Friday – My Favorite Day of Trading

Friday – My Favorite Day of Trading

Friday is my favorite day of trading because it’s the day I get rewarded from a hard work week. Yep, every Friday I write a paycheck to myself from my trading account. Fridays are also the day I bank any overdue profits I’ve been hanging onto (CRC would be an example) and clean up any struggling trades.

Friday is the day we count our money and reflect on our weeks trading. How did we do? How can we improve? Take time today to pause on trading and consider education. Reevaluate your trading goals, are your goals on track?

Good Trading – Hit and Run Candlesticks

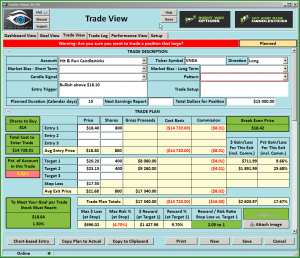

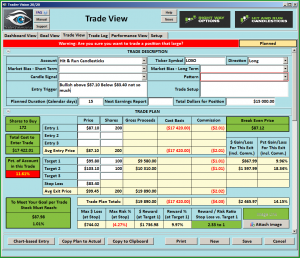

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Trade Updates – Hit and Run Candlesticks

Today we will likely close the 2nd ½ of CRC for about 27%. We will still be sitting 4 double digit winners that still have more to go based on the close yesterday.

Give us a try If you would like to learn what and how we do it. Click Here to give us a try, cancel at any time.

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

►Eyes on The Market

The bulls lost interest in a strong close yesterday; perhaps they need a rest? This past week has been great for the market as well as trading, but a hard-working horse needs a rest from time to time. The QQQ’s closed below the T-Line and below the Lower T-line but did close near the bullish uptrend line, will bullish trendline act as support? If not, it could be the beginning of a pullback that may require a few shorts to be put on or a look at the Inverse ETF’s

►What is a Trade Idea Watch-list?

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Rick’s personal trade ideas for the day MEMBERS ONLY

Start your education with wealth and the rewards of a Swing Traders Life – Click Here

Investing and Trading involves significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.