Weekly Bull Kicker On Volume

Looking at the chart on AQMS I see a weekly Bull Kicker on volume that has seen a little profit taking and now forming a continuation pattern. Let’s look at the daily chart now; price has chopped around above a rising 50 day-SMA in an (RBB) Rounded Bottom Breakout pattern. Friday left up with a Bullish Morning Star with both of the deuce magnets above. A three-day chart offers a nice Morning Star that will use as support. The big game changer this week will be the FOMC meeting report. Let’s trade wise and profitable while preserving our capital.

We will discuss the trade in detail in our Members Morning Prep starting at 9:10 EST this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9% • Education and practicing what you learn is one of the keys to success. Take a Road Trip and Learn

[button_2 color=”red” align=”center” href=”https://ob124-5a86cf.pages.infusionsoft.net/” new_window=”Y”]Road Trip With Continuation Patterns / Workshop[/button_2]

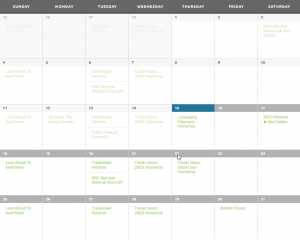

Event Calendar

SPY Update

The SPY produced four lower loss last week closing under the T-Line and the 50-SMA. Price did close above the lower bullish trend line keeping price contained in the wedge it has been building. Not that there is any guarantee but the price has been following the path of the tops and bottoms wedge. (February to now) Chop Chop Chop until we see a breakout or a breakdown. I will remain cautiously bullish until the chart turn bearish below the current chart pattern.5

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning

The VXX short-term futures

The VXX could be a big clue; there was no real fear last week. However, price does seem to have found a little support. Premarket today is showing a little activity. The hourly chart is looking at $43.50

Rick’s Swing Trade Ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

All eyes on the FOMC.

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.

On the Calendar

To kick off this FOMC week we begin with a Fed Speaker at 9:00 AM from the Atlanta Federal Reserve Bank. After that, all we have is three bond events to wrap of the day.

On the Earnings Calendar, we have quieted down as well with just 55 companies reporting results today. However, just because earnings season is winding down, it doesn’t relieve from the responsibility of checking earnings dates against current holdings and stocks we are planning to purchase.

Action Plan

Friday turned out to be a choppy day of price action. The Dow tried a couple of times to get over the big round number at 25,000 but ultimately failed to hold above it by the close of the day. The QQQ and the SPY seemed content to chop in a small range but while the IWM bounced slightly to close the day positive. Sadly, the SPY closed below the 50-day average raising concerns that the Bears could gain the upper hand.

As I write the morning note, the Dow Futures are decidedly bearish and currently pointing to a 130-point gap down at the open. If the selling pressure persists, we could easily start breakings some key support levels which would encourage even more bears to plie on raising the fears about the overall market. If there ever was a time that we need the Bull to step up it’s now. Keep in mind that the FOMC begins its 2-day interest rate policy meeting on Tuesday with their decision released Wednesday afternoon. The market continues to be hypersensitive about rates, and with a new Fed Chairman at the helm, tensions are high. I’m expecting some wider ranging chop that could contain some fast price action as we wait for their decision.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/K8LkavprIRg”]Morning Market Prep Video[/button_2]

Boring, choppy price action.

Choppy price action days like we saw yesterday can be frustrating and downright boring at times as we watch price grind up and down. Inexperienced traders just wanting some action often let choppy, boring markets affect their decision making. When I was a new trader just like most new traders, I just wanted to trade. Consequently, I made a lot of very bad decisions trying to force trades just because I was bored. Long story short if the choppy price action persisted very long I would have a huge string of losing trades. Individually the trades were not big losers but added up the damage to my account was substantial. If boredom is affecting your decision making, take a break. It’s amazing how a short break from your screens can help a trader maintain focus and promote good decision making.

Choppy price action days like we saw yesterday can be frustrating and downright boring at times as we watch price grind up and down. Inexperienced traders just wanting some action often let choppy, boring markets affect their decision making. When I was a new trader just like most new traders, I just wanted to trade. Consequently, I made a lot of very bad decisions trying to force trades just because I was bored. Long story short if the choppy price action persisted very long I would have a huge string of losing trades. Individually the trades were not big losers but added up the damage to my account was substantial. If boredom is affecting your decision making, take a break. It’s amazing how a short break from your screens can help a trader maintain focus and promote good decision making.

