No Fear

The only thing fear this that there is no fear! On Friday last week, the VIX hit the lowest low ever recorded by the index. As a result, complacency is very high as money continues to rush into the market as is it can never fall again. Trust me it will. However, you can also trust that you and will not be able to predict the time or the event that will bring back the bears. So the moral of the story is, don’t fight the trend AND avoid complacency.

The only thing fear this that there is no fear! On Friday last week, the VIX hit the lowest low ever recorded by the index. As a result, complacency is very high as money continues to rush into the market as is it can never fall again. Trust me it will. However, you can also trust that you and will not be able to predict the time or the event that will bring back the bears. So the moral of the story is, don’t fight the trend AND avoid complacency.

That sounds easy, but in reality, it’s pretty difficult to do because we have to set aside our bias and shut off the noise. What works for me is to focus on the price action. If we give up the idea that we can predict the next move of the market and look at a chart with an unbiased eye price will almost always provide clues. What we want, hope or believe should happen is irrelevant. Focus on Price.

On the Calendar

On the Economic Calendar this Tuesday we get started at 10:00 AM Eastern with the JOLTS report. With the country running at near full employment the job openings number continues to grow. Consensus for September is expecting job openings of 6.082 million. Janet Yellen speaks at 3:00 PM but other than that there are some bound auctions and a non-market-moving Consumer Credit report to close the day.

While the Economic Calendar is light, the Earnings Calendar is very busy with more than 425 earnings reports expected. Earnings continue to roll out with very strong reports, but that is no excuse to be complacent. Make sure to check current holdings as well as those you are thinking so adding to your portfolio for coming reports. A tiny effort on our part can save us from a very bad day if a company reports poorly.

Action Plan

The SPY, DIA and the QQQ’s once again all closed at record highs. Overnight futures were very bullish with the Dow Futures up more than 50 points. This morning that bullishness has tempered slightly with futures mixed. However, with so many earnings reports before the market opens anything is possible.

I will continue to manage the positions that I’m in as well as look for new long positions. The trend is up so until that trend ends I intend to trade in that direction. Like everyone else, I believe the market is overextended but will not try to predict a top and find myself fighting the entire market. What I do want to fight is complacency by staying focused on price action and have a plan to avoid emotion in the heat of battle. Believe in preparation, not luck!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/u2Iq6vfkeYQ”]Morning Market Prep Video[/button_2]

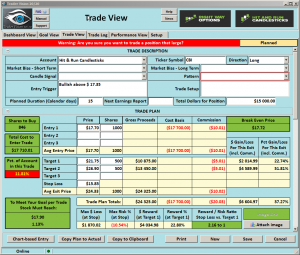

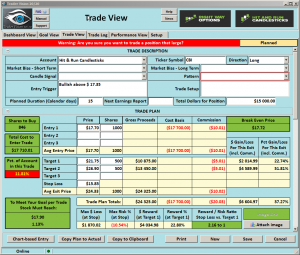

CBI – Bullish Over $17.35

CBI – Bullish over $17.3 5 or maybe on an inside day entry of yesterdays candle with a stop at or below $15.30. The CBI chart has been constructing a bottom for a few months trying to capture the 50-SMA. The 50-day SMA was successfully captured, and a Bullish Inverted Head and Shoulder was created. In the short term, several bullish candle and chart patterns have been created. (Can you find them)?

5 or maybe on an inside day entry of yesterdays candle with a stop at or below $15.30. The CBI chart has been constructing a bottom for a few months trying to capture the 50-SMA. The 50-day SMA was successfully captured, and a Bullish Inverted Head and Shoulder was created. In the short term, several bullish candle and chart patterns have been created. (Can you find them)?

►CBI – Train Your Eyes, Can You Find the Following?

RBB pattern • Scoop pattern • Inverted Head and Shoulders • Bullish Engulf 3-day chart • Pop Out of The Box pattern on the weekly chart •

Good Trading – Hit and Run Candlesticks

► Ticker Update (CRC)

You could have profited more than 74% or about $600, with 100 shares when we posted to our members on September 13.

If you are interested in learning how to end the week with a profit that could change your life simply contact us. Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • Coaching With Rick you can also learn this trading technique in our membership. – Get Started

► Eyes On The Market

WOW, yesterday was the 54th day closing above the lower purple T-Line Band in the SPY. I am getting asked all the time now “isn’t this market overbought” and I reply “Yes” but that has nothing to do with PRICE ACTION. Oversold /Overbought is a crutch for most traders, the trend and price action is where big money is. Remember that minor pullbacks in a trend are not a bearish reversal.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Back in the Saddle

Good morning friends. It’s good to be back in the saddle. Las Vegas is always fun and meeting with fellow traders at the Expo is a blast. However, as Dorthy says in Wizard to Oz, “There is no place like home.”

