Doji Close Yesterday

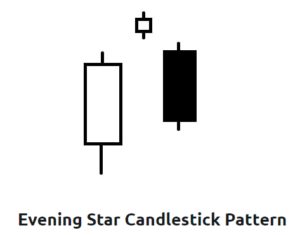

FOCUS: Stocks/Options Friday 8/16/2019; tar light, star bright, first star I see tonight . . . . Unfortunately, this hopeful nursery rhyme doesn’t apply in the world of swing trading, where an Evening Star candlestick pattern indicates that nasty things are on the horizon. When traders spot this pattern, which is a top reversal signal, they know that lower stock prices may soon be on the way. However, the Evening Star candlestick pattern is a tricky pattern to identify, so investors must proceed with caution when they think they’ve sighted it. Scroll down to learn a little more about this hard-to-spot signal. To read more click here

✅ SMS text alerts and reminders?👈

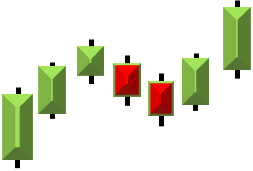

WOW you wake up on a Friday morning, and the DJ-30 is up 250 points, let’s party! Yesterday the SPY closed with a Doji, double bottom and on the Dotted Deuce, remember sustained follow-through is vital for a bullish move to be meaningful. A decisive close over yesterdays Doji ($285.65) could set the stage for a possible Morning Star type reversal. Over ($288.20) could be a set up to challenge the 50-SMA. A positive move today could also be a pure relief rally setting up another big short. Watch for clues and lack of follow-through; we sure will be.

The VIX-X CBOE Market Volatility Index needs to be below ($21.25) for the SPY or market to rally. Yesterday’s long wick Shooting Star type candle might get us to ($20.00). Overall the VIX charts are bullish, maintain a cautious stance on the market.

The VIX-X CBOE Market Volatility Index seems to be a bit nuts, up-down. Follow-through above $22.40 the VIX-X will want to challenge $23.65, below $21.25 a test of $20.00 is likely

😊 Have a great trading day – Rick

✅ Check out our newest YouTube videos👈

Trade-Ideas

✅ Untill this market settles down we will only post trade ideas from the trading room. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). . Chart discussion 9:10 AM Eastern.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it. 🎯 Dick Carp: the scanner paid for the year with HES-thank you 🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed. 🎯 Bob S: LTA is incredible…. I use it … would not trade without it 🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold. 🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service