Week Packed with Economic Data

U.S. stock futures climbed early Monday as investors geared up for a week packed with economic data and awaited potential new tariff announcements from President Donald Trump. In the premarket, steel and aluminum stocks surged, with U.S. Steel and Nucor both gaining 8%, Cleveland-Cliffs up 9%, and Alcoa trading 4% higher. The looming threat of additional tariffs came as investors prepared for several key economic reports, including January’s consumer price index on Wednesday, followed by initial weekly jobless claims and the producer price index on Thursday. Federal Reserve Chair Jerome Powell was also set to address Congress on Monday morning. Investors anticipated major corporate earnings reports from McDonald’s on Monday and Coca-Cola on Tuesday.

European stock markets kicked off the week positively, with the pan-European Stoxx 600 rising 0.35% at the open. Key regional indexes, including the U.K.’s FTSE 100, Germany’s DAX, France’s CAC 40, and Italy’s MIB, all saw a 0.3% increase at the start of trading. BP shares surged over 8% following news of an activist investor Elliott Management’s stake in the company. Thyssenkrupp, one of Europe’s leading steelmakers, stated it expects a “very limited impact” on its business if the U.S. imposes additional tariffs on steel and aluminum imports. The company emphasized that Europe remains its primary market, and it only exports high-quality niche products to the U.S., where it maintains a solid market position.

Asia-Pacific markets presented a mixed performance on Monday amid ongoing trade tensions, leaving investors cautious. Japan’s benchmark Nikkei 225 remained flat, while the Topix index saw a slight decline of 0.15%. The country reported a 3% year-on-year loan growth in January, down from December’s 3.1%. In South Korea, the Kospi closed unchanged, but the small-cap Kosdaq gained 0.91%. China’s CSI 300 Index edged up by 0.21%, with the Hang Seng index in Hong Kong rising significantly by 1.76%. China’s consumer inflation reached a five-month high in January. Conversely, in India, the Nifty 50 index dropped by 0.91%, and the BSE Sensex index fell by 0.87% following the Reserve Bank of India’s anticipated interest rate cut, marking the first reduction in five years.

