Investors chose to ignore the warnings from Jerome Powell reversing Thursday’s bearish engulfing as the tech giants led indexes higher breaking overhead resistance. After the market closed Moody’s downgraded the U.S. creditworthiness with a possible government shutdown at midnight this Friday. So the question for today is, can the market follow through and continue to ignore the massive debt problem we face? With CPI and PPI just around the corner, plan for volatility as we find out if the bulls have it right this time or if once again got it wrong as they have over the last 18 months. In any case, be prepared for substantial price volatility as the week unfolds.

Asian markets began the week mixed but mostly higher waiting on Biden-Xi talks that could be a bit contentious. However, European markets start the week with modest bullishness across the board ahead of talks with China as well as pending inflation data. U.S. futures recovered off of overnight lows after Moody’s credit downgrade but still point to a modestly lower open with CPI, PPI, and a possible government shutdown battle to curb the rapidly growing debt.

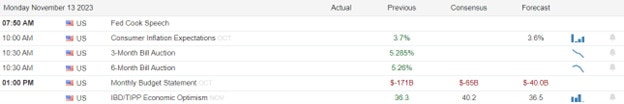

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ACM, FTRE, GENI, HROW, HSIC, MNDY, SKIN, SLF, TSEM, & TSN.

News & Technicals’

The U.S. government is facing a potential shutdown next week unless Congress can agree on a funding plan. However, the outlook for the U.S. fiscal strength has been downgraded by Moody’s, a credit rating agency, to negative from stable. This means that the U.S. may lose its top credit rating in the future if it does not address its rising deficits and debt. Moody’s said that the U.S. has unique credit strengths, such as its economic size, diversity, and resilience, but also faces downside risks, such as political polarization, social inequalities, and environmental challenges. Moody’s affirmed the U.S. long-term issuer and senior unsecured ratings at Aaa, the highest possible rating, but warned that the U.S. needs to improve its fiscal governance and sustainability. The Moody’s report was based on the data from the second quarter of 2023. Meanwhile, the newly elected House Speaker Mike Johnson, a Republican, said he will release a Republican government funding plan on Saturday. He did not provide any details about the plan but said he hopes to avoid a shutdown and reach a bipartisan agreement with the Democrats. The current government funding expires on Friday, November 17, 2023. If Congress fails to pass a new funding bill by then, the government will have to shut down non-essential services and furlough federal workers. This would have a negative impact on the economy and public services. The last government shutdown occurred in December 2022, and lasted for 35 days, the longest in U.S. history.

The workers of Ford’s two plants in Louisville, Kentucky, have given a mixed verdict on the proposed contract between the company and the United Auto Workers (UAW) union. The contract, which would last for four and a half years, was rejected by the majority of the production workers, who make up most of the workforce. The production workers voted 55% against the contract, according to the UAW Local 862 union. However, the skilled trades workers, who are a smaller group of workers with specialized skills, voted 69% in favor of the contract. The contract would offer wage increases, bonuses, profit sharing, and retirement benefits to the workers, as well as investments in the plants. The reasons for the rejection by the production workers are not clear, but some workers have expressed dissatisfaction with the contract terms, such as the lack of cost-of-living adjustments, the two-tier wage system, and the health care costs. The contract vote is still ongoing at other Ford plants across the country, and the final result will depend on the overall majority of the workers.

The U.S. bond market is stable on Monday, as investors weighed the economic outlook and awaited the inflation data that will be released this week. The inflation data, which will show the consumer price index (CPI) and the producer price index (PPI) for October, will be closely watched by the investors, as they will provide clues about the future direction of the monetary policy. The Federal Reserve, the U.S. central bank, has signaled that it will start tapering its bond purchases this month, and may raise interest rates next year if the inflation remains high and persistent. The bond yields, which reflect the market’s expectations of the interest rates, were little changed on Monday. The 10-year Treasury yield, which is a benchmark for long-term borrowing costs, rose slightly to 4.63%, from 4.62% on Friday. The 2-year Treasury yield, which is more sensitive to short-term interest rate changes, fell slightly to 5.056%, from 5.064% on Friday. The bond yields have been volatile in the past few months, as investors reacted to the changing economic conditions, such as the COVID-19 pandemic, the supply chain disruptions, the fiscal stimulus, and the labor market recovery.

The stock market rebounded Friday with a surprising reversal as the tech giants led indexes higher. The market was spooked Thursday by Fed Chair Powell’s comments at the IMF, which suggested a more aggressive monetary policy, and by a weak bond auction, which pushed the yields higher. However, investors defiantly choose to ignore the Chairman’s warning believing they have it right this time despite their poor track record in predicting a pivot over the last 18 months. We may not have long to find out if the bulls are correct with a CPI report on Tuesday followed by the PPI on Wednesday. We will also get a reading on the strength of the consumer with Retail Sales figures mid-week. That said, it could be a hurry-up and wait Monday with volatility in the morning after Moody’s downgrade and possible government shutdown this Friday at midnight. Buckle up it could be a wild week ahead.

Trade Wisely,

Doug

Comments are closed.