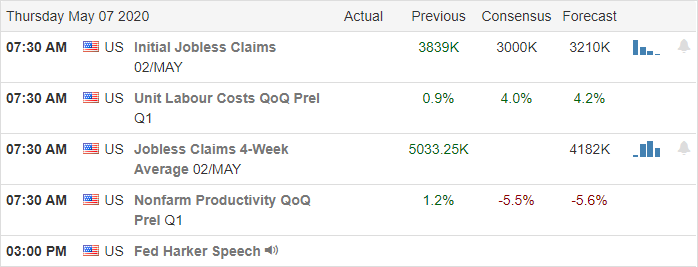

Asian markets closed mixed, but little changes as China reported that exports unexpectedly rose. European markets are bullish this morning as BOE holds rates steady and US future point to a substantial gap up ahead of a gigantic day of earnings and jobless claims expected to add more than 3 million more unemployed.

Earnings Calendar

Earnings Calendar

On the Thursday earnings calendar, we have a gigantic day with more than 750 companies reporting. Notable reports include ADT, AL, AMC, BUD, BALL, BIDU, BHC, BDX, BMY, ED, CTB, CUBE, DENN, DBX, IT, HL, HLF, HES, HLT, HFC, HST, IRM, JBLU, KTB, LYV, MAIN, MUR, NCLH, DOC, PFPT, RTX, ROKU, SKYW, STMP, SRCL, SPWR, SVMK, SYNA, TCO, TLRY, UBER, YELP, VIAC, & YETI.

Technically Speaking

After a day of very choppy price action that ultimately drifted south by the close now indicates a substantial gap up at the open. In a story on CNBC, Morgan Stanley warns that the rally fueled by investor fear of missing out is not a good sign for the market. I agree with that thinking and have said virtually the same thing over the last few weeks. However, me agreeing with a CNBC talking head does not change the fact that the bulls are in control continuing to buy. Index trends remain intact, and there are more good looking chart patterns than a person can buy. Can we continue to ignore the massive unemployment, bankruptcies, negative earnings growth, and the future downgrades? The US futures this morning seem to answer that question with a great big, yes, even with another 3 million in jobless claims expected!

Personally, it makes no sense to me, but as a full-time trader, my job is to trade the price action in the charts. My bias and my understanding of why the market is acting in such a manner is not required. Does that mean I should toss caution to the wind and ignore the technicals of the chart, such as support, resistance, and trend? NO! While the indexes continue to hold up-trends, we must recognize that the market continues to struggle with the price resistance above. A big morning gap up ahead of Jobless report with price resistance above is not a reason to such into new trade risk. In fact, it could be an excellent opportunity to ring the register and pocket some profits while watching for a possible pop and drop. Long story short, irrational market price action is commonplace, and it’s the trader’s job to weigh the risk and reward without emotion, bias, or the desire to predict the unknown.

Trade Wisely,

Doug

Comments are closed.