Parabolic Bull Run

The parabolic bull run continued on Monday as the magnificent seven surged to a new high for the year with the composite up % in 15 trading days. Though the T2122 indicator continues to display an overbought condition corporate buybacks and fear of missing out continue to fuel bullish momentum. Today with will get Existing Home Sales figures and the FOMC minutes along with a busy day of earnings highlighted by the highly anticipated report from NVDA after the bell. Plan carefully as volumes are likely to start declining as traders escape early to beat the travel rush for the holiday.

While we slept Asian markets closed mixed but mostly lower with modest gains and losses as China’s real estate crisis deepened requiring more government intervention. European markets trade mostly lower this morning with modest declines in a cautious session. U.S. futures point to a slightly bearish open ahead of earnings and economic reports with the holiday shutdown just around the corner.

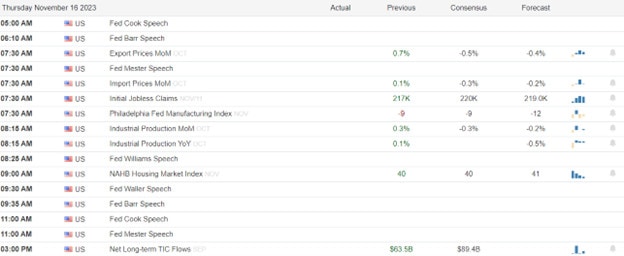

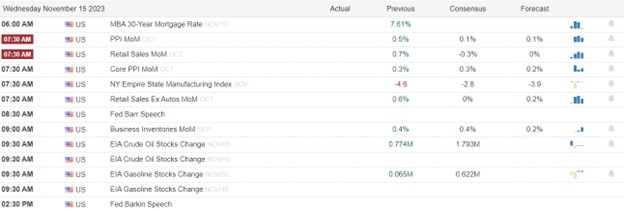

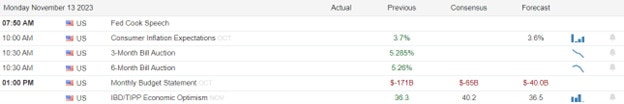

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ADI, ADSK, ANF, BIDU, BBY, BURL, CAL, DKS, DY, GES, HIBB, HPQ, JACK, J, KSS, LOW, MDT, NVDA, JWN, URBN.

News & Technicals’

Microsoft, the tech giant and the major investor of OpenAI, has expressed its continued support for the artificial intelligence research company and its former CEO Sam Altman, who was removed from his position on Friday. Microsoft’s CEO Satya Nadella said in an interview with CNBC on Monday that he still believes in OpenAI’s vision and mission and that he respects Altman’s contributions to the company. Nadella also said that he understands that OpenAI needs to change its governance structure, after facing a backlash from its employees and investors over Altman’s ouster. He said that he hopes that OpenAI can resolve its internal issues and continue to pursue its ambitious goals of creating artificial general intelligence and benefiting humanity.

OpenAI, the artificial intelligence research company that aims to create artificial general intelligence and benefit humanity, is facing a crisis of leadership and trust, as hundreds of its employees have signed a letter demanding the resignation of its board. The letter, which was leaked to the media, accuses the board of mismanaging the company, violating its values and principles, and ousting its former CEO Sam Altman without a proper explanation. The letter also warns that if the board does not step down, many employees will leave the company and join Altman’s new venture at Microsoft, where he and another co-founder and board member of OpenAI, Greg Brockman, have been hired to lead a new AI division. The letter claims that the employee exodus will happen “imminently.” Among the signatories of the letter are some of the top executives and researchers of OpenAI, such as Mira Murati, who served as the interim CEO after Altman’s departure, Brad Lightcap, the chief operating officer, and Ilya Sutskever, a co-founder and board member of OpenAI. The letter reflects the deep dissatisfaction and frustration of the employees with the board’s decisions and actions, and the loss of confidence in the company’s direction and vision.

Lowe’s, the home improvement retailer, has reduced its sales forecast for the year, as it faced lower demand from customers for do-it-yourself projects in the third quarter. Lowe’s reported that its sales fell by nearly 13% compared to the same quarter last year and that its comparable sales, which measure sales at stores open at least a year, declined by 7.5%. Lowe’s said that customers spent less on home improvement projects, as they shifted their spending to other categories, such as travel, entertainment, and dining out. Lowe’s also faced supply chain challenges, labor shortages, and higher costs, which affected its margins and profitability. Lowe’s now expects its comparable sales to drop by about 5% for the fiscal year, which is worse than its previous estimate of a 2% to 4% decline. Lowe’s shares slid by more than 8% on Tuesday, after the disappointing results.

The stock market continued its parabolic bull run driven mostly by the so-called magnificent seven as the QQQ stretched to a new year high ahead of the Thanksgiving holiday. Treasury bonds went down slightly with the 10-year U.S. Treasury bond yield, trading around 4.42%, which is good for both stocks and bonds. The Bloomberg U.S. Aggregate bond index, which represents the overall U.S. bond market, is up more than 3.0% in November but is still slightly negative for the year 2023. Today we have a busy earnings calendar with the higher anticipated report from NVDA after the bell. Investors will also look for inspiration in the Existing Home Sales and FOMC minutes coming at 2 PM Eastern. As you plan forward please keep in mind the U.S. markets will be closed on Thursday and will have a half-day on Friday, ending at 1 PM.

Trade Wisely,

Doug