On the Calendar

No rest this Friday on the Economic Calendar with four important reports. Kicking off at 8:30 AM Eastern with the Housing Starts report which is calling for a decline from the 1.326 million annualized in January to 1.285 for February. Permits according to consensus will decline in February to 1.322 million vs. 1.377 million annualized. At 9:15 is Industrial Production forecasters expect a 0.4% increase overall with the manufacturing growth increasing 0.4% as well. The Consumer Sentiment report at 10:00 AM is expected to decline slightly to 98.8 vs. the 99.7 February reading. Also at 10:00 AM is the JOLTS report is expecting job openings to decline slightly to 5.800 million vs. 5.811 in December. AT 1:00 PM is the Old Rig count but it very unlikely it will move the market.

On the Earnings Calendar, we have 67 companies expected to report results.

Action Plan

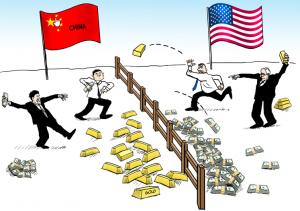

At the open yesterday, futures pointed to a possible bounce, but the bulls lacked the energy to hold onto early gains as trade war fears continue to swirl. The good news is the DIA held onto supports by the close while the other indexes all help up pretty well. There is, however, the reason to keep a close eye on the DIA and the SPY because it wouldn’t take much to tip the scales to favor the bears. So come on bulls sharpen those horns and push.

As I write this, futures markets are flat to every so slightly bullish but remember we have some big reports the market will have to digest before the open. Also, keep in mind as we head into the weekend that the FOMC meets next week on interest rate policy so don’t be surprised to see some directionless chop in the day ahead. Have a great weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/M9PfdpsAyQk”]Morning Market Prep Video[/button_2]

Stay Off The Thin Ice

Trading this market right now reminds me something my grandfather used to tell me…”Stay Off The Thin Ice”. The SPY closed on the 50-day SMA with the T-Line above itself the past 20+ days, it is very important for the bulls to maintain support above the 50day SMA. If not the next landing could be hard. The DIA’s closed yesterday with a Doji on a little support. The DIA’s are in bad shape below the 50-day SMA, the weight of the bear could be too much at this point, and a retest of the February lows may be required. If the bulls can pop the DIA’s over the 50-day SMA, it would allow the room to challenge the January highs. The market is between a rock and a hard spot, trade very carefully. Capital preservation should be at the top of your list right now.

We will discuss the trade in detail with a trading plan in our Members Morning Prep starting at 9:10 EST this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9%

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning

The VXX short-term futures

The VXX showed no real fear yesterday and closed below the T-Line if the VXX gets above $48.40 we are likely to see a bloodbath. Stay off the thin ice.

Rick’s Swing Trade Ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

3-Day Doji Continuation Pattern

MLNX has broken out of a recent consolidation base and followed through with a low/high, higher/low pattern. For the last nine bars price has run the T-Line and on the 3-Day chart, we have a bullish Doji Continuation pattern set up. Profit zones $85.00 ish then the $100.00 area with positive price action. Plan your trade and trade your plan.

MLNX has broken out of a recent consolidation base and followed through with a low/high, higher/low pattern. For the last nine bars price has run the T-Line and on the 3-Day chart, we have a bullish Doji Continuation pattern set up. Profit zones $85.00 ish then the $100.00 area with positive price action. Plan your trade and trade your plan.

We will discuss the trade in detail in our Members Morning Prep starting at 9:10 EST this morning. members morning briefing

Recently closed

VXX 6% • CAT 39% • TWTR 50% • FEYE 28% • OCN 39% • TWTR 54% • QQQ 28% • QQQ 179% • TWTR 180% • VXX 375% VIPS 118% • WTW 21.9% • Actual confirmed trades, putting my money where my mouth is.

[button_2 color=”red” align=”center” href=”https://ob124-cea4cb.pages.infusionsoft.net/” new_window=”Y”]Fibonacci Workshop Tonight 8pm EST • Recording Available[/button_2]

Read the Chart

The SPY has pulled back to the 50-SMA and support, which means nothing unless there is bullish price action with following through. The T-Line is still above itself for the past 20 days, but the 34-SMA is below the 50-SMA.

DIA’s are still below the 50-SMA and trapped inside the chart pattern. The 34-SMA is below the 50-SMA, and the T-Line is below the 34-EMA…Somebody needs to wake the bulls up.

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning

The VXX short-term futures

VXX closed back above the 200-SMA, it’s trying

Rick’s Swing Trade Ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

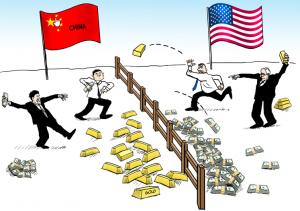

Trade War Fears

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

However, yesterday’s selling seemed measured and controlled with 3 of the four indexes holding onto a fragile but current up-trend. Keep in mind that big moves inspired by fear can also quickly reverse if that fear suddenly passes. Have a plan, stay focused on price and be prepared for anything but don’t let fear control your trading.