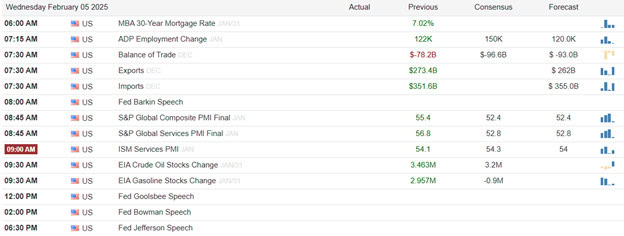

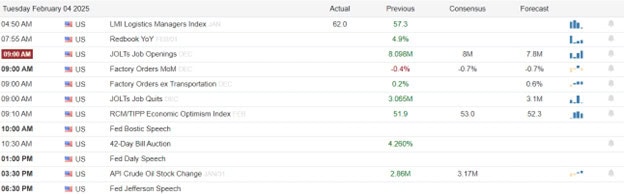

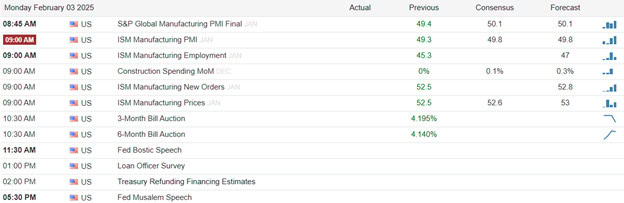

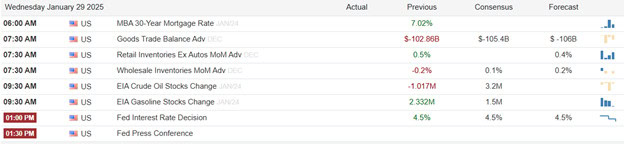

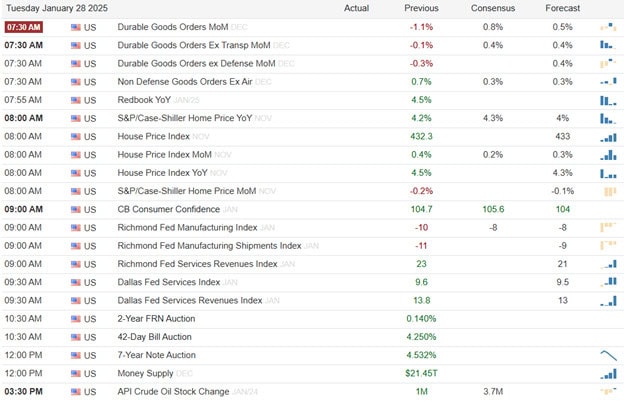

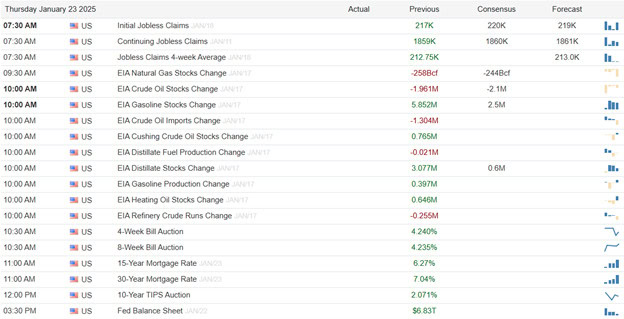

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell include CNA, EPC, HAIN, INCY, MCD, MNDY, ON, ROK, ROIV, TSEM, & TGI.

After the bell reports include AMKR, ACGL, ARWR, ALB, ACLS, BTG, BRX, CINF, CMCO, CMP, CXW, COTY, FLNC, HLTI, INSP, KRC, LSCC, MEDP, MITK, SSD, SPSC, VRTX, VNO, & WTS.

News & Technicals’

The Consumer Financial Protection Bureau (CFPB) instructed its employees to work remotely until February 14th due to the closure of its Washington, D.C., headquarters, as per a memo from CFPB Chief Operating Officer Adam Martinez. This directive follows an email from the newly appointed acting director Russell Vought, who on Saturday ordered the suspension of almost all regulatory activities, including the supervision of financial firms. Additionally, Vought announced on social media that he was cutting off fresh funding to the agency, criticizing its past lack of accountability.

On Sunday, U.S. President Donald Trump announced plans to impose new 25% tariffs on steel and aluminum imports, adding to the existing duties, though no timeline for implementation was provided. These metals are essential in industries such as transportation, construction, and packaging. During his first term, Trump had already imposed tariffs on steel and aluminum imports from Canada, Mexico, and the EU, along with volume restrictions on imports from countries like South Korea, Argentina, and Australia. A Congressional Research Service report revealed that in the first five months of this policy, the Trump administration generated over $1.4 billion in revenue from these tariffs.

New projections for the federal Pell Grant program indicate a potential $2.7 billion funding shortfall later this year. Pell Grants, a crucial source of financial aid for low-income families, support approximately 40% of college students. Michele Zampini, senior director of College Affordability at The Institute for College Access & Success, warned that without additional funding, students might experience eligibility or funding cuts for the first time in over a decade.

Mega cap technology companies are set to significantly increase their investment in artificial intelligence and datacenter buildouts in 2025, with planned expenditures reaching $320 billion. Meta, Amazon, Alphabet, and Microsoft have all outlined ambitious spending initiatives based on recent comments from their CEOs. This figure marks a substantial rise from the $230 billion spent in 2024. Amazon has the most aggressive investment plan, with CEO Andy Jassy announcing the company aims to allocate over $100 billion, up from $83 billion the previous year. The funds will primarily support AI developments within Amazon Web Services, which Jassy describes as a “once-in-a-lifetime business opportunity.”

Monday gives us a data break but the rest of the we should expect price volatility with a week packed with economic data. Toss in the threat of new tariffs and we have a recipe for significant uncertainty. Bonds are already moving slightly higher with the worry of inflation so plan carefully and be prepared for some big point swing as we move through the week.

Trade Wisely,

Doug