E-Learning Open Session 11-11-17

After the gap down open it was nice to see the Bulls step up. They left behind bullish candles in the DIA, SPY, and QQQ. A very good sign but now it’s critical they follow-through to confirm. After the morning rally, the bullishness seemed to die on the vine with light volume chop dominating the rest of the day. A Concern? Maybe. The VIX also seems to register a concern with a slightly higher close yesterday.

After the gap down open it was nice to see the Bulls step up. They left behind bullish candles in the DIA, SPY, and QQQ. A very good sign but now it’s critical they follow-through to confirm. After the morning rally, the bullishness seemed to die on the vine with light volume chop dominating the rest of the day. A Concern? Maybe. The VIX also seems to register a concern with a slightly higher close yesterday.

There is certainly no reason to panic. As of now the trends in the market continue to be bullish. However, there is also a reason not to be complacent. Plan your trades carefully and be diligent with your trade management. Take some profits into strength and carefully manage stop loss orders. Avoid over trading and make sure your trades are sized correctly to your risk tolerance. Of course, this is a good course of action at all times saving your hard-earned capital and reducing emotional trading in the heat of the moment.

Today on the Economic Calendar there are 2 Fed members and Janet Yellen speaking even before the market opens. Such an ambitious group. At 8:30 AM Eastern is the PPI-FD report. For, October, forecasters are expecting a core 0.1% increase vs. the September increase of 0.4%. Remove food and energy, and the number is 0.2% and remains the same with trade services excluded.

Today marks the last really big day of this earnings season. There are 290 companies set to step up and report today. HD, TJX, BZH, LMT & MBT are reporting just to name a few. There are still a lot more earnings to come, but they roll out a much slower pace going forward.

The DIA, SPY, and QQQ had a much better day with the Bulls stepping up after the gap down open and producing bullish engulfing candle patterns. That is a very good sign but keep in mind; price must follow-through today to confirm. Currently, futures are flat to slightly lower but with the PPI report and so many earnings reports that could easily change.

Currently, the trend is higher except for the poor IWM which just can’t seem to get its act together. In the past, IWM has served as an early warning to future market direction. I would never trade based on that signal but is a reminder not to become complacent in trade planning and risk management. As good as yesterday was take note that the VIX didn’t respond by moving sharply lower but made a small gain. Higher volatility can lead to quick reversals and challenging price action.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/3KAh0J8LaUo”]Morning Market Prep Video[/button_2] HDP – Exploded a few days ago engulfing our big three moving averages and now consolidating. The T-Line has caught up, and the recent lows have tested the T-Line a couple of times. The trend has maintained its bullish direction with the 34-EMA pointing up. With a breakout out of $18.70, we see two swing profit zones. The study of price action can help determine when to sell, add or hold.

HDP – Exploded a few days ago engulfing our big three moving averages and now consolidating. The T-Line has caught up, and the recent lows have tested the T-Line a couple of times. The trend has maintained its bullish direction with the 34-EMA pointing up. With a breakout out of $18.70, we see two swing profit zones. The study of price action can help determine when to sell, add or hold.

Good Trading – Hit and Run Candlesticks

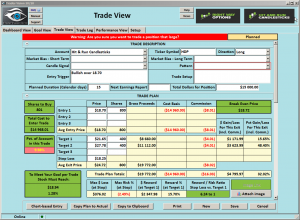

With the ACLS trade, the profits are now about 22% or about $640, with 100 shares.

If you are interested in learning how to end the week with a profit that could change your life simply start a membership and learn what we have to share. – Yes I want the winning trades

I love using the T-Line to help determine the moving trend; I also love using the 2 and 3-day charts to filter through the noise. When I use the T-Line, and the 2 or 3-day charts price action and the trend become much more clear. Members know this for clarity. The point is; take a look at at the SPY chart on your computer using the T-Line and the 2 or 3-day chart.

Yes, the Bulls have sat down on the job, but there seems to be enough to keep price afloat. Above $256 the Bulls remain bullish with a normal pullback. Below $256 the 50-SMA will likely get challenged, and that might not be a good thing for the Bulls.

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Longer term the Bulls are still in control but a close look at the short-term and it’s the Bears with a slight upper hand. Last Thursdays mean selloff and rally produced bullish hammer candle patterns, but as now, price, has not been able to follow-through to the upside. The SPY and QQQ have made a nice attempt on Friday but at the end of the day fell just short. As a result, I made no new buys on Friday and took more of a wait and see attitude.

Longer term the Bulls are still in control but a close look at the short-term and it’s the Bears with a slight upper hand. Last Thursdays mean selloff and rally produced bullish hammer candle patterns, but as now, price, has not been able to follow-through to the upside. The SPY and QQQ have made a nice attempt on Friday but at the end of the day fell just short. As a result, I made no new buys on Friday and took more of a wait and see attitude.

With the VIX rising from historic lows we may experience some choppy price action with nasty whipsaws intra-day. I would be careful not to chase trades (bullish or bearish) at the market open. Stay very focused and flexible with well-planned trades to avoid emotional decisions in the heat of the moment. If by chance the Bears do gain a firmer grip the VIX could spike quickly, and selling could accelerate. That is why I will need to see the Bulls print a candle that breaks the high of the prior day before I add additional long risk.