On the Calendar

Thursday is a big day on the Economic Calendar with several potential market-moving reports with four of them dropping at 8:30 AM. The weekly Jobless Claims is expected to come in at 229,000, continuing to show strong labor demand. A robust consensus of 23.0 with rising backlogs and the risk of hitting capacity constraints, from the Philly Fed Business Survey. The Empire Ste Mfg. Survey should come in cooler at 15.0 according to consensus. Then the Import/Export Prices are seen rising a moderate 0.3% on imports as well as 0.3% increases in export prices. At 10:00 AM we hear from the Housing Market Index which forecasters see steady strength with an unchanged reading or 72. To finish off the major reports today, we have the Treasury International Capital at 4:00 PM.

Today marks our last really big earnings day this season with nearly 190 companies expected to report. While there are earnings spread out for the remainder of the month, they should be overall less impactful as the number of reports diminishes.

Action Plan

Things were looking pretty good yesterday until fear of a trade war with China sent a share of BA sharply lower. After losing the 25,000 level, the Dow experienced some pretty heavy selling testing the lower boundary of the price wedge pattern. Although the SPY, QQQ, and IWM experienced some selling pressure, they all managed to close within their current uptrend and stayed above their respective 50-day averages.

I said yesterday that my gut tells me that the market wants to go higher. Yesterday’s price action while bearish didn’t dissuade that feeling. With 3 out of 4 indexes holding onto an uptrend, the technicals slightly favor the bulls as long as support levels hold. However, it wouldn’t take much more selling pressure to shift the battle to the bears so stay focused on price action. The current pullback has the potential to set-up some great entries if the bulls can tow the line. Mark up your watchlist and be prepared.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/k3wS2vOCzL8″]Morning Market Prep Video[/button_2]

Who invited the Bears?

Okay, we had a nice little bull party going on; who invited the bears? It seems everywhere you look we see Bearish Engulfing candles and nasty failure patterns in the charts. Is it really that bad? First, let’s remember that Bearish Engulfing candles must follow-through in the next period to confirm. Without that confirmation, it’s nothing more than a day of profit-taking. Secondly, let’s step back from the hard right edge and notice that only the DIA has failed to break out into an uptrend. I pointed out yesterday that the index has moved up so many days in a row that rest or pullback was possible.

Okay, we had a nice little bull party going on; who invited the bears? It seems everywhere you look we see Bearish Engulfing candles and nasty failure patterns in the charts. Is it really that bad? First, let’s remember that Bearish Engulfing candles must follow-through in the next period to confirm. Without that confirmation, it’s nothing more than a day of profit-taking. Secondly, let’s step back from the hard right edge and notice that only the DIA has failed to break out into an uptrend. I pointed out yesterday that the index has moved up so many days in a row that rest or pullback was possible.

Please understand I’m not saying that to try and pat myself on the back for a correct call. What I’m trying to demonstrate is that if you remove emotion and study the price action, the answers are usually there. No prediction just simple observation. So, who invited the bears? The king of all indicators, Price Action.

On the Calendar

There are some big reports on the hump day Economic Calendar. At 8:30 AM we have two potential market-moving reports with PPI and Retail Sales. Consensus suggests the headline will come in up 0.2%. Remove food and energy, and it is expected to rise 0.2% while trade services move up 0.3%. According to forecasters, Retail Sales should snap back after declining in January with a 0.4% February expected increase. Remove autos and gasoline, and they see a 0.4% increase. Business Inventories at 10:00 AM should see a sizable build of 0.5% in January giving a boost the inventory component of GDP. Last but not least is the Petroleum Status Report which is on forecast but obviously critical the prices of oils stocks.

On the Earnings Calendar, I see 122 companies stepping up to report quarterly results. Stay on your toes as this earnings season finally begins to lighten up after this week.

Action Plan

The bears stepped in yesterday producing a slew of reversal patterns on all four major indexes on Tuesday. At the close Bearish Engulfing candles were left behind on the QQQ, IWM, SPY. The DIA was also under pressure one again failing at the 50-day average but managed to hold just above the physiological 25,000 level on the Dow index. It was pretty grim as I looked through my watchlists last night seeing lots of potential topping patterns and blue ice failure patterns all over the place.

One would naturally expect the bears to follow through today with another push lower today, but the premarket futures are indicating a willingness of the bull to fight back. As I write this, the Dow Futures are pointing to a gap up of about 80 points at the open. However, with all the early earnings news and important economic reports coming before the open anything is still possible. Everywhere I look in the charts I see clues of bearishness, but for some reason, my gut is telling me the market wants to go up. That’s not a prediction; it’s merely a feeling that of course will have to be confirmed by price action. Price is king and always will be.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/99bX2M2tiS8″]Morning Market Prep Video[/button_2]