The bears feasted on Tuesday as the renewed banking weakness sparked a sharp selloff hoping to send a message to the FOMC on the pending rate decision this afternoon. Big tech held its ground while IWM suffered the most technical damage with many regional banking names included in the average. Today we face a big round of earnings events so plan whipsaws and uncertain chop as we wait for the Fed decision at 2 PM Eastern with Powell’s presser thirty minutes later that may well create some wild price swings.

Asian market traded mix overnight as worries about the huge banking outflows and the next Fed decision. However, European markets seem much more upbeat with gains across the board. The U.S. is also trying to shake off the pending Fed decision and banking worries with futures suggesting modest gains at the time of writing this report.

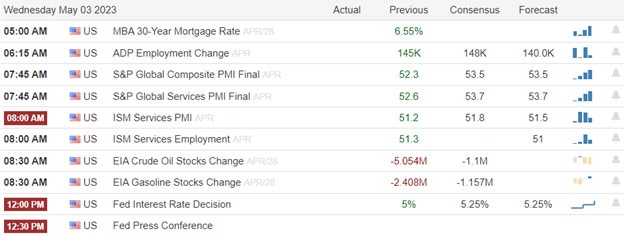

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ALB, ALGT, ALL, ATUS, APA, ATO, GOLD, TECH, EAT, BLDR, BG, CDW, CIVI, CTSH, CXW, CTVA, DIN, EMR, EL, ETSY, EXC, FSLY, FTS, FDP, GRMN, GNRC, GOGO, HBI, HST, HUBS, INFN, IR, JNG, KHG, KTOS, KLIC, LMND, LPX, MRO, VAC, MELI, MET, MTG, MOS, MYGN, NE, NUS, OPK, PGRE, PDCE, PSX, PSA, QRVO, RDN, RYN, O, SMG, SBGI, SPWR, SYNA, TRMB, TRIP, TTEC, OLED, UTHR, UPWK, WMB, WING, WWE, YUM, & ZG.

News & Technicals’

The global economy is facing a dilemma as inflation continues to soar despite the efforts of central banks to tame it. By raising interest rates, central banks hope to cool down the demand for goods and services and reduce the cost of living. However, higher interest rates also make borrowing more expensive and can hurt economic growth and financial stability. According to a survey by the World Economic Forum, most economists believe that central banks have to choose between fighting inflation and supporting the financial sector. This could pose a serious challenge for policymakers as they try to balance the needs of the economy and society.

The clock is ticking for the U.S. government on its debt ceiling, which could trigger financial complications for the economy as worries of stagflation grow. While Democrats have publicly blamed Republicans for refusing to cooperate on raising the debt ceiling, they have also quietly taken some steps to open the door for a possible compromise. President Joe Biden has signaled his willingness to negotiate with Republicans on his spending plans, while Democratic leaders in Congress have explored ways to use their slim majority to raise the debt limit without GOP support. These moves suggest that both parties are aware of the high stakes of the debt ceiling standoff and may be willing to make concessions to avert economic consequences.

Renewed banking weakness brought out the bears on Tuesday adding pressure to the pending FOMC rate decision. As investors worry about possible recession or stagflation the earnings season excitement is struggling to overcome. Some people are buying bonds instead of stocks because they think bonds are safer or moving cash into money market funds to protect capital from massive uncertainty. Plan for a choppy session as we wait on the FOMC decision with a big round of earnings data and economic reports to keep the whipsaw and the price action volatile.

Trade Wisely,

Doug

Comments are closed.