Breakout Over The 200-SMA

Breakout Over The 200-SMA

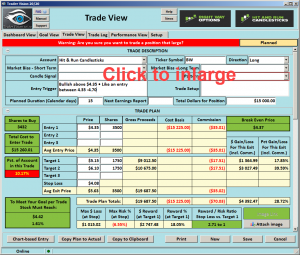

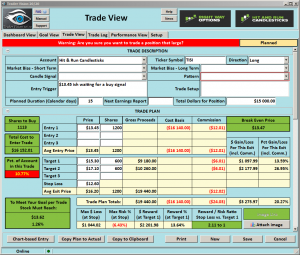

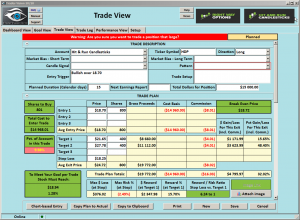

CERS – Came from an (RBB) Rounded Bottom Breakout closing over the 200-SMA. After eight days of consolidation, CERS broke out again after a PBO Bullish Engulf from the T-Line. Take a look at the 2,3,4,5 day charts, all set up in an (RBB) Rounded Bottom Breakout pattern. Price could be looking at the $4.70 resistance level. Could be a 20-25% trade properly managed and planned.

CERS – Came from an (RBB) Rounded Bottom Breakout closing over the 200-SMA. After eight days of consolidation, CERS broke out again after a PBO Bullish Engulf from the T-Line. Take a look at the 2,3,4,5 day charts, all set up in an (RBB) Rounded Bottom Breakout pattern. Price could be looking at the $4.70 resistance level. Could be a 20-25% trade properly managed and planned.

$14.00 30-Day Trial

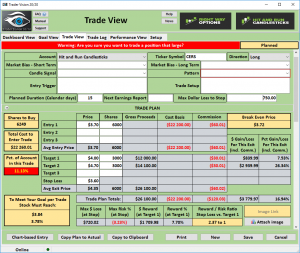

Good Trading – Hit and Run Candlesticks

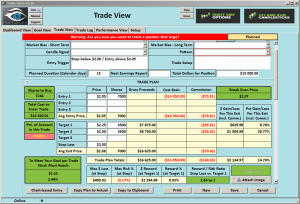

► Members’ Trade Idea Update (SQ)

That crazy SQ popped another 5% Friday! With the SQ trade Idea, the profits are now about 71% or about $1842.00, with 100 shares.

If you are interested in learning how to end the week with a profit that could change your life simply start a membership and learn what we have to share. – Yes I want the winning trades

► Eyes On The Market

Friday the SPY printed an inside day Harami. The key for the Bulls is to fight the Bears from trying to pull them back down below the recent low. One of the most obvious patterns I see in the SPY chart is the Lower High and Lower Low pattern. This patter is a Bearish pattern, the bulls can reverse the pattern, but they will need to follow through above $259.00

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

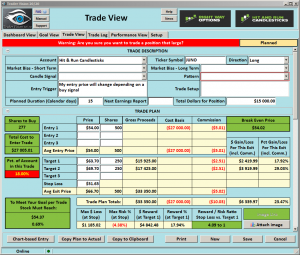

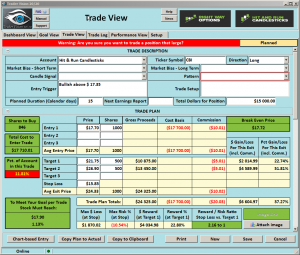

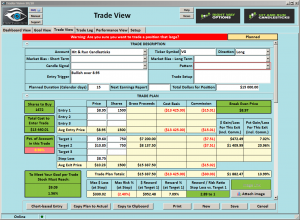

HDP – Exploded a few days ago engulfing our big three moving averages and now consolidating. The T-Line has caught up, and the recent lows have tested the T-Line a couple of times. The trend has maintained its bullish direction with the 34-EMA pointing up. With a breakout out of $18.70, we see two swing profit zones. The study of price action can help determine when to sell, add or hold.

HDP – Exploded a few days ago engulfing our big three moving averages and now consolidating. The T-Line has caught up, and the recent lows have tested the T-Line a couple of times. The trend has maintained its bullish direction with the 34-EMA pointing up. With a breakout out of $18.70, we see two swing profit zones. The study of price action can help determine when to sell, add or hold.