Bull Trap Being Sprung?

Markets gapped lower Monday but rallied to close the gap and retest the 50sma and downtrend. The bad news for bulls is that all three major indices failed that test (or at least failed to pass it Monday). This leaves all four (SPY, DIA, QQQ, and IWM) in a potential Dreaded-h pattern in the making. So, the downtrend remains in effect and the key technical indicator for Tuesday. In spite of this, Defensive sectors were out of favor all day. Does this put us in a bull trap in progress?

Overnight, Asian and European markets were all in the red. This is probably due to the U.S. blacklisting 28 entities in China (prohibiting them from buying anything made in America). This move was ostensibly made over Human Rights violations, but market analysts suspect it has more to do with adding Trade War pressure (or at least believe that is how China will interpret the move). Adding to the market fears are reports that the UK PM had a testy call with German Chancellor Merkel, making any new Brexit deal “overwhelmingly unlikely.” This, of course, raises the risk of a No Deal Brexit. As of 7:30 am, U.S. futures were also pointing to a significant (0.7%) gap down on the overnight news.

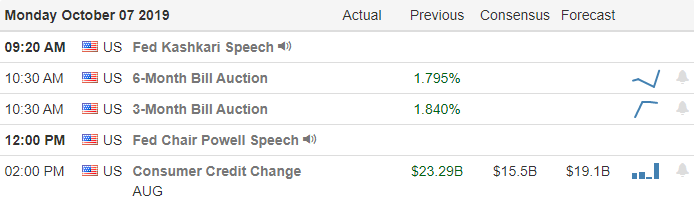

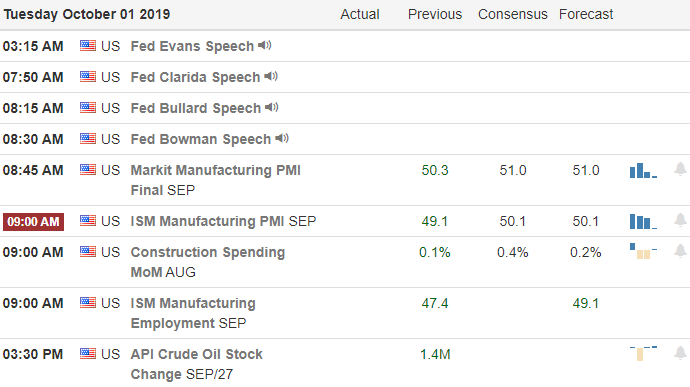

On Tuesday PPI data (8:30 am) may impact markets, as inflation data may help inform FOMC action. Fed Chair Powell will also speak again in the afternoon. It’s worth noting that market expectations of an Oct. Fed rate cut have fallen slightly from >90% last week to 70% Monday.

The bottom line remains to be cautious. It is very hard to swing trade the recent markets successfully until we start getting less “gaps and whiplash” and more “trend and follow-through.” Be careful chasing after one nice (or ugly) candle. However, the downtrend remains in control for now.

Ed

For Your Consideration: Here are a few tickers we will be adding to our swing trade watch-list. Short – DD, TSN, QSR, LDOS, HEI, FSLR, WES, LSCC, RDUS Long – DOCU, VZ, EQR, PNW, SO, DUK, ES Trade smart, and trade your trade. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service