As unemployment topped 30 million, the bears decided to return to work yesterday, and profit-takers took advantage of the best monthly market rally since 1987. Earnings from AMZN & AAPL that disappointed investors keep the bears active in the futures market overnight, which now suggests a substantial gap down at the open. However, at this time, all the indexes indicate they still have their 50-day averages below that could serve as support.

Asian markets closed with Japan falling nearly 3% while other markets were closed for holidays. European markets are decidedly lower this morning with the DAX and CAC down more than 2%. US Futures point to a gap down of more than 400 points ahead of earnings and economic reports. Expect to hear, ‘Sell in May and go away,’ repeated over and over as we head into the weekend.

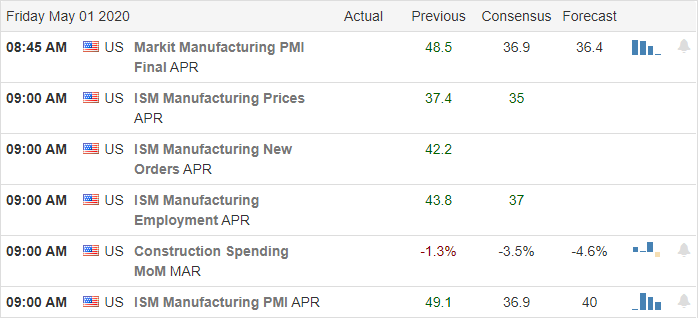

Economic Calendar

Earnings Calendar

On the first day of May, we have a lighter day on the earnings calendar, with about 100 companies reporting results. Notable reports include CVX, CLX, ABBV, APO, CL, DISH, EL, XOM, HON, PSX, VTR, & WPC.

Technical Speaking

Disappointing unemployment numbers yesterday woke up the bears and brought out some profit-takers. Overall this was the best month for the market since 1987, with the recovering 35% from the March lows. After the bell, we heard for AMZN and AAPL, and both seemed to disappoint investors setting off an overnight selloff in the futures. AMZN looks to open about $120 points lower this morning or about 5% while AAPL is down about 8 points or 2.75%. These to tech bellwethers comprise a significant weight in the QQQ, and it will be interesting to see how that affects the index leadership as we begin May.

With the Dow Futures pointing to more than a 400 gap down on the first day of May expect to hear the old saying, ‘sell in May and stay away,’ repeated over and over by traders and the media. After such a strong rally in the indexes, a pullback is not out of the question, but hope for an economic reopening begins; I’m not sure that old saying will carry much weight. Even with the sizable gap down this morning, all the indexes so far indicate to open above their 50-day averages. Will they hold? Only time will tell, but with another day of earnings and economic reports, anything is possible. Consider your risk carefully as we slide into the weekend.

Trade Wisely,

Doug

Comments are closed.