Good morning friends. It’s good to be back in the saddle. Las Vegas is always fun and meeting with fellow traders at the Expo is a blast. However, as Dorthy says in Wizard to Oz, “There is no place like home.”

The Bulls remain in control, and the overall trends are still very bullish. I will continue trading long, and with the overall trend, however, I think it would be wise to stay laser-focused on price action. As strong as this bull run is we don’t want to become complacent. One method to combat complacency is taking profits consistently into market strength. Doing so will relieve the pressure on a winning trade. There is nothing like taking profits to the bank to remove the emotions of fear and greed.

On the Calendar

There are several items on the Economic Calendar such as bond auctions but nothing that is expected to move the market. At 12:10 PM there is a Fed Speaker to be aware of but again unlikely to move the market.

On the Earnings Calendar, there are just over 200 companies expected to report today. As the last really big week for this earnings season we and expect about 1500 reports so stay on your toes for another wild week.

Action Plan

With the DIA, SPY, and QQQ all setting new closing records on Friday the trend higher is still absolutely intact and bullish at this time. The poor IWM just can’t seem to get with the program join in with the rally. As of now it continues to consolidate and would have to be considered the weakest of the indexes even though sellers have been unable to take control.

Futures this morning are mixed as I write this, but of course, with so many pre-market earnings reports anything is possible. The bullishness of this rally has been remarkable, and I know many traders think these prices are unsustainable. While I agree this bullishness seems irrational, it would be unwise to anticipate a market correction. If you take a look at the tech bubble of the late 90’s you can see that irrational market behavior can last several years. Please understand I am not suggesting this rally will last for years, I’m simply pointing out it has happened before. Stay with the trend until the trend ends.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/V8qfzyepo7Y”]Morning Market Prep Video[/button_2]

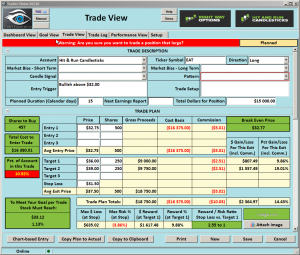

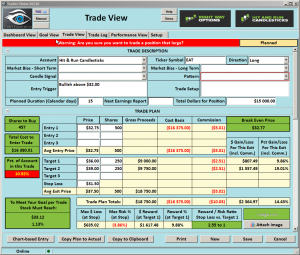

EAT – Bullish Over $32.00

EAT (Brinker International), Bullish over $32.00 and the Bullish Morning Star on the 3-day chart. The EAT chart has constructed a strong bottom with very good price action coming into a Rounded Bottom Breakout pattern. Understanding what you want out of a trade can help when setting up a trading plan. Price is King!

EAT (Brinker International), Bullish over $32.00 and the Bullish Morning Star on the 3-day chart. The EAT chart has constructed a strong bottom with very good price action coming into a Rounded Bottom Breakout pattern. Understanding what you want out of a trade can help when setting up a trading plan. Price is King!

►EAT – Train Your Eyes, Can You Find the Following?

RBB pattern Doji Engulf pattern •Bullish rectangle• Bullish Morning Star • Doji continuation pattern • Hint, look at the 1 -2- and 3-day charts.

Good Trading – Hit and Run Candlesticks

► Ticker Update (ALGN) Set up a Private Phone Call Us

You could have profited more than 38% or about $675, with 100 shares when we posted to our members on August 8.

If you are interested in learning how to trade charts and end the week with a profit that could change your life simply contact us. Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • Coaching Learn More With Rick you can also learn these trading techniques in our membership. – Get Started

► Eyes On The Market

Last week the SPY gave no clues that the Bears were starting to hunt, and for the open today, I still don’t see that. Friday price closed with a Morning Star pattern, and today we need to see confirmation. The open today will be a little soft but remember it’s the complete construction of the candle that we analyze. To stay away from the pain of the noise following fast, medium and medium + is very helpful such as the 3-8-17 or something close to that.

A close below $257.00 on the SPY would warrant a test of the October low.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Do you have an edge?

Will we get the typical pre-FOMC choppy price action or will the 380 earnings reports break the mold? Perhaps the bigger question is, Do you have an edge? On the positive side, the market is trending higher, and so far earnings have been overall strong. On the other side, the market appears overextended, and the uncertainty of earnings reports and FOMC looms.

Will we get the typical pre-FOMC choppy price action or will the 380 earnings reports break the mold? Perhaps the bigger question is, Do you have an edge? On the positive side, the market is trending higher, and so far earnings have been overall strong. On the other side, the market appears overextended, and the uncertainty of earnings reports and FOMC looms.

