Reacting to hot ISM services numbers, the bear had a little party on Monday, producing a big point move in the indexes but support levels and bullish trends remained intact by the close. Though traders continue to worry about future FOMC rate increases and recession, the hope of the last push higher for Santa remains strong. However, plan for the big point whipsaws and overnight gaps to continue as the bulls and bears fight it out as the uncertain path forward for the economy drives the wild emotion.

Asian markets closed mixed in a volatile overnight session, with China easing some lockdown restrictions. However, European markets trade modestly bearish across the board this morning as future recession fears loom. U.S. futures gave back overnight gains to currently suggest a flat open as they wait on earnings and economic data to try and find inspiration. This could prove to be an interesting bull-bear battle at vital support, so plan carefully and expect considerable volatility.

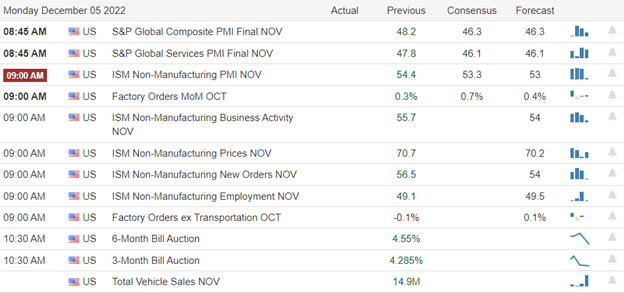

Economic Calendar

Earnings Calendar

As usual, near the end of the quarter, we have a few earnings stragglers we will have to keep track of, but their numbers will continue to dimmish over the month. Notable reports include AVAV, AZO, CASY, CONN, PLAY, MDB, SFIX, SIG, SWBI, & TOL.

News & Techinicals’

The investment by TSMC is one of the largest foreign investments in U.S. history and the largest in Arizona. Semiconductor chips are used in everything from computers and smartphones to cars, microwaves, and healthcare devices. Once the plants open, they will produce enough chips to meet the U.S. annual demand. The announcement comes in the wake of the passage of the CHIPS and Science Act signed into law in early August.

Microsoft President Brad Smith said the company offered Sony a 10-year contract to make each new release of Call of Duty available on Sony’s PlayStation console at the same time as the Xbox. Microsoft hopes the move will assuage regulators’ and its rivals’ antitrust fears over its proposed $69 billion acquisition of Activision Blizzard, the developer behind Call of Duty. In addition, any move to make Call of Duty unavailable to Sony’s PlayStation console would be “economically irrational,” Microsoft’s President Brad Smith said.

The bears had a little party on Monday, reliving some of the short-term overbought condition, but they seemed to lack conviction, with index charts holding supports and bullish trends still intact. So although the big point move may have been a bit disconcerting, the move could prove to be very positive as long as the bulls defend the price supports. Today we have a few more earnings reports that could provide some inspiration with only the International Trade numbers on the economic calendar. Of course, it would be healthy if the indexes consolidated in a smaller price trading range, but with the all-or-nothing condition of the market, that’s likely just wishful thinking. Keep a close eye on the support and resistance levels and plan for the choppy volatility to continue.

Trade Wisely,

Doug

Comments are closed.