The Economic Calendar begins quietly but later in the week is full of important reports. Other than some bond auctions there’s a 2:00 PM Treasury Budget report which is very unlikely to move the market.

On the Earnings Calendar, we are now showing just over 170 reports today. A few noteworthy are FL, BBY, DKS, SFUN, DQ, ANF, WPRT, WUBA, SORL to name a few. Continue to stay on top of reporting dates for companies you own or are considering for purchase.

The Futures market is starting trading last night in the green responding to a huge shopping and spending day in Asia. At about 11:00, however, the bears came back out to play can currently suggest a gap down of more than 40 Dow points. That would mean a gap below Friday’s low on the DIA and make a retest of the Thursday low a possible target. The QQQ has been the strongest of the indexes while the IWM is obviously the weakest.

Overall the index trends in DIA, SPY, and QQQ are still bullish but are continuing to show some signs of stress. The VIX is showing a slight increase in fear, but let’s keep in mind the all the earnings reports in the next couple days anything is possible. A few good reports and Bulls may find their footing for a push higher. A bullish candle that breaks the previous days high is the clue I will be watching hoping to see. However, the Bears will maintain short-term control as long as lower higher candles continue. I suggest a little caution in order and stay very focused on price action for clues. Also, keep in mind with the VIX on the rise choppy price action with quick reversals are possible.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/ijKoTBFFpFk”]Morning Market Prep Video[/button_2] BW – Has been in an (RBB) Rounded Bottom Breakout pattern for the past 23 days. Finally, on Thursday of last week, the Bulls made there move with Bullish Engulf on good volume and Friday we say follow through. The Bullish Engulf found courage at the 50-SMA and after a Doji. If you know how the RBB pattern works then, you know the potential is amazing!

BW – Has been in an (RBB) Rounded Bottom Breakout pattern for the past 23 days. Finally, on Thursday of last week, the Bulls made there move with Bullish Engulf on good volume and Friday we say follow through. The Bullish Engulf found courage at the 50-SMA and after a Doji. If you know how the RBB pattern works then, you know the potential is amazing!

Good Trading – Hit and Run Candlesticks

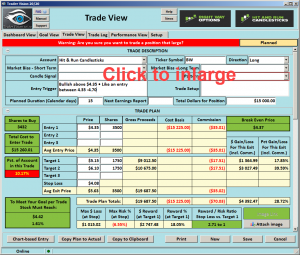

You could have profited more than 16% or about $72, with 100 shares when we posted to our members on November 9. (Just a few days)

If you are interested in learning how to end the week with a profit that could change your life simply start a membership and learn what we have to share. – Yes I want the winning trades

The SPY seems to be opening a weak little today near the T-Line, remember we don’t judge candles until they complete their construction in the time frame you are trading. After last weeks Hammer we will consider anything above $256.00 as Bullish construction. Below $256.00 suggest the sellers have taken more control if this is the case the 50-SMA may be their objective.

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Who invited the Bears to party? They have been hiding in the woods for so long it’s been easy to forget about them. Buy just about anything, and up it went with this incredible bull run. Overall the index trends still up but yesterday was a reminder that the bears have not eaten in a very long time and they are hungry! Now that earnings season is coming to an end I think we can expect more volatility and 2-sided price action ahead.

Who invited the Bears to party? They have been hiding in the woods for so long it’s been easy to forget about them. Buy just about anything, and up it went with this incredible bull run. Overall the index trends still up but yesterday was a reminder that the bears have not eaten in a very long time and they are hungry! Now that earnings season is coming to an end I think we can expect more volatility and 2-sided price action ahead.

The market will likely begin to shift its attention to retail and the impacts of holiday spending. It will also begin to ponder the likely December interest rate increase. Next weeks Economic Calendar is full of big reports that could move the market around and increase volatility. Stay focused this historic year may still have several more surprises up its sleeve.

We finish up this light Economic Calendar week with just one report of interest. At 10:00 AM Eastern Consumer Confidence is expected to remain near 13-year highs with a 100.0 reading vs. 101.1 in October. After that is the Baker-Hughes Rig Count at 1:00 but there is really no chance it will move the market at all.

As earnings season begins to wind down, we only have 73 companies on the on the Calendar today. Keep in mind that Monday and Tuesday still have a considerable number of reports. The habit of checking for earnings reports should become part of your daily preparation. They say it only takes about 30 days to develop a good habit that you will keep for a lifetime. Keep up the good work.

After an ugly bearish morning, the Bulls started to regain control. The bulls maintained control in the aftermarket Futures throughout the evening. About midnight, however, the bears began to push back and seem to still be in control this morning. Futures are currently pointing to a gap down of about 50 points in the Dow at the open. Volatility spiked yesterday, and the intraday price action experienced several nasty whipsaws.

Now that bulk of earnings reports are behind us I think there is very good chance we will see higher volatility. The overall trend of the market is still up, but I don’t be surprised if price action soon becomes much more 2-sided with bears coming out to play. Historically Nov. and Dec are bullish months for the market due to the holiday spending that occurs. However, there is nothing about this year that has followed traditional norms. Focus on Price Action, support, resistance, and trend. Price will always provide the clues forward if we can remove our bias and focus on what it’s saying.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/_irExczbWeQ”]Morning Market Prep Video[/button_2]