Mixed Bank Results Ahead of Empire State

Markets gapped down Friday (down 0.83% in the SPY, down 0.80% in the DIA, and down 0.91% in the QQQ). However, this was a bear trap as the bulls immediately stepped in to lead a rally that faded the gap within an hour and kept going at a slower pace (especially in the DIA) all day long. This saw us close near the highs of the day. SPY crossed back up through its 200sma, DIA crossed up through its resistance level, and QQQ climbed back up through its 50sma again. That action gave us gap-down, large, white candles that are nearly Marubozu (Shaved Head) candles in all three of the major indices. All of this happened on less-than-average volume again.

On the day, nine of the 10 sectors were in the green again as Healthcare (+0.76%) led the way higher and Utilities (-0.45%) lagged behind the other sectors. At the same time, the SPY was up 0.40%, the DIA was up 0.30%, and QQQ was up 0.69%. At the same time, the VXX was down 2.51% to 12.02 and T2122 climbed even deeper into the overbought territory at 98.82. 10-year bond yields rose to 3.504% and Oil (WTI) was up 2.00% at $79.96 per barrel. So, overall, it was a lower-volume, comeback day for the bulls after a gap down to start the day as earnings season kicked off again.

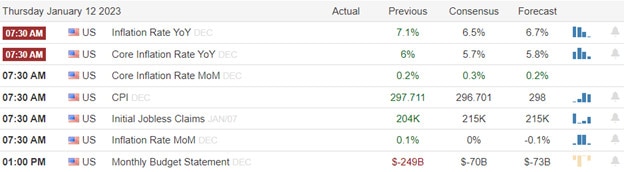

In economic news, the December Import Price Index rose by more than expected at +0.4% (compared to a forecast of -0.9%). Meanwhile, the December Export Price Index fell way more than expected at -2.6% (versus the forecast of -0.5%). Later in the day, the Michigan Consumer Sentiment reading came in better than expected at 64.6 (compared to a forecast of 60.5 and the December reading of 59.7). This is the highest reading since May of 2022 and indicates an improving consumer outlook for the year. In the afternoon, Treasury Sec. Yellen warned Congress the US will reach its Debt Ceiling on Thursday and will begin “extraordinary measures” to avoid default. These measures will stretch the time before the US defaults on its debts, but Treasury cannot accurately gauge how long of an extension we will get. However, she told Speaker McCarthy that default is not likely to happen before early June. She urged Congress to either suspend or increase the debt limit as soon as possible to avoid the harm a default would do to the country.

SNAP Case Study | Actual Trade

In stock news, HBI shares rose on Friday after the company said it expects to report Q4 net sales a bit above the top end of its previous forecast and adjusted operating profit above the midpoint of its previous guidance. (HBI reports in February.) In the afternoon, the Wall Street Journal reported that GOOGL source told them YouTube is testing a group of free (ad-supported) streaming channels and is in talks with various entertainment companies about featuring their movies and shows on a cable-like YouTube hub of channels. Meanwhile, an SEC filing revealed that the GS unit which covers housing transactions, credit card, and financial technology has lost $3.03 billion in three years and a $1.2 billion loss in the first nine months of 2022. Elsewhere, the US Dept. of Energy is loaning IONR $700 million (for 10 years at a fixed-rate to be determined when the funds are dispersed) to build its Nevada lithium mining operation. (F and TM are among the companies that have already committed to buy lithium from that operation.) Finally, NATI announced it’s starting a strategic review that will include looking for potential suitors to buyout the company.

In energy news, Reuters reports that XOM will sharply boost both gasoline and diesel production at its Beaumont TX refinery after completing a $2 billion expansion. The expansion will add 250,000 barrels-per-day of crude refining (by January 31) at what was already the second-largest refinery in the US. However, the net gains in refining capacity will be short-lived as LYB has already said it will be shutting down its own 264,000 Barrel-per-day refinery in Houston at the end of 2023. Elsewhere, Natural Gas fell another 5.79% on Friday. This brought the natty down more than 50% in the last 30 days and to a level not seen since June of 2021. Meanwhile, Oil (WTI) posted its largest weekly gain since October as the US Dollar fell to a 7-month low and hope for expanded demand from China.

So far this morning, earnings have been not great. MS and EDU both reported beats on both the revenue and earnings lines. However, GS, CFG, SBNY, and SI all reported beats on the revenue lines while missing on the earnings lines. None of the companies has held their call or provided updated guidance yet.

Overnight, Asian markets were mixed. Japan (+1.23%) and India (+0.89%) were the only significant gainers while Hong Kong (-0.78%) was the only appreciable loser on the day. The rest of the region made small moves in either direction from flat. However, in Europe, the bourses are nearly red across the board. Only Athens (+0.39%) is in the green while the FTSE (-0.34%), DAX (-0.04%), and CAC (-0.13%) take the region lower in early afternoon trade as the volume leaders. As of 7:30 am, US Futures are pointing toward a down start to the week. The DIA implies a -0.29% open, the SPY is implying a -0.21% open, and the QQQ implies a -0.29% open at this hour. At the same time, 10-year bond yields are higher to 3.546% and Oil (WTI) is up two-thirds of a percent to $80.37/barrel in early trading.

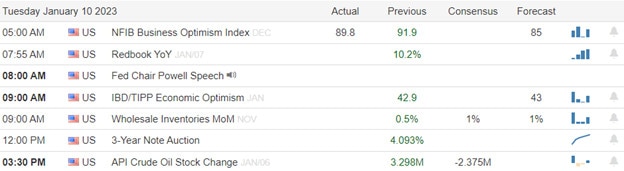

The major economic news events scheduled for Tuesday are limited to NY Fed Empire State Mfg. Index (8:30 am) and a Fed speaker (Williams at 3 pm). The major earnings reports scheduled for the day include CFG, GS, MS, EDU, and SBNY before the opening bell. Then after the close, IBKR and UAL report.

In economic news later in the week, on Wednesday, we get Dec. Retail Sales, Dec. PPI, Dec. Industrial Production, Nov. Business Inventories, Nov. Retail Inventories, Fed Beige Book, and a Fed speaker (Harker). Then, on Thursday, Dec. Building Permits, Dec. Housing Starts, Weekly Initial Jobless Claims, Philly Fed Mfg. Index, and EIA Weekly Crude Oil Inventories are reported. We also get another Fed speaker (Williams). Finally, on Friday, we get Dec. Existing Home Sales and two Fed speakers (Harker and Waller).

In terms of earnings, on Wednesday, we hear from SCHW, JBHT, PNC, PLD, AA, DFS, FHN, FUL, KMI, and WTFC. On Thursday, CMA, FAST, FITB, KEY, MTB, NTRS, PG, SNV, TFC, CNXC, NFLX, PPG, and SIVB report. Finally, on Friday, we hear from ALLY, ERIC, HBAN, RF, SLB, and STT.

With that background, it looks we are going to start the week (pending the NY Empire State Mfg. Index) with a modest gap down as the SPY is retesting its 200sma and DIA is retesting a support level (both from above). The bulls do not have to worry about extension from the T-line (8ema), but the T2122 indicator is deep into the overbought territory at this point. It appears that earnings are the story of the morning up to this point. Still, we have to remember that we get December PPI and a slew of other data on Wednesday morning. With the Fed meeting in two weeks, every significant report will be seen basically only in light of how the FOMC might use it to justify a lower/higher rate hike. Right now, Futures are implying a greater than 91% chance that we only get a quarter-point hike this time (only 8.8% are betting we get a half-percent hike). Any news that would give the hawks in the room ammunition will be taken badly by markets. So, be watchful.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service