Netflix Impressive Results

S&P 500 and Nasdaq-100 futures rose on Wednesday, driven by Netflix impressive results. The earnings season continues with anticipated reports from Procter & Gamble and Johnson & Johnson, while Halliburton and GE Vernova are also set to release their results. Additionally, former President Trump announced a significant joint venture named “Stargate” with OpenAI, Oracle, and Softbank, aiming to invest at least $500 billion in AI infrastructure in the United States.

European stocks opened higher on Wednesday, reflecting the positive sentiment seen in global markets since the start of the week. The U.K.’s FTSE index edged up by 0.1%, Germany’s DAX increased by 0.7%, and France’s CAC 40 gained 0.1%. The pan-European Stoxx 600 also rose by 0.3%. Notably, Adidas shares surged by 5.96% by 8:51 a.m. London time, following the company’s announcement of a 19% sales growth in its fourth-quarter results on Tuesday. Meanwhile, the U.K. reported borrowing £17.8 billion ($21.9 billion) in December, marking an increase of £10.1 billion compared to December 2023 and the highest budget deficit recorded for December in four years.

Asia-Pacific markets experienced a mixed trading session on Wednesday. Hong Kong’s Hang Seng index saw a significant drop of 1.72%, while mainland China’s CSI 300 fell by 0.93%. In contrast, India’s Nifty 50 managed a slight rebound, gaining 0.28% after hitting its lowest point since last June. Australia’s S&P/ASX 200 rose by 0.33%, and Japan’s Nikkei 225 and Topix indices increased by 1.58% and 0.87%, respectively. South Korea’s Kospi and Kosdaq also performed well, with the Kospi adding 1.15% and the Kosdaq rising by 0.86%. Additionally, Korean companies are contemplating relocating their production plants from Mexico to the U.S. in response to Trump’s protectionist policies.

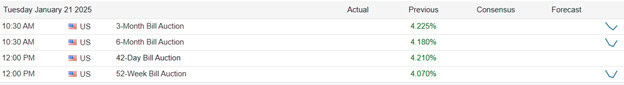

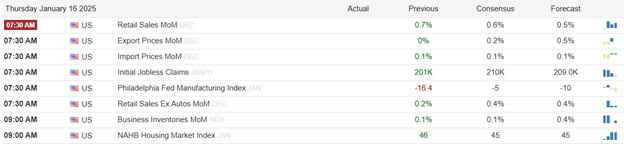

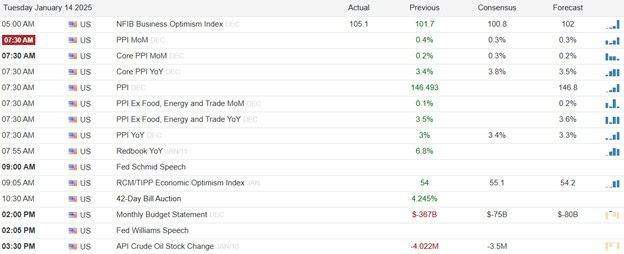

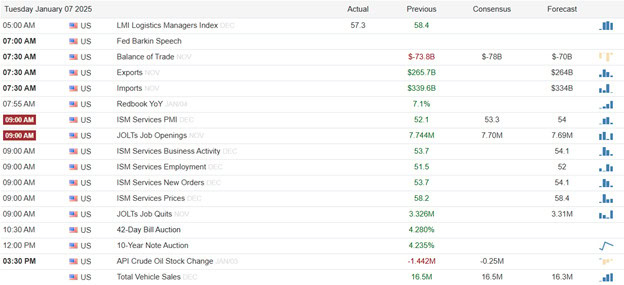

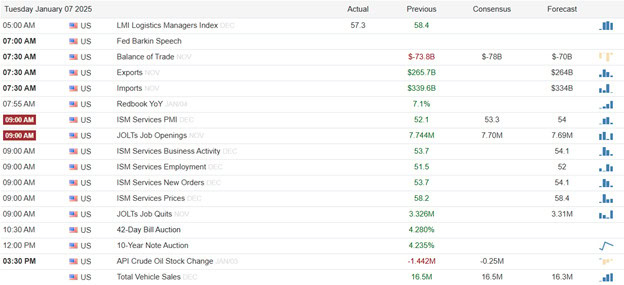

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ABT, ALLY, APH, BKU, CMA, CBSH, FNB, GEV, HAL, JNJ, OFG, PG, TEL, TXT, TRV & UCB. After the bell reports include AA, CACI, CADE, CP, CATY, CLS, DFS, HXL, KMI, KMX, NBHC, PLXS, RLI, SLG, STLD, WCN, & WSBC.

News & Technicals’

Kevin O’Leary expressed interest in a proposal by Trump for U.S. owners to acquire a 50% stake in a platform, though he noted that current laws make such a deal unlikely. On Tuesday, Trump mentioned he would consider the possibility of Tesla CEO Elon Musk or Oracle Chairman Larry Ellison purchasing TikTok.

The president of the European Central Bank, Christine Lagarde, emphasized the need for Europe to be prepared for potential trade tariffs from newly inaugurated U.S. President Donald Trump. In a statement to CNBC on Wednesday, Lagarde noted that Trump had criticized the EU for being “very, very bad” to the U.S. and warned of impending tariffs. However, she also acknowledged that Trump’s decision not to impose blanket tariffs on his first day in office was a “very smart approach.”

President Donald Trump announced that his team is considering a 10% tariff on China, which could be implemented as early as February 1. Speaking to reporters at the White House on Tuesday evening, Trump cited China’s role in sending fentanyl to Mexico and Canada as the reason for the proposed tariff. He also mentioned that he had a phone conversation with Chinese President Xi Jinping on Friday, discussing fentanyl and trade. According to the Chinese readout, Xi emphasized the importance of cooperation and described the economic relationship between the two countries as mutually beneficial.

Stripe has confirmed the layoff of 300 employees, which accounts for approximately 3.5% of its workforce, primarily affecting the product, engineering, and operations departments. Despite these cuts, the payments company, valued at around $70 billion in private markets, plans to expand its headcount by 10,000 by the end of the year, representing a 17% increase. According to a memo from Chief People Officer Rob McIntosh, Stripe is “not slowing down hiring.” Business Insider initially reported on the layoffs and the memo.

Emotions are high and chase is on with the Netflix impressive results engaging the fear of missing out from traders. Remember to follow your rules, avoiding already very extended stocks and plan carefully to protect current gains should a pullback begin. Exuberance is contagious so the rally may continue but also remember it’s the last one in door that gets the worst of the punishment.

Trade Wisely,

Doug