During times like this, I normally slow my trading activity. I try to focus on my current portfolio first. I tend to slow to add trades during times of uncertainty. I’m only interested in low-risk entries to keep potential losses as small as possible. I try not to chase the morning pops and drops. I choose instead to wait 15 to 30 minutes before looking for new risk. Always remember quality is more important than quantity and prepare for anything.

On the Calendar

On the Economic Calendar, this last day of October begins the FOMC 2-day meeting kicks off. Their announcement regarding interest rates will occur tomorrow at 2:00 PM Eastern. At 8:30 AM today we have the Employment Cost Index is expected to surge 0.7% today. The 9:00 AM reading of the S&P CoreLogic Case-Shiller which is expected to rise 0.6% bringing the year-on-year rate up to 6.0%. Then at 9:45 AM the Chicago PMI is expected to slow just slightly to 62.0 according to forecasters, which is still very strong. The 10:00 AM Consumer Confidence is seen rising to 121.0 vs. September’s 119.8 print.

The Earnings Calendar ramps up today with more than 260 reports. We had better get used to it because the number grows to more than 380 on Wed. and over 600 on Thursday. Prepare, prepare, prepare.

Action Plan

Political turmoil, earnings, and FOMC. Oh, My! With so much on the proverbal market plate, the next few days the uncertainty alone is likely to give traders indigestion. There are a lot of good charts, but because of all the news and the potential violent reactions can you still find an Edge? Tough call.

The good news is that the market is still wildly bullish even considering yesterdays little pullback. If earnings continue to come out positive, then there is every reason to believe that the market will continue its trend. Futures are pointing to a bullish open, however, keep in mind that normally we get choppy price action as the market waits on the FOMC. The problem is, I’m not sure normal applies here! Anything is possible so plan accordingly.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/oXQXU5NDo6A”]Morning Market Prep Video[/button_2]

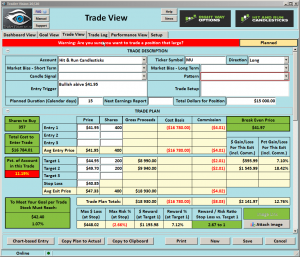

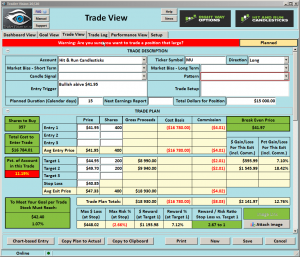

MU – Bullish Over $41.95

MU (Micron Technology), Bullish over $41.95 The MU Chart saw a little profit taking in September then the Bulls came back in with a Bull Kicker. A small run accrued followed by bullish consolidation. The past 3 bars have formed a bullish Morning Star closing back over the T-Line.

MU (Micron Technology), Bullish over $41.95 The MU Chart saw a little profit taking in September then the Bulls came back in with a Bull Kicker. A small run accrued followed by bullish consolidation. The past 3 bars have formed a bullish Morning Star closing back over the T-Line.

Don’t miss out on our 30-Day Trial Click Here

►Train Your Eyes, Can You Find the Following?

34-Rising Trend • Bull Kicker •Bullish rectangle• Bullish Morning Star • 24 day V-Stop Run.

Good Trading – Hit and Run Candlesticks

► Ticker Update (SEDG)

You could have profited more than 142% or about $1919, with 100 shares when we posted to our members on February 14. If you are interested in how to trade charts like this, Rick Saddler founder of Hit and Run Candlesticks offers private recorded coaching • Coaching With Rick you can also learn this trading technique in our membership. – Get Started

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]30-Day Trial HRC – RWO or Both[/button_2]

► Eyes On The Market

The SPY closed yesterday with a Doji inside day that suggests indecision. The T-line trend remains bullish as well as the J-Hook continuation chart pattern. On the 2-day chart, the price has closed above the V-Stops and the upper T-Line Band for the past 22 days. I am hearing about a few traders starting to short, be very careful shorting when the market is such a Bull.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

The only thing fear this that there is no fear! On Friday last week, the VIX hit the lowest low ever recorded by the index. As a result, complacency is very high as money continues to rush into the market as is it can never fall again. Trust me it will. However, you can also trust that you and will not be able to predict the time or the event that will bring back the bears. So the moral of the story is, don’t fight the trend AND avoid complacency.

The only thing fear this that there is no fear! On Friday last week, the VIX hit the lowest low ever recorded by the index. As a result, complacency is very high as money continues to rush into the market as is it can never fall again. Trust me it will. However, you can also trust that you and will not be able to predict the time or the event that will bring back the bears. So the moral of the story is, don’t fight the trend AND avoid complacency.