ARLM – Breakout, Flag, and Hammer On Support

ARLM – Breakout, Flag, and Hammer On Support

ARLM (Alarm Com) The ALRM Chart has presented us with a bullish trend, breakout, flag and hammer on support. Bullish confirmation above the Hammer usually within 3-4 days. Expected buying above the Hammer body open.

ARLM (Alarm Com) The ALRM Chart has presented us with a bullish trend, breakout, flag and hammer on support. Bullish confirmation above the Hammer usually within 3-4 days. Expected buying above the Hammer body open.

►Talking about today’s Trade Ideas

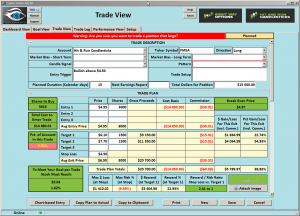

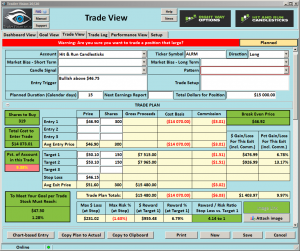

Starting at 9:10 EST each day I explain the possible trade from start to finish: Why chosen, entry, stop and profit zones. Answer questions to help you succeed in trading.

Monthly • Quarterly • Semi-Annual • Annual • Change your future and enjoy the life of working from home with swing trading. The next step is up to you.

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 8:45 EST AM every morning with the HOG and then Rick at 9:10 EST. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

►Trade Updates for Hit and Run Candlesticks

Last week we closed a couple of positions and took 50% off the take on several positions to protect over the weekend.

Monthly • Quarterly • Semi-Annual • Annual • We control our risk and manage our gains • We teach the Same • Cancel Anytime

► Ticker (SHW) – You could have profited about 11.3%% or about $3382.00, If 100 shares when we posted to our members on September 11.

► Eyes On The Market (SPY)

With a bank holiday today and a Fed FOMC meeting on Wednesday I would suspect the market will be somewhat quite until Wednesday afternoon.

Friday the SPY closed with an inside day doji, the 8th day in a row that the SPY closed higher than it’s open. Price Action and the T-Line are still working together to create a bullish environment.

Friday the VIX closed higher than it’s open and closed above the previous day’s candle. Near historical lows and in double bottom territory the VIX may be trying to mount a upward push. Above $10.50 would be poking the bear.

Rick’s trade ideas for the day – MEMBERS ONLY

Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.