VXX Puts Another Base Hit

Yesterdays Bearish Shooting Star in the VXX is suggesting we’re going to celebrate the New Year in style with another good base hit. Congratulations to the members in the VXX Put!

A Day Traders Market

The Top Gun Trading room is up just under $2,800 in December while risking only $100 to $200 per trade. Our latest trades can be seen below, The Top Gun Day Trading Room operated by Steve Risner and Steve and many in the room have paid for there membership in one single day of trading. Top Gun Day Trading is a Division of Hit and Run Candlesticks Inc. So let’s take a look at what’s going on in the day trading room.

Top Gun Day Trading – Despite the weakest market in over a decade, the room is up over $2,800 in December while risking only $100 to $200 per trade. Our latest trades include:

- 400 shares of SPXS for +$163.00

- 2 AAPL Puts for +$185 in less than 10-min

- Day Trading Room Open House: Today and Tomorrow • Password B-52 • Login Here

- Get started for the new year Click Here please ask us if there are any 25% discount coupons left.

SPY ETF – After the sellers had their way with the SPY, the buyers came in and pulled the candle out of the mud and closed us above the Bullish Morning Star. That’s what you call follow-through. On the SPY weekly chart price action is getting close to drawing a Bullish Piercing Candle, a good close today could do it. For the (RBB) Rounded Bottom Breakout traders the SPY is set up on the 60-Min chart.

The SPY is starting to run into a little resistance, so let’s be a little careful. We should see a pullback soon to test the rally we have had. Another thing I want to mention is this market is still under a ton of pressure, and the Bears still control the trend. We could easily see price action walk to trend at this point.

Good trading and Happy New Year

TC2000 T2122 Chart – The four weeks New High/Low Ratio is still in the oversold area and Stochastics is deep within the oversold area as well. FYI: A chart oversold is only a condition, not a reason to buy. Oversold can last a long time while you keep trying to pick a bottom and losing money

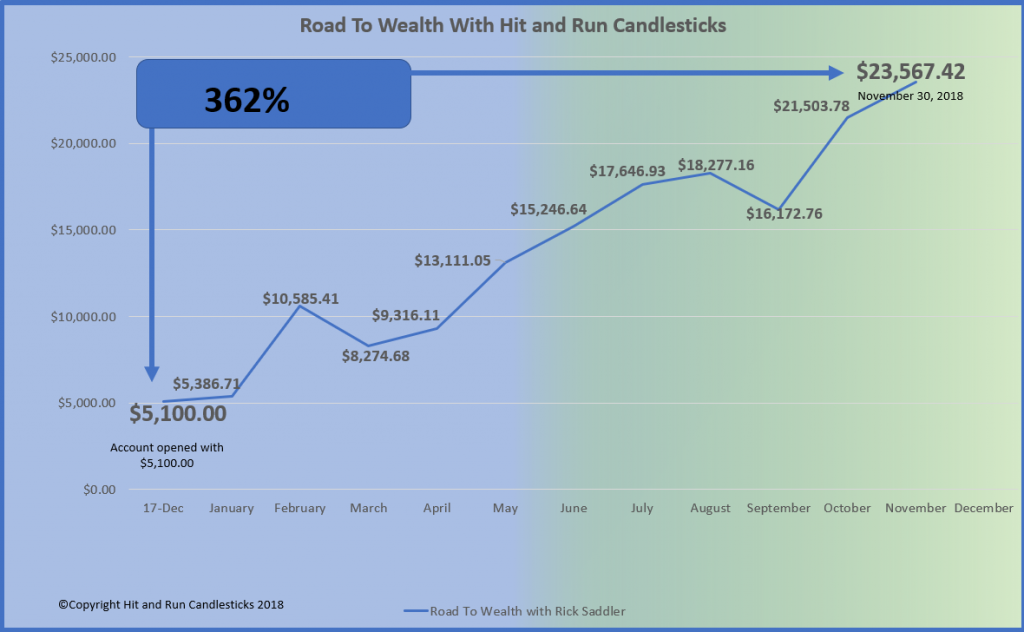

Yes, The Little Account Can!

For 2019 Rick plans on taking the now $23,567.00account to $50,000.00 before December 31, 2019. Remember he already has increased the account $5,000.00 to $23,567.00 or 362% in 2018. Would you like to learn from someone that truly makes money, not just one hit wonders and backs it up with his account statement.

Trading Services We Offer

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing/ Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by it and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service