Consecutive Gains in Tech

U.S. stock futures remained relatively stable following consecutive gains in tech. A report from the Washington Post suggesting that President-elect Donald Trump’s tariff plan would be less extensive than anticipated initially boosted stocks, though Trump later refuted this in a Truth Social post. Cameron Dawson, chief investment officer at NewEdge Wealth, warned of potential market volatility throughout the year, citing high valuations and investor positioning as key factors. She emphasized that the elevated expectations for 2025 could lead to erratic price movements. Investors are also awaiting the Job Openings and Labor Turnover Survey due on Tuesday and the ADP private payrolls report scheduled for Wednesday.

European equities saw a modest rise as money markets largely ignored a regional inflation uptick and maintained their expectations for European Central Bank interest-rate cuts. Euro-zone consumer prices increased by 2.4% year-over-year in December, up from 2.2% in November, aligning with the median estimate from a Bloomberg poll. This rise was primarily driven by energy costs, which saw their first increase since July, according to Eurostat. Meanwhile, the broader market is dealing with the potential for escalating trade tensions after Donald Trump denied reports that he might ease plans for comprehensive tariffs upon his return to the White House.

Japan’s Nikkei 225 surged by 1.97%, driven by a rally in tech stocks, making it the leading performer among its regional peers. The Topix also saw a significant increase of 1.1%. South Korea’s Kospi edged up by 0.14%, while Australia’s S&P/ASX 200 rose by 0.34%. In contrast, Hong Kong’s Hang Seng index fell sharply by 1.43%, even as China’s CSI 300 climbed by 0.72%. The spotlight was on Hong Kong-listed tech stocks after the U.S. Defense Department designated Chinese tech giant Tencent Holdings and battery maker CATL as “Chinese military companies.”

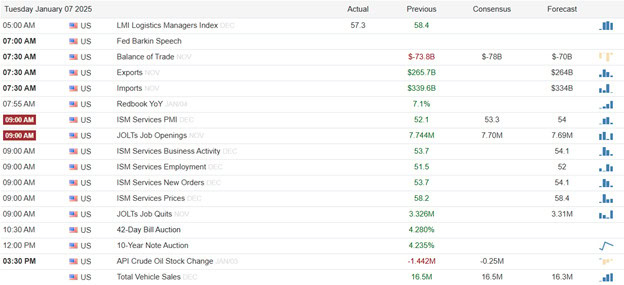

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include APOG, LNN, & RPM. After the bell reports include AIR, AZZ, CALM, & SLP.

News & Technicals’

On Tuesday, U.S. Treasury yields remained relatively stable as investors awaited key economic data that could provide new insights into the state of the economy and labor market. This week, several important economic reports are scheduled for release, with a particular focus on the labor market. The ISM’s latest PMI report for the services sector and the Job Openings and Labor Turnover Survey (JOLTs) are both due on Tuesday, with economists surveyed by Dow Jones expecting the JOLTs report to show 7.7 million job openings. Investors are closely monitoring this data as it could influence their views on the potential outlook for monetary policy, especially interest rates. This comes after the central bank indicated in December that fewer interest rate cuts might be forthcoming ahead of its next meeting on January 28-29. The Federal Reserve is widely expected to keep rates unchanged, with traders last pricing in a 93% chance of steady interest rates, according to CME Group’s FedWatch tool.

Annual inflation in the euro zone increased for the third consecutive month, reaching 2.4% in December, according to Eurostat on Tuesday. This preliminary figure matched the forecast by economists polled by Reuters and represented a rise from the revised 2.2% in November. Core inflation remained steady at 2.7% for the fourth month in a row, aligning with economists’ expectations, while services inflation slightly increased to 4% from 3.9%. Germany, the euro zone’s largest economy, saw a higher-than-expected inflation rate of 2.9% in December, as reported separately this week. In contrast, France’s inflation rate was 1.8% last month, falling short of the 1.9% predicted by a Reuters analyst poll.

Shares of Tencent Holdings plummeted nearly 8% in Hong Kong after the U.S. Department of Defense added the Chinese tech giant to its list of “Chinese military companies.” Battery maker CATL, a supplier for automakers like Ford and Tesla, was also included on the list. According to the National Defense Authorization Act of 2024, the DoD will be barred from directly procuring goods or services from these entities starting in June 2026, and indirectly from June 2027. Vincent Su, a senior equity analyst at Morningstar, noted that CATL’s inclusion on the list could deter U.S. customers from purchasing the company’s energy storage system (ESS) batteries in the future.

In response to the 2023 ruling and the backlash against diversity, equity, and inclusion (DEI) programs, McDonald’s has become the latest major company to alter its approach. Following the lead of Walmart, John Deere, and Harley-Davidson, which scaled back their DEI initiatives last year, McDonald’s announced on Monday that it will retire specific diversity goals for senior leadership. Additionally, the company plans to end a program that encouraged its suppliers to implement diversity training and increase minority representation within their leadership. McDonald’s will also pause “external surveys,” though it did not provide further details. This move aligns with similar actions by other companies, such as Lowe’s and Ford Motor, which have also suspended their participation in an annual survey.

Trade Wisely,

Doug